- Turkey

- /

- Telecom Services and Carriers

- /

- IBSE:TTKOM

Global Stocks Estimated To Be Undervalued In May 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade negotiations and economic uncertainties, investors are closely monitoring mixed performances across major indices. With the Federal Reserve maintaining a cautious stance on interest rates and international trade discussions potentially easing tensions, opportunities may arise for discerning investors to identify undervalued stocks. In such an environment, a good stock is often characterized by strong fundamentals and resilience in the face of broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.00 | CN¥52.88 | 48.9% |

| Hunan SUND Technological (SZSE:301548) | CN¥48.45 | CN¥95.71 | 49.4% |

| SNGN Romgaz (BVB:SNG) | RON5.70 | RON11.14 | 48.8% |

| Geo Holdings (TSE:2681) | ¥1632.00 | ¥3261.48 | 50% |

| Newborn Town (SEHK:9911) | HK$8.39 | HK$16.46 | 49% |

| GEM (SZSE:002340) | CN¥6.34 | CN¥12.14 | 47.8% |

| World Fitness Services (TWSE:2762) | NT$83.00 | NT$164.45 | 49.5% |

| Boreo Oyj (HLSE:BOREO) | €15.90 | €31.46 | 49.5% |

| dormakaba Holding (SWX:DOKA) | CHF716.00 | CHF1400.80 | 48.9% |

| Bloks Group (SEHK:325) | HK$129.60 | HK$255.66 | 49.3% |

Let's explore several standout options from the results in the screener.

Türk Telekomünikasyon Anonim Sirketi (IBSE:TTKOM)

Overview: Türk Telekomünikasyon Anonim Sirketi, along with its subsidiaries, functions as an integrated telecommunication company in Turkey with a market cap of TRY204.75 billion.

Operations: The company's revenue segments include Fixed Line Services at TRY15.34 billion, Mobile Services at TRY12.67 billion, and Broadband Services at TRY13.89 billion.

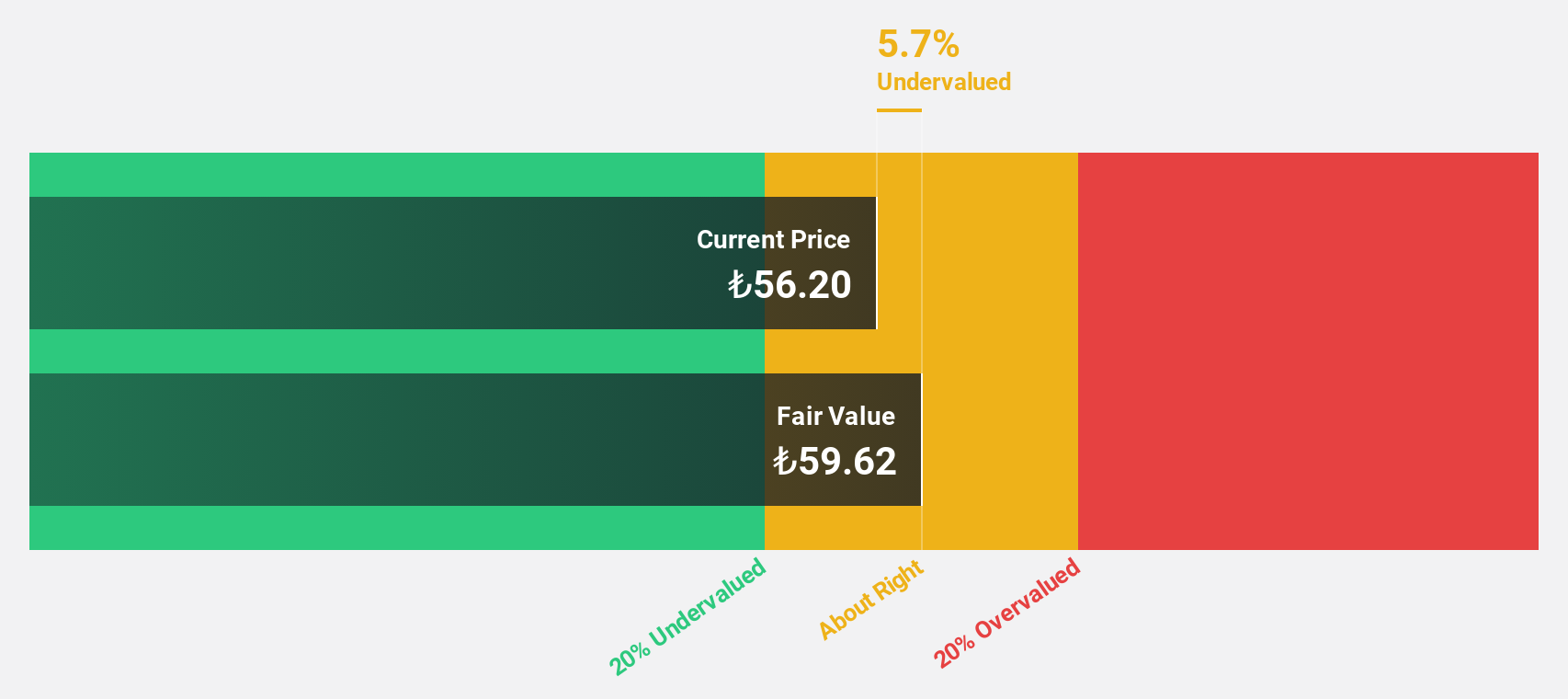

Estimated Discount To Fair Value: 20.3%

Türk Telekomünikasyon Anonim Sirketi appears undervalued, trading over 20% below its fair value estimate of TRY73.36. Despite a decline in profit margins from 15.9% to 6%, the company reported strong Q1 sales growth to TRY45.60 billion and net income improvement to TRY5.13 billion year-on-year. Forecasts suggest robust revenue and earnings growth, outpacing the market at rates of 25.1% and 64% annually, respectively, highlighting potential upside based on cash flow analysis.

- The analysis detailed in our Türk Telekomünikasyon Anonim Sirketi growth report hints at robust future financial performance.

- Take a closer look at Türk Telekomünikasyon Anonim Sirketi's balance sheet health here in our report.

Estun Automation (SZSE:002747)

Overview: Estun Automation Co., Ltd. focuses on the R&D, production, and sale of intelligent equipment and its components in China, with a market cap of CN¥17.96 billion.

Operations: Estun Automation's revenue is primarily derived from its Instrument and Meter Manufacturing segment, which generated CN¥4.25 billion.

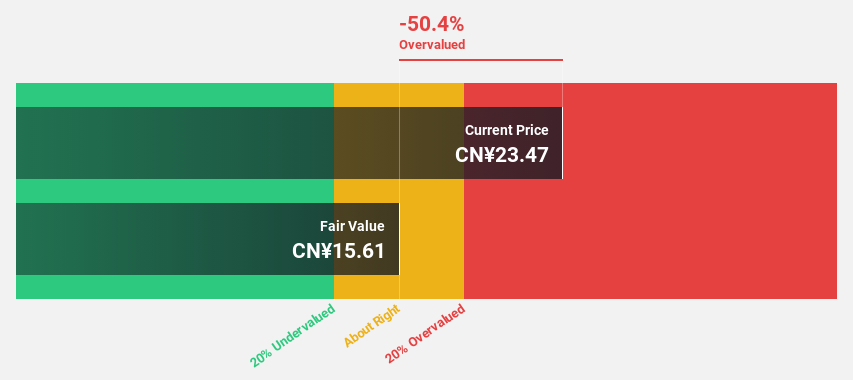

Estimated Discount To Fair Value: 30.8%

Estun Automation is trading at CNY 20.71, significantly below its fair value estimate of CNY 31.22, suggesting potential undervaluation based on cash flows. The company reported Q1 sales growth to CNY 1,244.13 million and net income improvement to CNY 12.63 million year-on-year despite a challenging previous year with a net loss of CNY 810.44 million for 2024. Revenue is forecasted to grow at an annual rate of 14.1%, outpacing the broader CN market growth rate of 12.5%.

- Our expertly prepared growth report on Estun Automation implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Estun Automation stock in this financial health report.

Alchip Technologies (TWSE:3661)

Overview: Alchip Technologies, Limited operates in the research, design, and manufacture of fabless application-specific integrated circuits (ASIC) and system on a chip (SOC) across Japan, Taiwan, and China with a market capitalization of approximately NT$185.97 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, generating NT$51.97 billion.

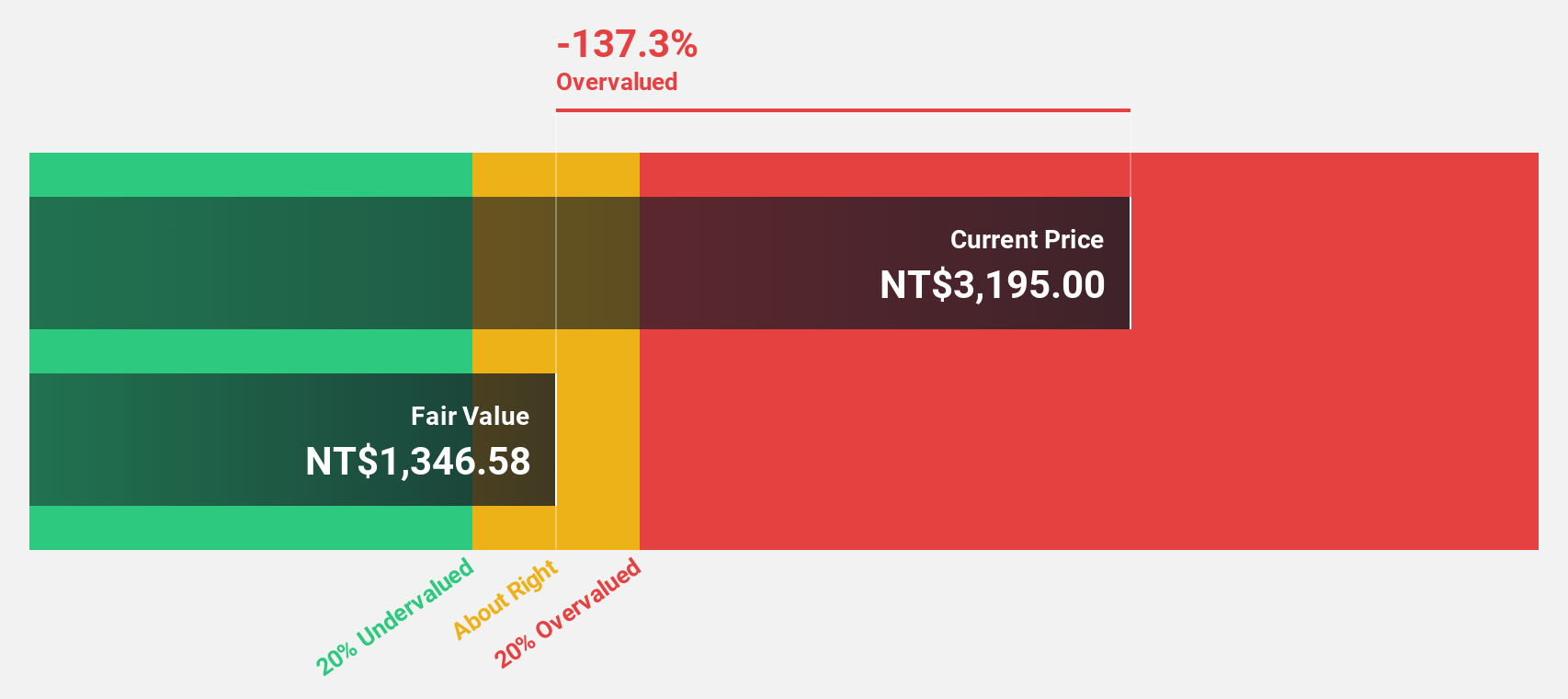

Estimated Discount To Fair Value: 29.7%

Alchip Technologies is trading at NT$2,530, well below its fair value estimate of NT$3,600.17, highlighting potential undervaluation based on cash flows. The company's earnings grew by 93.8% last year and are forecast to grow significantly over the next three years at a rate of 23.29% annually. Despite recent share price volatility, Alchip's revenue growth is expected to outpace the Taiwanese market significantly at 23.6% per year.

- According our earnings growth report, there's an indication that Alchip Technologies might be ready to expand.

- Get an in-depth perspective on Alchip Technologies' balance sheet by reading our health report here.

Summing It All Up

- Delve into our full catalog of 460 Undervalued Global Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Türk Telekomünikasyon Anonim Sirketi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Türk Telekomünikasyon Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TTKOM

Türk Telekomünikasyon Anonim Sirketi

Operates as an integrated telecommunication company in Turkey.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives