Undiscovered Gems Including Guangzhou KDT MachineryLtd And 2 Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a challenging start to the year, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index dipping into correction territory. Amidst these turbulent conditions, investors are keenly observing economic indicators and Federal Reserve policies that suggest interest rates may remain elevated for some time, influencing market sentiment and investment strategies. In such an environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and resilience in navigating economic uncertainties—qualities that can transform them into undiscovered gems in an otherwise volatile landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Guangzhou KDT MachineryLtd (SZSE:002833)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou KDT Machinery Co., Ltd. focuses on the production and sale of specialized equipment for furniture machinery primarily in China, with a market capitalization of CN¥7.05 billion.

Operations: Guangzhou KDT Machinery Co., Ltd. generates revenue primarily from the sale of special-purpose equipment, totaling CN¥2.78 billion. The company's market capitalization stands at approximately CN¥7.05 billion.

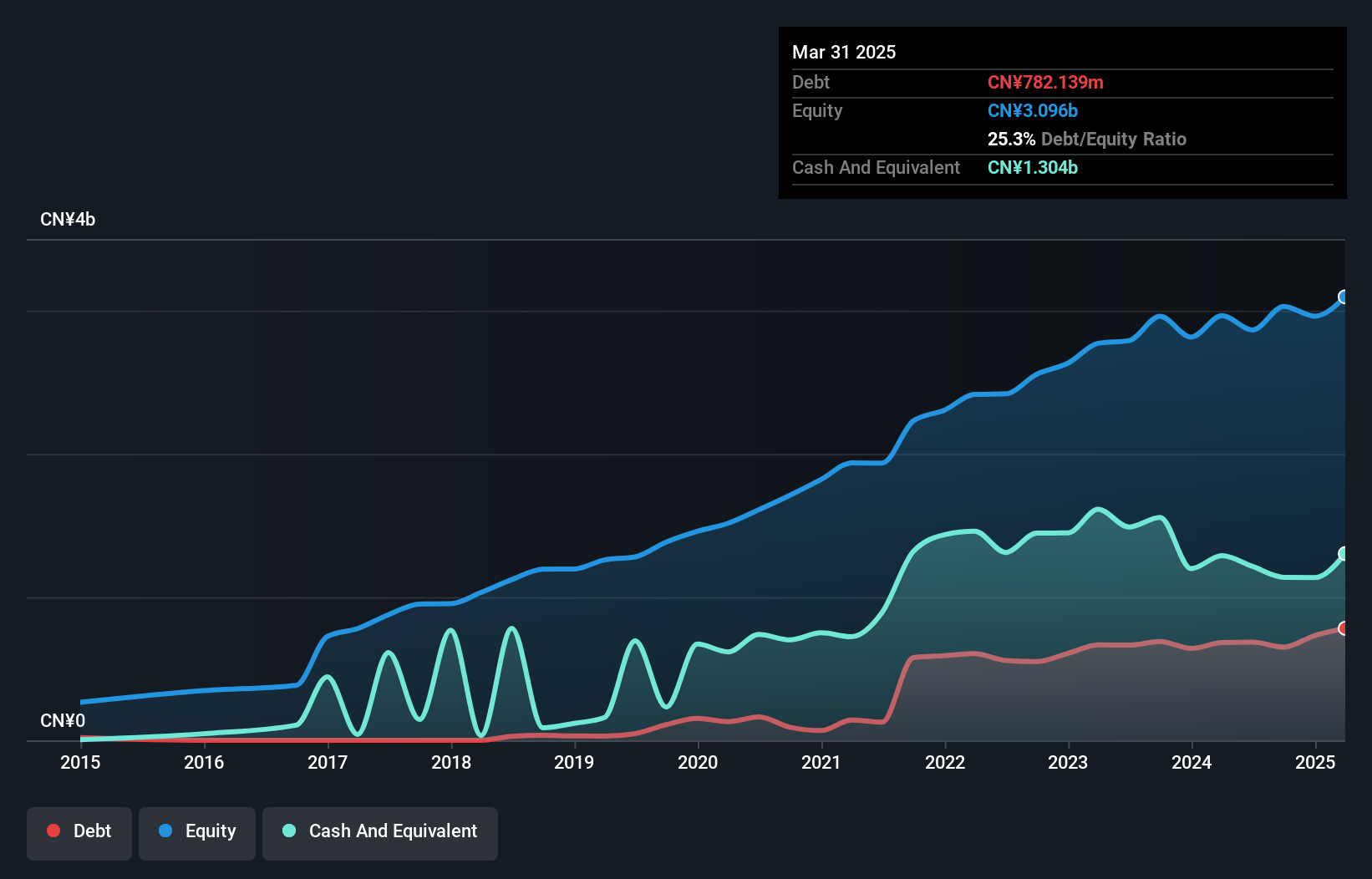

Guangzhou KDT Machinery, a smaller player in the machinery sector, shows promising signs with its earnings growing by 3.4% over the past year, outpacing the industry's -0.06%. Despite an increase in its debt to equity ratio from 7.9% to 21.5% over five years, it holds more cash than total debt and maintains positive free cash flow. Trading at a price-to-earnings ratio of 12.4x—much lower than the CN market's 34.1x—it seems undervalued compared to peers. Recent results show sales climbing to CNY 2.17 billion, though net income slightly dipped to CNY 455 million from CNY 479 million last year.

Solar Applied Materials Technology (TPEX:1785)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solar Applied Materials Technology Corporation engages in the manufacturing, processing, recycling, refining, and trading of sputtering targets for thin film applications, precious metal materials, and specialty chemicals for automobiles across Taiwan, China, and international markets with a market cap of approximately NT$36.01 billion.

Operations: Solar Applied Materials Technology generates revenue primarily from its Taiwan SOLAR and Kunshan Solar segments, contributing NT$10.51 billion and NT$15.37 billion, respectively.

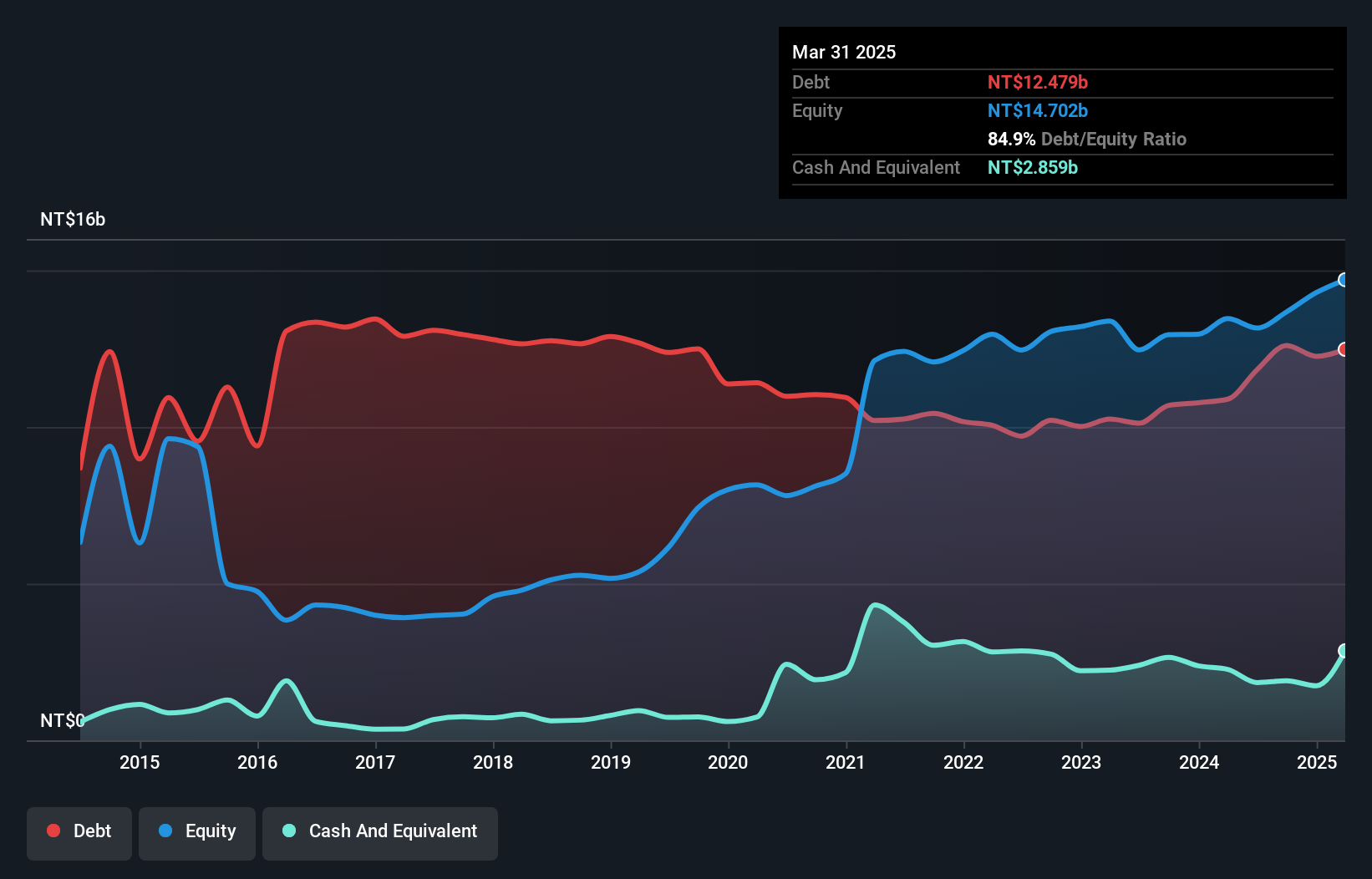

Solar Applied Materials Technology, a nimble player in the chemicals industry, posted impressive earnings growth of 14% over the past year, outpacing its sector peers. Recent financials reveal sales for Q3 2024 at TWD 7.62 billion, up from TWD 5.95 billion a year prior, with net income rising to TWD 458 million from TWD 408 million. Despite a high net debt to equity ratio of 78%, interest payments are well covered by EBIT at a comfortable multiple of over ten times. The company’s earnings per share improved to TWD 0.77 from TWD 0.69 year-on-year, indicating robust operational performance amidst industry challenges.

- Navigate through the intricacies of Solar Applied Materials Technology with our comprehensive health report here.

Learn about Solar Applied Materials Technology's historical performance.

Tadano (TSE:6395)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tadano Ltd., with a market cap of ¥143.92 billion, manufactures and sells construction and vehicle-mounted cranes, as well as aerial work platforms, both in Japan and internationally.

Operations: Tadano Ltd. generates revenue primarily through the sale of construction and vehicle-mounted cranes, along with aerial work platforms. The company's financial performance is influenced by its cost management and operational efficiency, reflected in its net profit margin trends over recent periods.

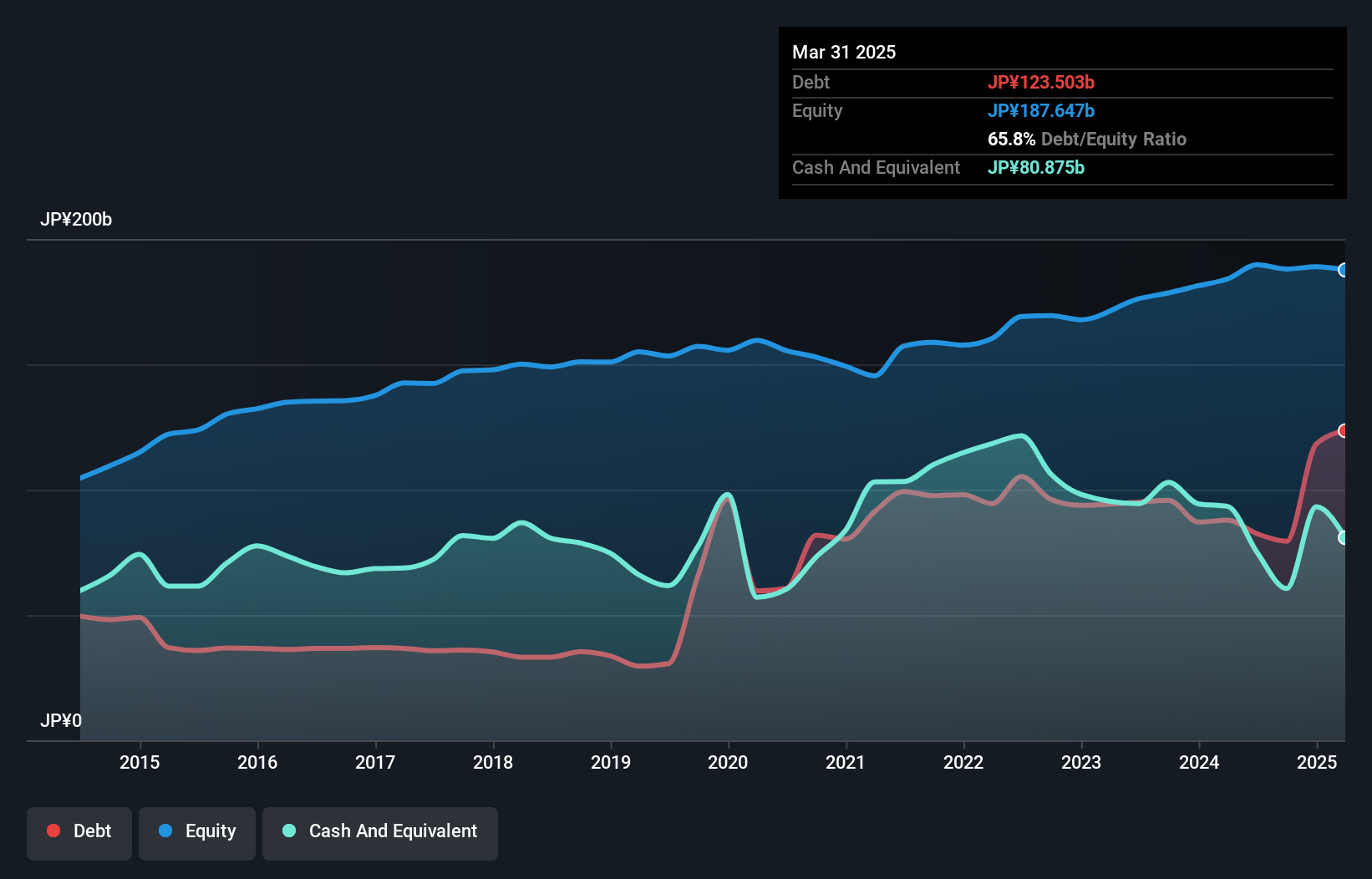

Tadano, a notable player in the machinery sector, is currently trading at 32.7% below its estimated fair value, presenting potential upside for investors. The company's interest payments are well covered with EBIT at 15.4 times coverage, indicating strong financial health. Over the past year, Tadano's earnings grew by an impressive 125%, significantly outpacing the industry average of 1.7%. With a satisfactory net debt to equity ratio of 10%, Tadano demonstrates prudent financial management. Recently revised guidance anticipates net sales of ¥290 billion and operating income of ¥23 billion for fiscal year-end December 2024, reflecting solid growth prospects.

- Click here to discover the nuances of Tadano with our detailed analytical health report.

Gain insights into Tadano's historical performance by reviewing our past performance report.

Key Takeaways

- Discover the full array of 4628 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:1785

Solar Applied Materials Technology

Manufactures, process, recycles, refines, and trades sputtering targets for thin film, precious metal materials, and specialty chemicals for automobiles in Taiwan, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives