- China

- /

- Capital Markets

- /

- SHSE:603093

Undiscovered Gems in Asia to Explore This July 2025

Reviewed by Simply Wall St

As global markets experience a wave of optimism, with key indices such as the S&P 500 and Nasdaq Composite reaching all-time highs, investors are increasingly looking towards Asia for opportunities in lesser-known stocks. In this dynamic environment, identifying promising small-cap companies can be particularly rewarding, as these firms often thrive on innovation and adaptability amidst evolving trade relations and economic policies.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ve Wong | 11.74% | 0.90% | 4.16% | ★★★★★★ |

| FALCO HOLDINGS | 4.93% | -0.16% | 1.44% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| Hangzhou Biotest BiotechLtd | 0.04% | -64.74% | -41.95% | ★★★★★★ |

| ShenZhen Click TechnologyLTD | 4.03% | 31.94% | 12.56% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 40.68% | 13.17% | 53.25% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 121.34% | 2.97% | 8.06% | ★★★★☆☆ |

| Shanghai Material Trading | 3.58% | -6.74% | -5.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Highly (Group) (SHSE:600619)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Highly (Group) Co., Ltd. is engaged in the research, development, manufacturing, and sales of components for white goods and energy vehicles both domestically and internationally, with a market cap of CN¥10.68 billion.

Operations: Shanghai Highly (Group) generates revenue through the sale of components for white goods and energy vehicles. The company's financial performance is influenced by its cost structure, which includes manufacturing and development expenses. It has a market capitalization of CN¥10.68 billion.

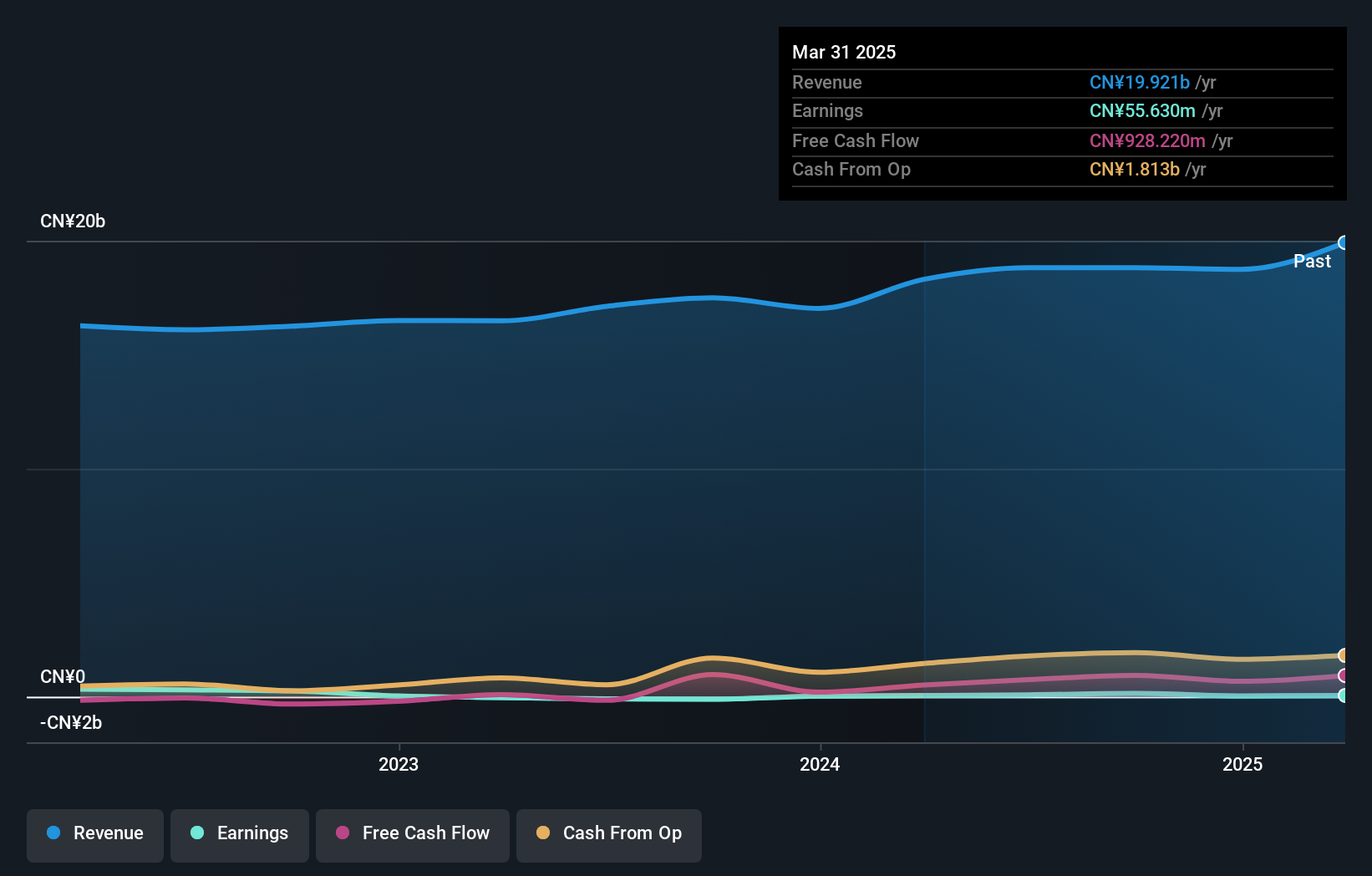

Shanghai Highly, a notable player in the machinery sector, has seen its earnings grow by 9% over the past year, surpassing industry averages. The company reported Q1 2025 sales of CNY 6.75 billion, up from CNY 5.58 billion a year prior, with net income reaching CNY 15.26 million compared to a previous loss of CNY 6.53 million. Despite an increase in debt-to-equity ratio from 39% to nearly 50% over five years, its net debt-to-equity remains satisfactory at about 6%. Trading significantly below fair value estimates and showcasing high-quality earnings positions it as an intriguing prospect amidst Asia's emerging market landscape.

- Click here to discover the nuances of Shanghai Highly (Group) with our detailed analytical health report.

Learn about Shanghai Highly (Group)'s historical performance.

Nanhua Futures (SHSE:603093)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanhua Futures Co., Ltd. offers financial services with a focus on the derivatives market and has a market capitalization of approximately CN¥12.40 billion.

Operations: Nanhua Futures Co., Ltd. generates revenue primarily through its derivatives-focused financial services. The company's market capitalization stands at approximately CN¥12.40 billion, reflecting its position in the financial services industry.

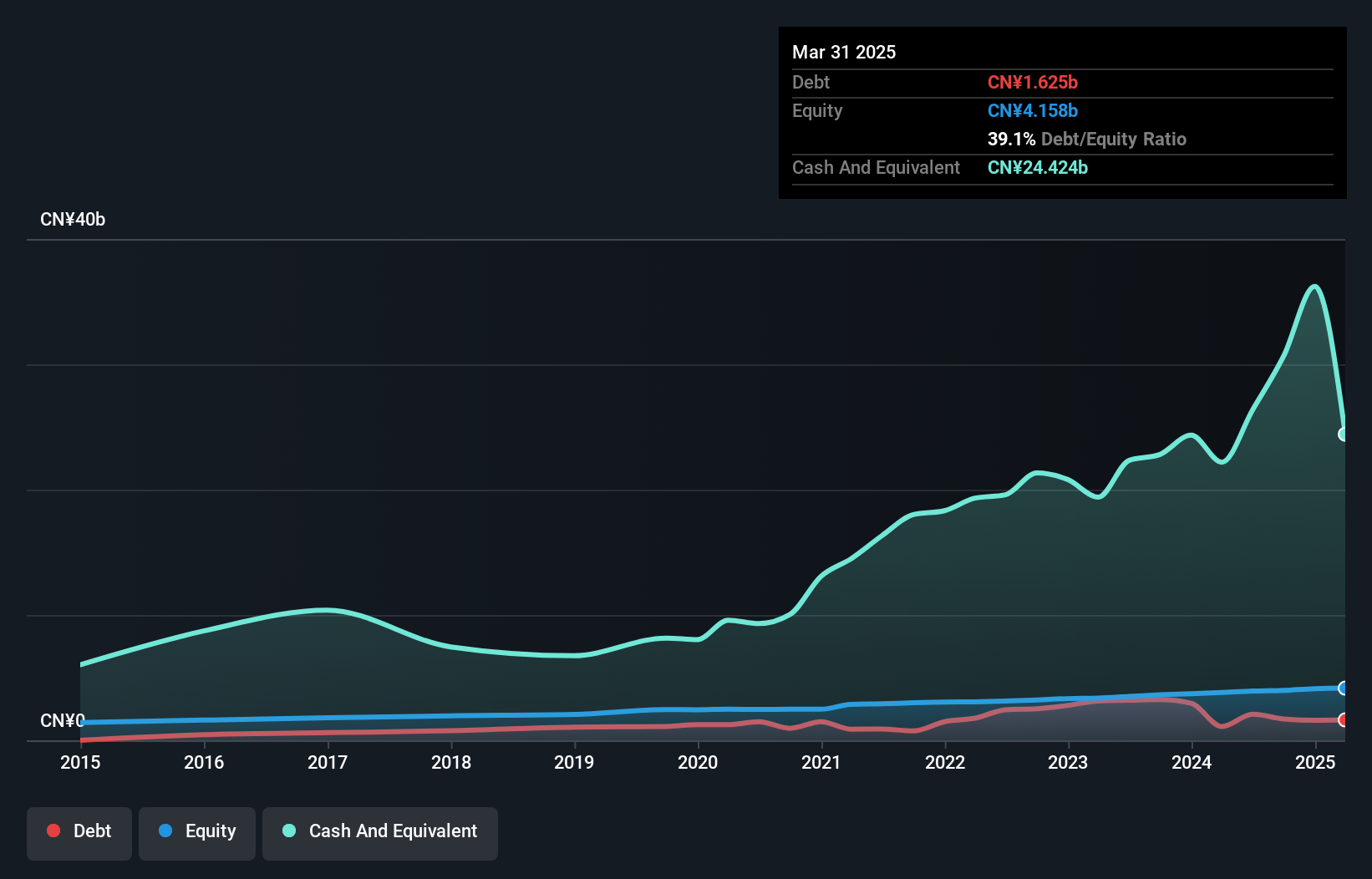

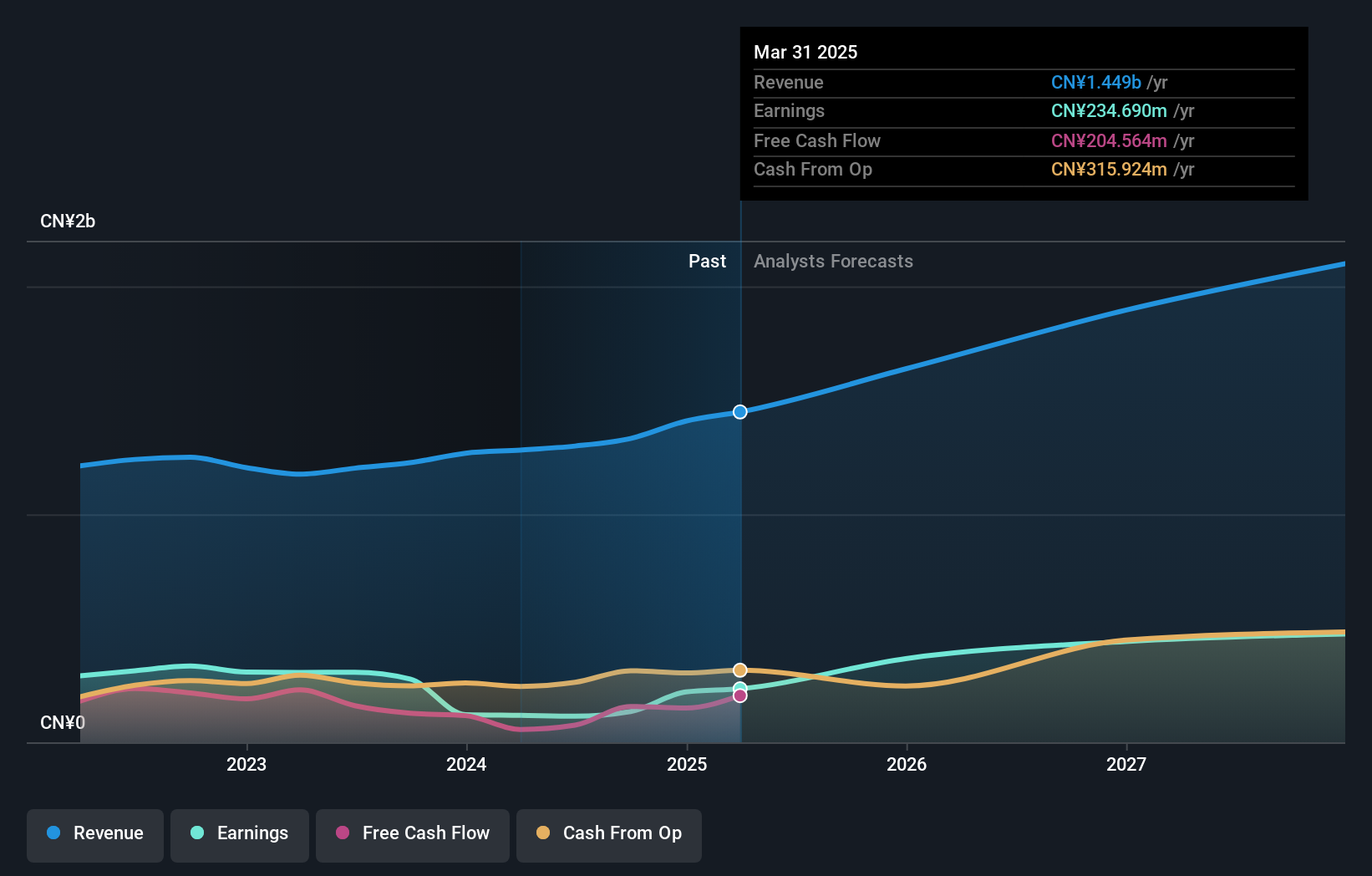

Nanhua Futures, a smaller player in the financial sector, has shown consistent earnings growth of 34.2% annually over five years, although last year's 7.7% lagged behind industry averages. The company boasts more cash than its total debt and has reduced its debt-to-equity ratio from 50% to 39.1%. Despite a volatile share price recently, it maintains high-quality earnings and positive free cash flow. With a price-to-earnings ratio of 27.1x below the market's average of 39.6x, Nanhua appears attractively valued for potential investors seeking opportunities in Asia's dynamic markets.

- Take a closer look at Nanhua Futures' potential here in our health report.

Gain insights into Nanhua Futures' historical performance by reviewing our past performance report.

Hangzhou Weiguang ElectronicLtd (SZSE:002801)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Weiguang Electronic Co., Ltd. engages in the research, development, manufacture, and sale of motors, fans, micro-motors, drives and controllers, robots and automation equipment, pumps, and new energy auto parts in China with a market cap of CN¥8.10 billion.

Operations: The company generates revenue primarily from the sale of motors, fans, micro-motors, drives and controllers, robots and automation equipment, pumps, and new energy auto parts. It operates with a market capitalization of CN¥8.10 billion. The focus on diverse product lines suggests multiple revenue streams contributing to its financial performance.

Hangzhou Weiguang Electronic, a notable player in the electronics sector, is debt-free and has shown impressive earnings growth of 98.8% over the past year, outpacing its industry. Despite this growth, earnings have decreased by 1% annually over five years. The company reported a significant one-off loss of CN¥85.3 million recently impacting its financials but remains profitable with positive free cash flow. A price-to-earnings ratio of 34.5x suggests it's valued attractively compared to the broader CN market at 39.6x. Recently, it announced a cash dividend of CNY 3.50 per 10 shares for shareholders as part of its profit distribution plan for 2024.

- Unlock comprehensive insights into our analysis of Hangzhou Weiguang ElectronicLtd stock in this health report.

Understand Hangzhou Weiguang ElectronicLtd's track record by examining our Past report.

Where To Now?

- Click this link to deep-dive into the 2609 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanhua Futures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603093

Nanhua Futures

Provides financial services focused on derivatives business.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives