Spotlighting Bichamp Cutting Technology (Hunan) And 2 Other Leading Growth Stocks With Insider Ownership

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding tariffs and mixed economic signals have led to cautious investor sentiment. While U.S. stocks ended the week lower due to tariff concerns, strong earnings reports from many S&P 500 companies provided some optimism amidst the volatility. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate management's confidence in their business prospects. This article will explore Bichamp Cutting Technology (Hunan) and two other leading growth stocks that exemplify this trait.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Brightstar Resources (ASX:BTR) | 9.8% | 86% |

Let's dive into some prime choices out of the screener.

Bichamp Cutting Technology (Hunan) (SZSE:002843)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bichamp Cutting Technology (Hunan) Co., Ltd. operates in the cutting tools industry and has a market cap of CN¥6.64 billion.

Operations: Bichamp Cutting Technology (Hunan) Co., Ltd. generates its revenue through various segments within the cutting tools industry, contributing to its market cap of CN¥6.64 billion.

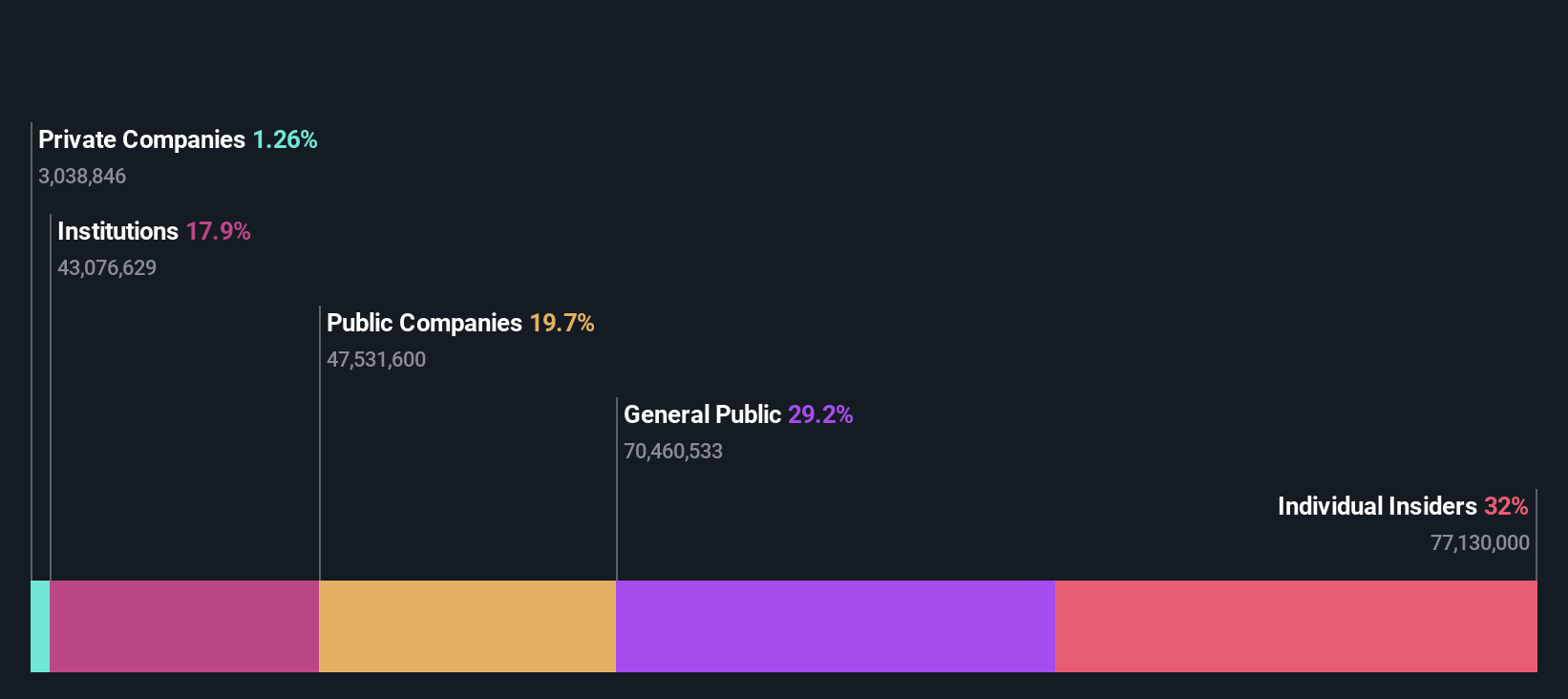

Insider Ownership: 31.8%

Earnings Growth Forecast: 28.7% p.a.

Bichamp Cutting Technology (Hunan) demonstrates strong growth potential, with revenue expected to increase by 24.1% annually, outpacing the Chinese market's growth. Earnings are projected to grow at 28.7% per year, although the company's return on equity is forecasted to be low at 13.5%. Recent volatility in share price and its removal from the S&P Global BMI Index may concern investors, but no substantial insider trading activity has been reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Bichamp Cutting Technology (Hunan).

- The analysis detailed in our Bichamp Cutting Technology (Hunan) valuation report hints at an inflated share price compared to its estimated value.

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Gian Technology Co., Ltd. manufactures and sells metal injection molding products in China and internationally, with a market cap of CN¥7.91 billion.

Operations: The company's revenue segments are not provided in the text.

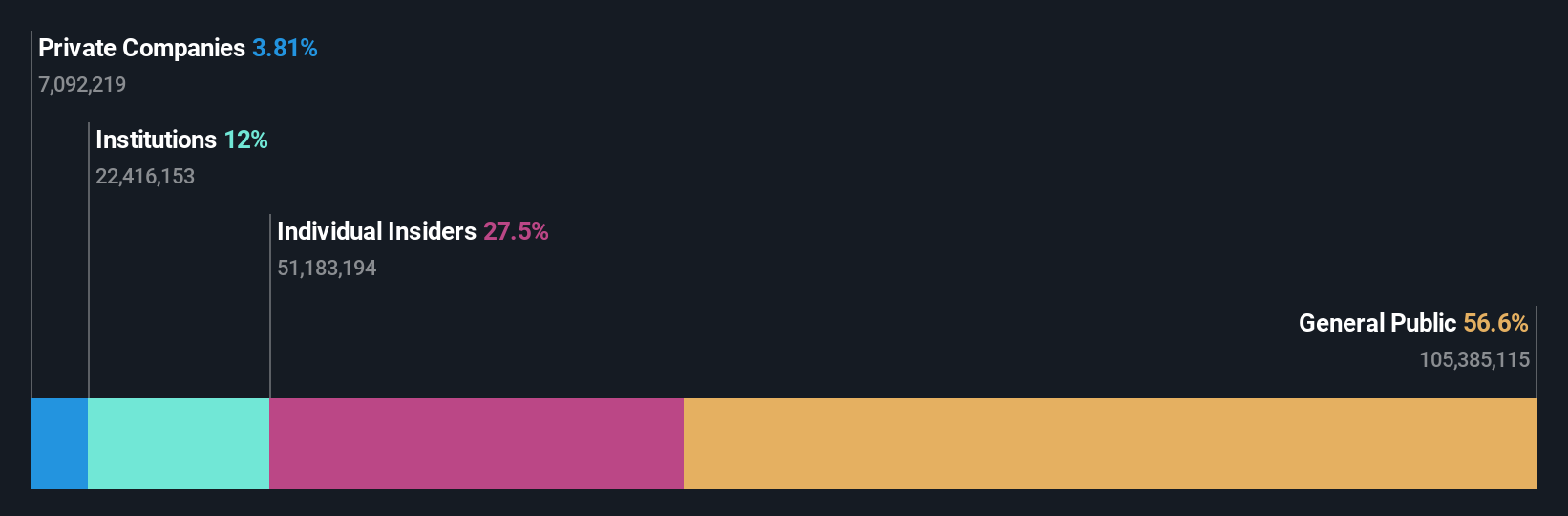

Insider Ownership: 27.5%

Earnings Growth Forecast: 41.1% p.a.

Jiangsu Gian Technology is poised for significant growth, with revenue expected to rise by 29.3% annually and earnings projected to grow at 41.1%, surpassing the Chinese market averages. Despite a low forecasted return on equity of 14.4% in three years, this potential is coupled with a volatile share price and no recent insider trading activity. Recent shareholder meetings focused on procedural amendments and strategic initiatives like foreign exchange hedging and credit line applications.

- Unlock comprehensive insights into our analysis of Jiangsu Gian Technology stock in this growth report.

- Our expertly prepared valuation report Jiangsu Gian Technology implies its share price may be too high.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥198.74 billion.

Operations: The company generates revenue from its platform business, amounting to ¥27.09 billion.

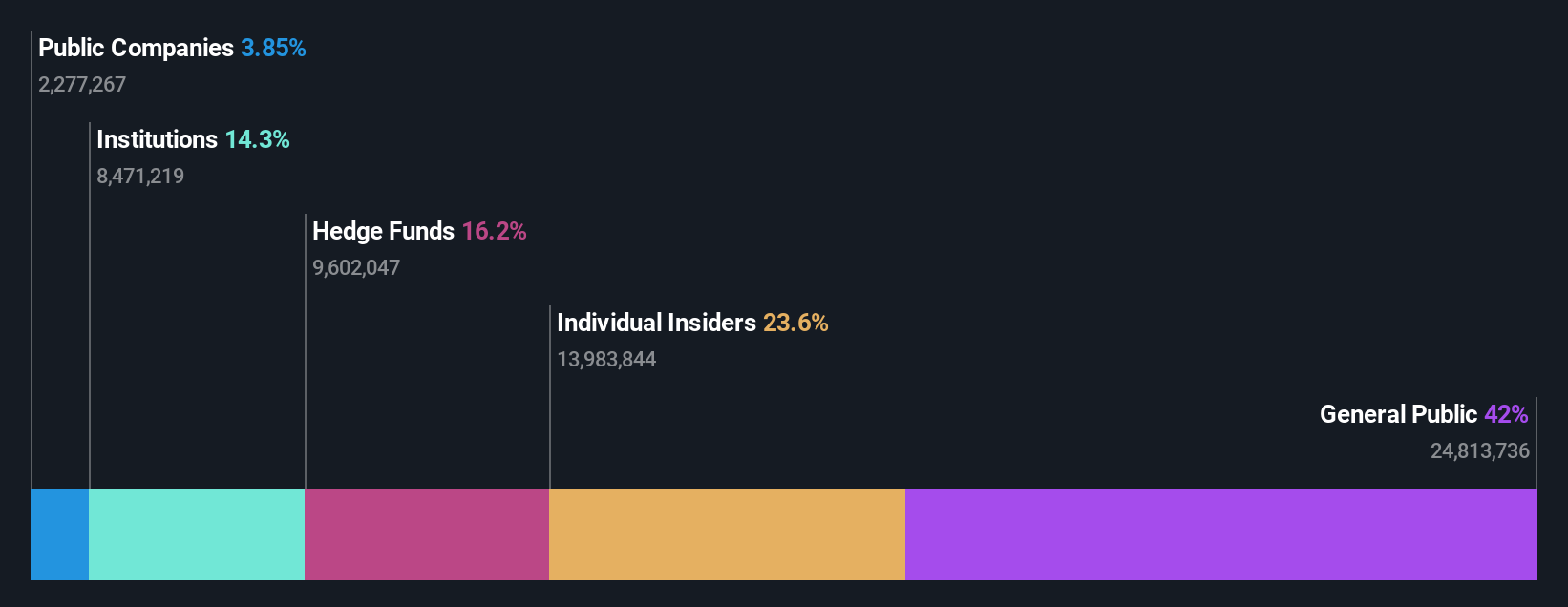

Insider Ownership: 23.7%

Earnings Growth Forecast: 71.4% p.a.

freee K.K. is positioned for growth with earnings expected to increase by 71.35% annually, outpacing the Japanese market average. Despite a forecasted low return on equity of 19.5% in three years and high share price volatility, it trades at 33.3% below estimated fair value, indicating potential undervaluation. Revenue growth is projected at 18.5% per year, faster than the market's 4.2%, with profitability anticipated within three years amid no recent insider trading activity or significant events beyond routine board meetings regarding new share issuance.

- Get an in-depth perspective on freee K.K's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that freee K.K's share price might be on the cheaper side.

Seize The Opportunity

- Get an in-depth perspective on all 1438 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if freee K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives