In October 2024, Chinese equities have shown resilience, buoyed by recent central bank measures aimed at countering deflationary pressures and supporting economic growth. As the Shanghai Composite Index gains momentum, investors are increasingly interested in dividend stocks as a means to achieve steady income amidst fluctuating market conditions. In this environment, a good dividend stock is typically characterized by a strong balance sheet and consistent earnings that can sustain regular payouts to shareholders.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 3.92% | ★★★★★★ |

| Lao Feng Xiang (SHSE:600612) | 3.45% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.24% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.21% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.10% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.22% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.60% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.10% | ★★★★★★ |

Click here to see the full list of 195 stocks from our Top Chinese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

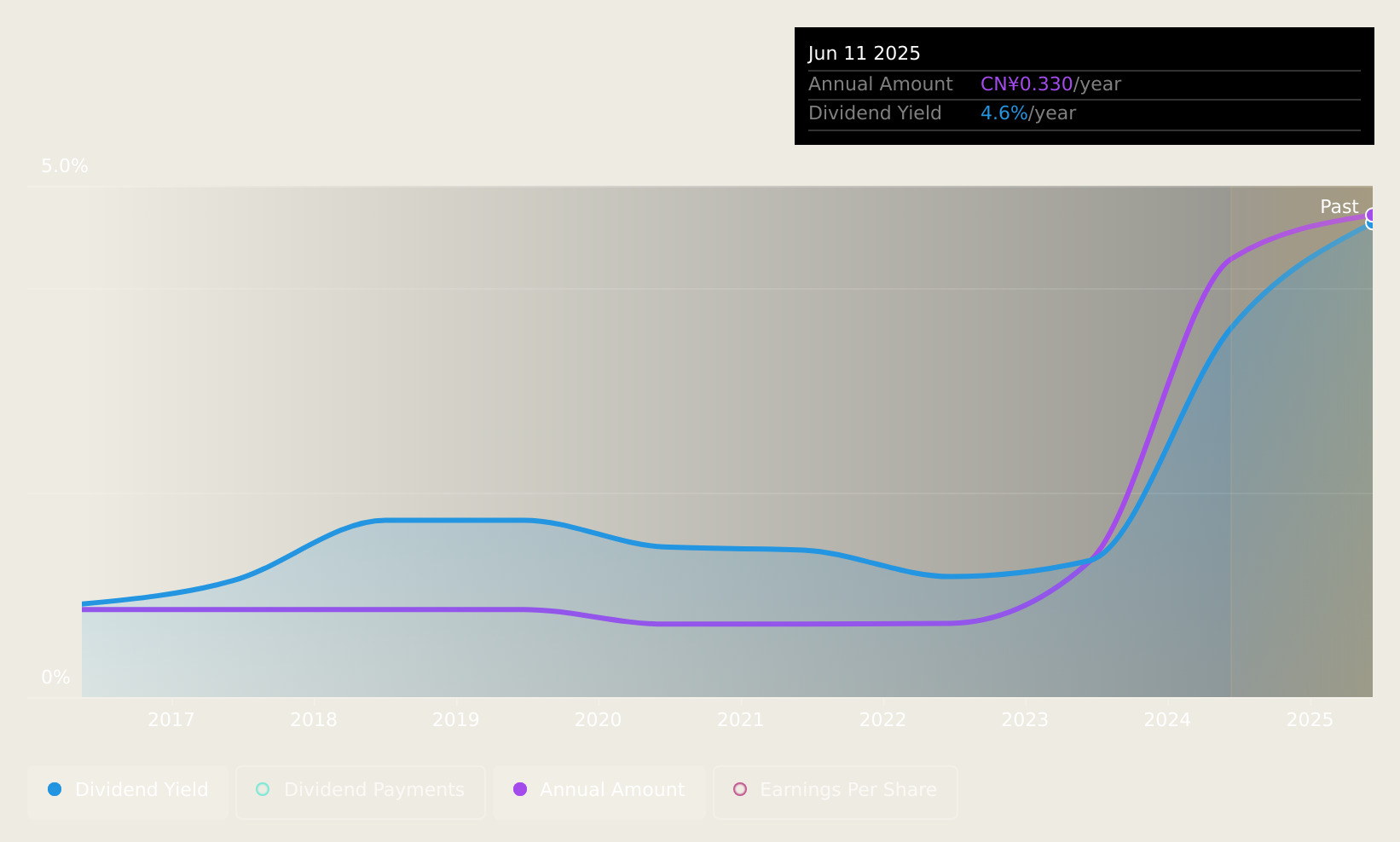

Changhong Meiling (SZSE:000521)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. operates in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥9.25 billion.

Operations: Changhong Meiling Co., Ltd.'s revenue segments include Air Conditioners at CN¥13.24 billion and Small Home Appliances at CN¥1.98 billion.

Dividend Yield: 3.1%

Changhong Meiling's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 38.7% and a cash payout ratio of 10%, indicating strong earnings and cash flow coverage. The company's recent inclusion in the S&P Global BMI Index highlights its market relevance. With earnings growth reported at CNY 530.44 million for the first nine months of 2024, Changhong Meiling offers an attractive dividend yield of 3.1%, ranking in the top quartile within China’s market.

- Dive into the specifics of Changhong Meiling here with our thorough dividend report.

- Our valuation report here indicates Changhong Meiling may be undervalued.

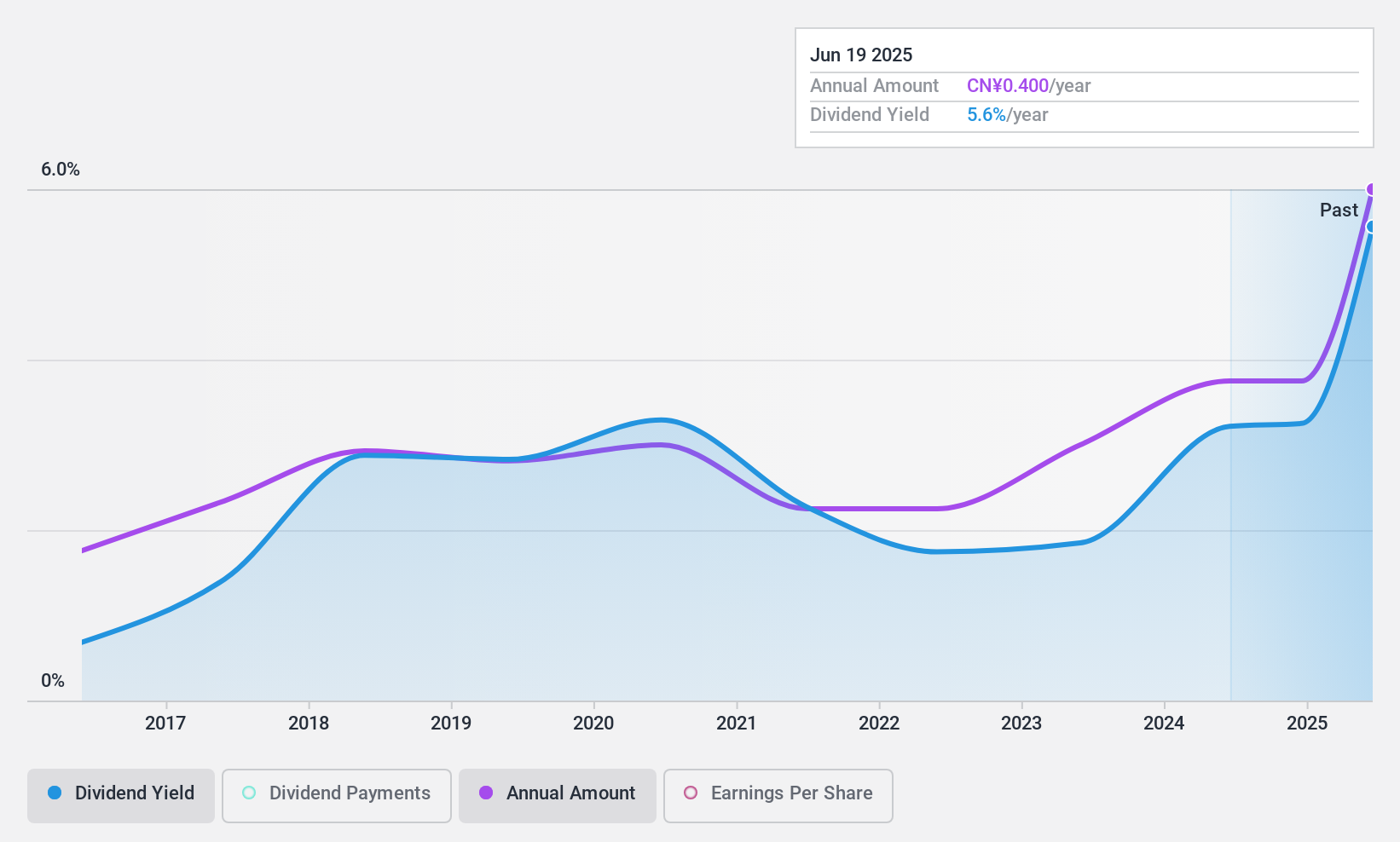

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research and development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.34 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd.'s revenue is primarily derived from Smart Toilet and Cover products at CN¥1.41 billion, Water Tanks and Accessories at CN¥643.59 million, and Same Floor Drainage System Products at CN¥191.70 million.

Dividend Yield: 3.1%

Xiamen R&T Plumbing Technology Ltd. offers a dividend yield of 3.13%, placing it in the top 25% of Chinese dividend payers. Despite reasonable payout ratios—52.5% for earnings and 54.1% for cash flows—the company's dividends have been volatile over its eight-year history, with significant annual drops exceeding 20%. Recent earnings showed increased sales to CNY 1.14 billion, but net income declined to CNY 90.97 million, affecting dividend sustainability perceptions.

- Delve into the full analysis dividend report here for a deeper understanding of Xiamen R&T Plumbing TechnologyLtd.

- Our comprehensive valuation report raises the possibility that Xiamen R&T Plumbing TechnologyLtd is priced lower than what may be justified by its financials.

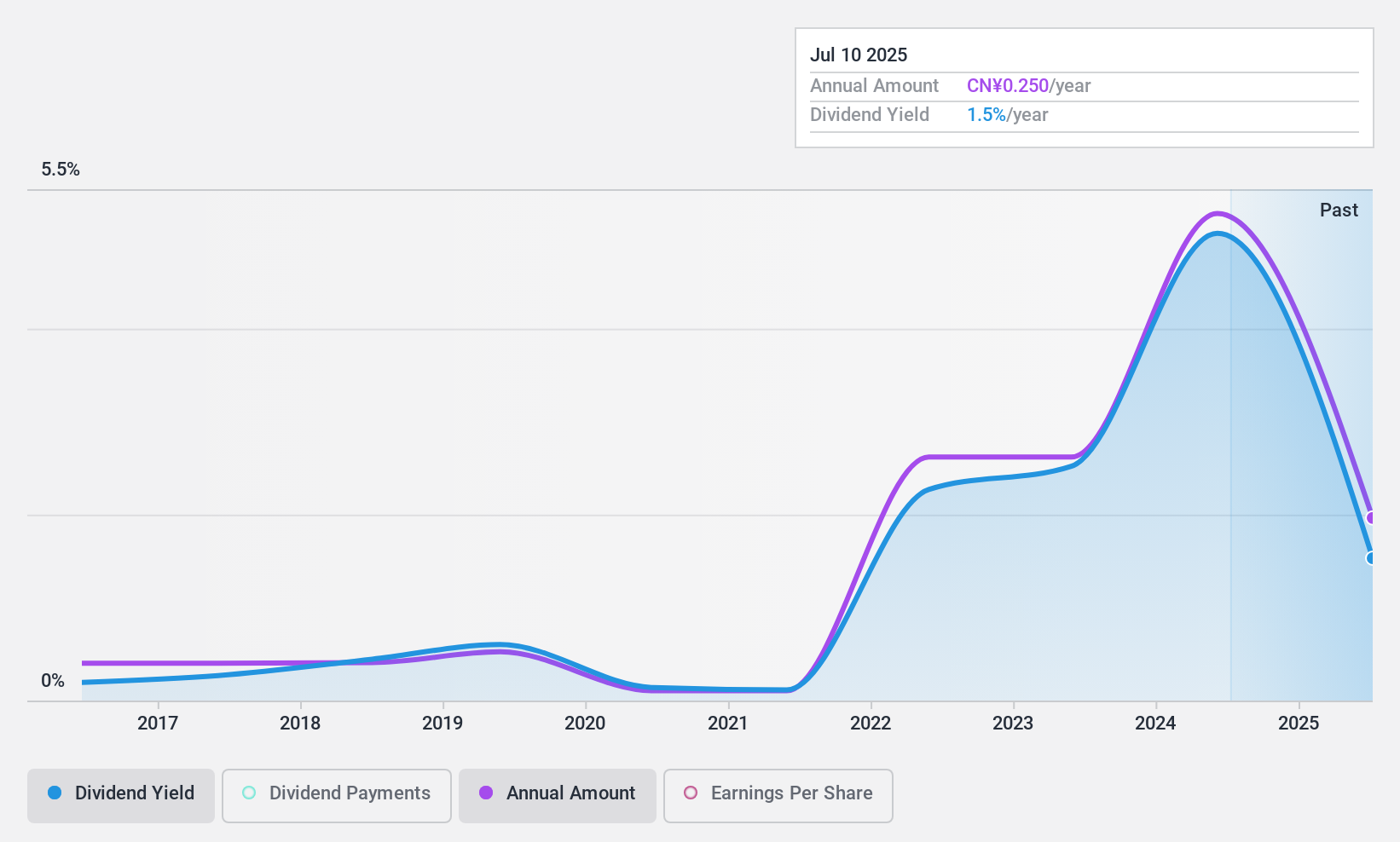

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and internationally, with a market cap of CN¥6.01 billion.

Operations: Boai NKY Medical Holdings Ltd. generates revenue from its operations in the fine chemical and medical care industries, serving both domestic and international markets.

Dividend Yield: 5.1%

Boai NKY Medical Holdings' dividend yield of 5.14% ranks in the top 25% among Chinese stocks, but its sustainability is questionable due to a high cash payout ratio of 206.3%. While dividends are covered by earnings with a payout ratio of 69.6%, they have been volatile over the past decade, experiencing significant drops. Recent earnings showed decreased sales and net income, with CNY 1.11 billion in sales and CNY 311.24 million in net income for nine months ending September 2024, highlighting potential challenges for dividend reliability.

- Take a closer look at Boai NKY Medical Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Boai NKY Medical Holdings is trading beyond its estimated value.

Seize The Opportunity

- Reveal the 195 hidden gems among our Top Chinese Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002790

Xiamen R&T Plumbing TechnologyLtd

Engages in the research and development, production, and sale of bathroom products and accessories worldwide.

Undervalued with excellent balance sheet and pays a dividend.