- China

- /

- Semiconductors

- /

- SHSE:688516

3 Chinese Stocks Estimated To Be Trading At Discounts Of Up To 25.3%

Reviewed by Simply Wall St

As Chinese equities experience a modest rise, buoyed by central bank support amid persistent deflationary pressures, investors are increasingly on the lookout for opportunities in stocks that may be trading below their intrinsic value. In this context, identifying undervalued stocks can be particularly appealing as these assets might offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥37.50 | CN¥73.48 | 49% |

| Beijing Konruns PharmaceuticalLtd (SHSE:603590) | CN¥23.82 | CN¥46.03 | 48.2% |

| Zhejiang Huahai Pharmaceutical (SHSE:600521) | CN¥19.16 | CN¥37.02 | 48.2% |

| Neusoft (SHSE:600718) | CN¥9.95 | CN¥19.27 | 48.4% |

| Guangdong Skychem Technology (SHSE:688603) | CN¥86.58 | CN¥170.26 | 49.1% |

| Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777) | CN¥19.11 | CN¥36.29 | 47.3% |

| Seres GroupLtd (SHSE:601127) | CN¥91.42 | CN¥172.09 | 46.9% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥16.27 | CN¥32.14 | 49.4% |

| GemPharmatech (SHSE:688046) | CN¥12.75 | CN¥25.27 | 49.6% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.12 | CN¥4.01 | 47.2% |

Underneath we present a selection of stocks filtered out by our screen.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems both in China and internationally, with a market cap of CN¥48.65 billion.

Operations: The company's revenue segments include the manufacturing and sale of power distribution and utilization systems in both domestic and international markets.

Estimated Discount To Fair Value: 16.2%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥34.48, below its estimated fair value of CN¥41.13, indicating potential undervaluation based on cash flows. The company's revenue grew significantly in H1 2024 to CN¥6.99 billion from CN¥5.55 billion the previous year, with net income rising to CN¥1.15 billion from CN¥869.71 million, showcasing strong financial performance despite a less stable dividend track record and earnings growth forecasted slower than the market average.

- Our expertly prepared growth report on Ningbo Sanxing Medical ElectricLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Ningbo Sanxing Medical ElectricLtd's balance sheet by reading our health report here.

China Southern Power Grid TechnologyLtd (SHSE:688248)

Overview: China Southern Power Grid Technology Co., Ltd. operates in the energy sector, focusing on power grid technology and solutions, with a market capitalization of CN¥19.84 billion.

Operations: Unfortunately, the provided text does not include specific revenue segments or figures for China Southern Power Grid Technology Co., Ltd. If you have additional information on their revenue breakdown, I can help summarize it accordingly.

Estimated Discount To Fair Value: 14.2%

China Southern Power Grid Technology Ltd. trades at CN¥35.14, below its fair value estimate of CN¥40.94, reflecting potential undervaluation based on cash flows. The company reported substantial revenue and net income growth in H1 2024, with sales reaching CNY 1.55 billion and net income at CNY 184.48 million, despite a volatile share price and an unstable dividend track record. Earnings are forecast to grow significantly above the market average over the next three years.

- In light of our recent growth report, it seems possible that China Southern Power Grid TechnologyLtd's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of China Southern Power Grid TechnologyLtd stock in this financial health report.

Wuxi Autowell TechnologyLtd (SHSE:688516)

Overview: Wuxi Autowell Technology Co., Ltd. manufactures and sells automation equipment for the photovoltaic, lithium battery, and semiconductor industries in China, with a market cap of CN¥17.54 billion.

Operations: The company generates revenue of CN¥8.20 billion from its Industrial Automation & Controls segment.

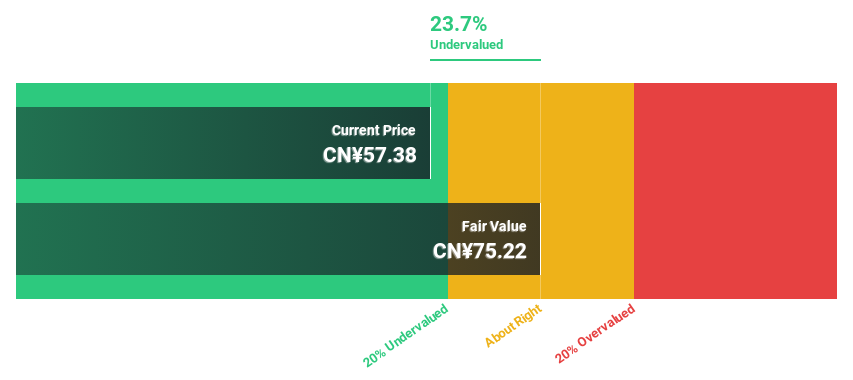

Estimated Discount To Fair Value: 25.3%

Wuxi Autowell Technology Ltd. is trading at CN¥55.97, substantially below its estimated fair value of CN¥74.96, highlighting potential undervaluation based on cash flows. The company reported significant revenue and net income growth for H1 2024, with sales of CNY 4.42 billion and net income of CNY 769.08 million, though it faces high share price volatility and a dividend not fully covered by free cash flows. Earnings are forecast to grow significantly over the next three years.

- Our earnings growth report unveils the potential for significant increases in Wuxi Autowell TechnologyLtd's future results.

- Click here to discover the nuances of Wuxi Autowell TechnologyLtd with our detailed financial health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 100 companies within our Undervalued Chinese Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Autowell TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688516

Wuxi Autowell TechnologyLtd

Manufactures and sells automation equipment for photovoltaic equipment, lithium battery equipment, and semiconductor industries in China.

Flawless balance sheet and undervalued.