- China

- /

- Communications

- /

- SZSE:300620

3 Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a period of heightened volatility, with trade tensions and monetary policy shifts grabbing headlines, investors are increasingly looking towards Asia for growth opportunities. In this context, companies with high insider ownership often stand out as attractive prospects due to the alignment of interests between management and shareholders, which can be particularly appealing in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 32.1% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here we highlight a subset of our preferred stocks from the screener.

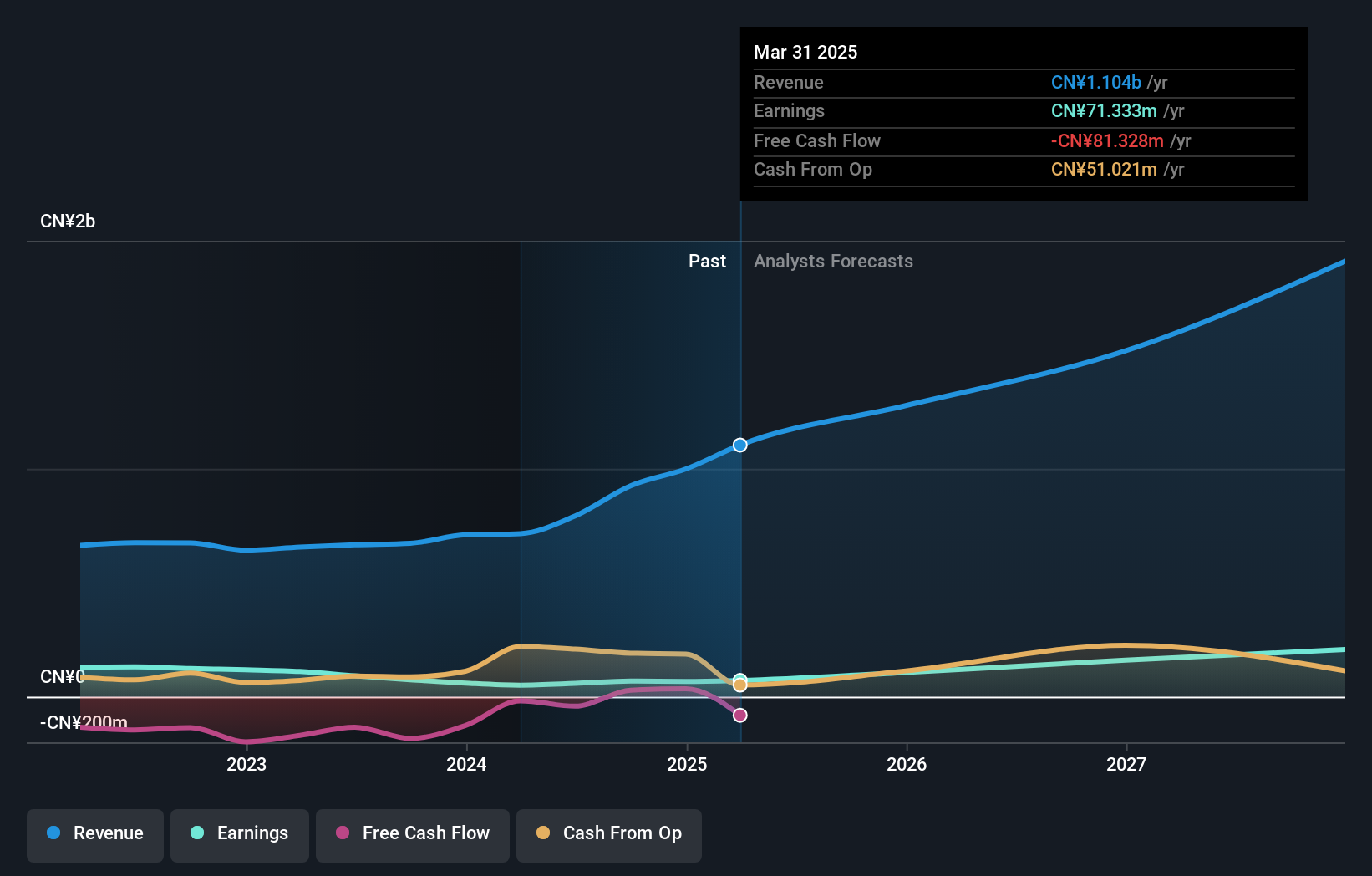

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry and has a market cap of CN¥30.92 billion.

Operations: Unfortunately, the provided text does not contain specific information about Yuanjie Semiconductor Technology's revenue segments. Therefore, I am unable to summarize them. If you have more detailed data on their revenue breakdown, please share it so I can assist you further.

Insider Ownership: 27.7%

Earnings Growth Forecast: 67.1% p.a.

Yuanjie Semiconductor Technology is experiencing robust growth, with earnings up 171% over the past year and revenue expected to grow at 43.9% annually, outpacing the Chinese market. Despite a highly volatile share price recently, no substantial insider trading has been reported in the last three months. The company's recent half-year results showed sales of CNY 204.48 million and net income of CNY 46.26 million, indicating strong financial performance amidst high insider ownership levels.

- Click here to discover the nuances of Yuanjie Semiconductor Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Yuanjie Semiconductor Technology implies its share price may be too high.

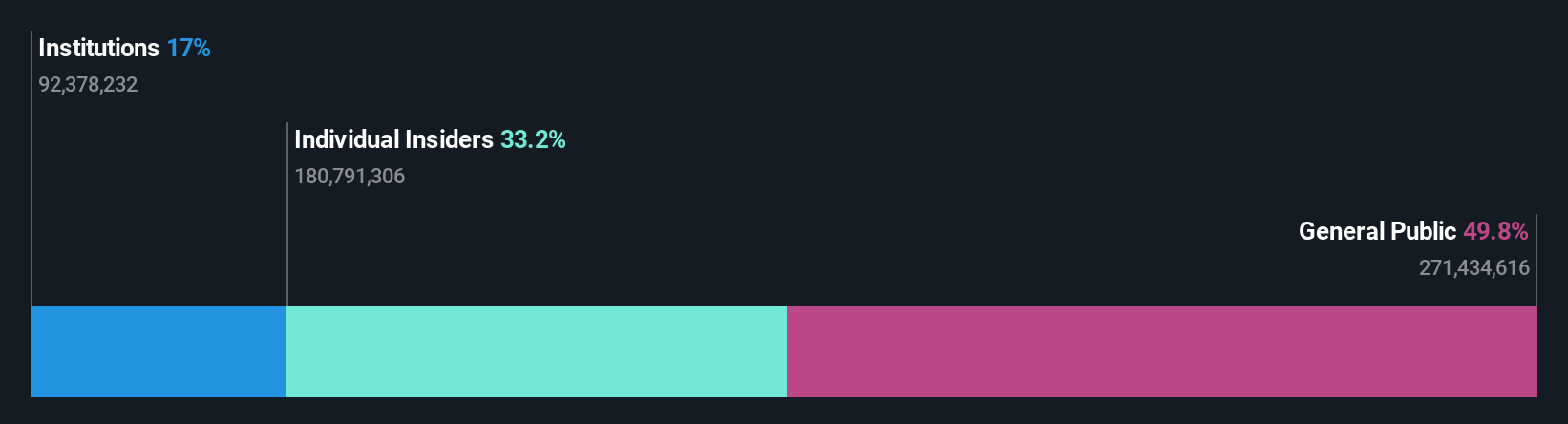

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD is an electrical automation company based in China with a market cap of CN¥38.44 billion.

Operations: Shenzhen Megmeet Electrical Co., LTD generates revenue through several segments, including Smart Home Appliances Electronic Control Products (CN¥3.88 billion), Industrial Power Products (CN¥2.41 billion), Industrial Automation (CN¥711.82 million), New Energy and Rail Transit (CN¥854.36 million), Smart Equipment (CN¥507.67 million), and Precision Connection (CN¥404.19 million).

Insider Ownership: 33.2%

Earnings Growth Forecast: 47.6% p.a.

Shenzhen Megmeet Electrical is experiencing significant growth, with earnings projected to rise 47.6% annually, surpassing the Chinese market's 25.9%. Despite recent volatility in its share price and a decline in net profit margins from 7.4% to 3.3%, revenue is expected to grow at a robust 24.7% per year, outpacing market trends. Recent half-year results showed increased sales of CNY 4,642.72 million but a drop in net income to CNY 173.59 million compared to last year.

- Dive into the specifics of Shenzhen Megmeet Electrical here with our thorough growth forecast report.

- Our valuation report unveils the possibility Shenzhen Megmeet Electrical's shares may be trading at a premium.

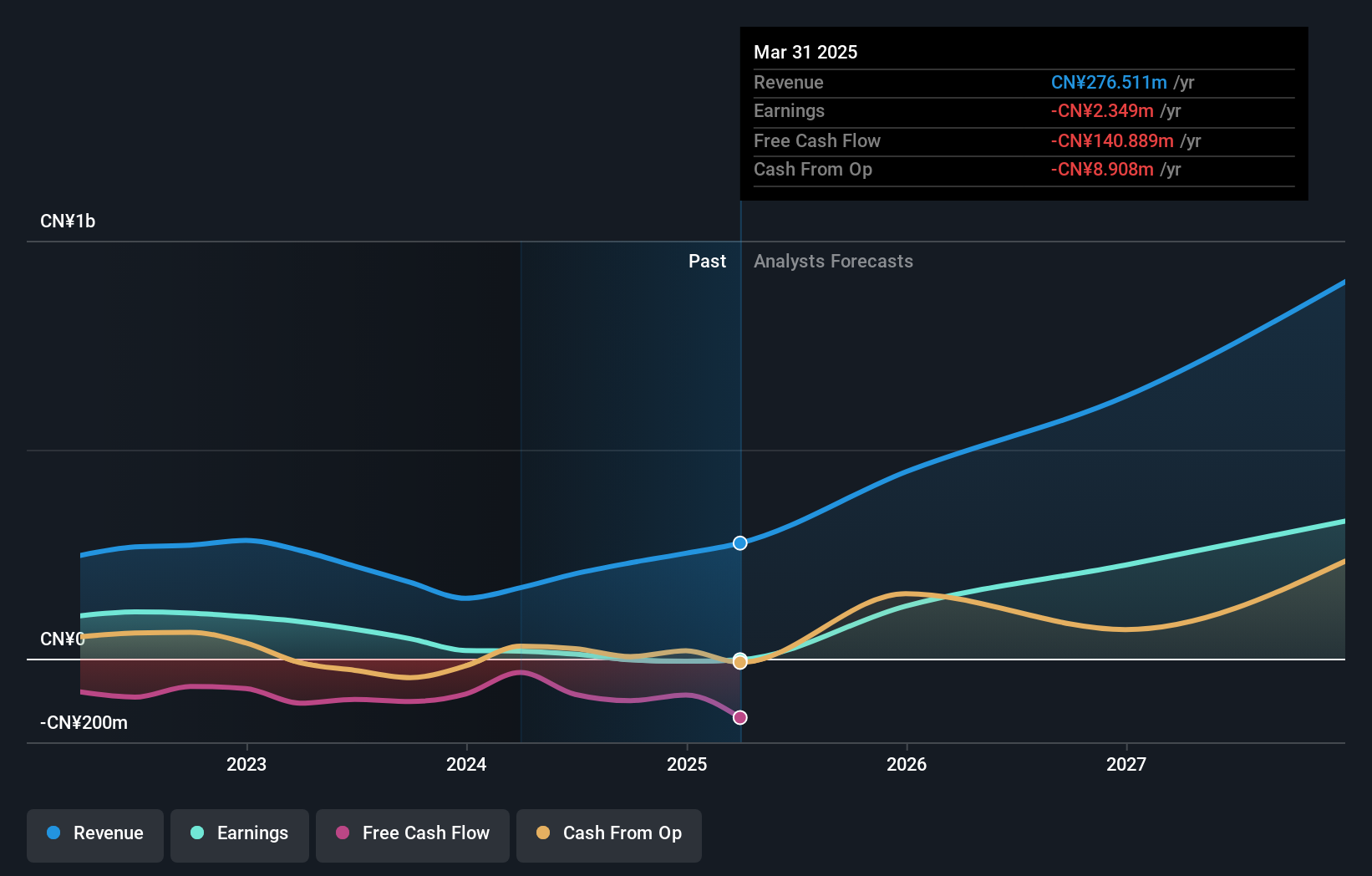

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. designs and manufactures passive optical components for both domestic and international markets, with a market cap of CN¥26.10 billion.

Operations: The company's revenue primarily comes from its Optoelectronic Devices and Other Electronic Devices segment, totaling CN¥1.17 billion.

Insider Ownership: 31.8%

Earnings Growth Forecast: 39.4% p.a.

Advanced Fiber Resources (Zhuhai) shows strong growth potential, with earnings projected to rise 39.45% annually, outpacing the Chinese market's 25.9%. Recent half-year results revealed increased revenue of CNY 596.65 million and net income of CNY 51.87 million, reflecting substantial year-over-year growth. However, the company's share price has been highly volatile recently and its Return on Equity is forecasted to remain low at 9.6% in three years despite significant insider ownership stability.

- Click here and access our complete growth analysis report to understand the dynamics of Advanced Fiber Resources (Zhuhai).

- Our comprehensive valuation report raises the possibility that Advanced Fiber Resources (Zhuhai) is priced higher than what may be justified by its financials.

Summing It All Up

- Click through to start exploring the rest of the 618 Fast Growing Asian Companies With High Insider Ownership now.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300620

Advanced Fiber Resources (Zhuhai)

Designs and manufactures passive optical components in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives