- Japan

- /

- Semiconductors

- /

- TSE:6677

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets react to the recent "red sweep" in the U.S. elections, with major indices like the S&P 500 reaching record highs and small-cap stocks making significant gains, investors are closely watching how these political shifts might influence economic growth and inflation. In such a dynamic environment, dividend stocks can offer a blend of income stability and potential capital appreciation, making them an attractive option for those looking to navigate market uncertainties while benefiting from regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.15% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hefei Meyer Optoelectronic Technology (SZSE:002690)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc. operates in the field of optoelectronic technology, focusing on the development and manufacturing of intelligent sorting and inspection equipment, with a market cap of CN¥14.16 billion.

Operations: Hefei Meyer Optoelectronic Technology Inc. generates revenue primarily from the production and sales of photoelectric detection equipment, amounting to CN¥2.35 billion.

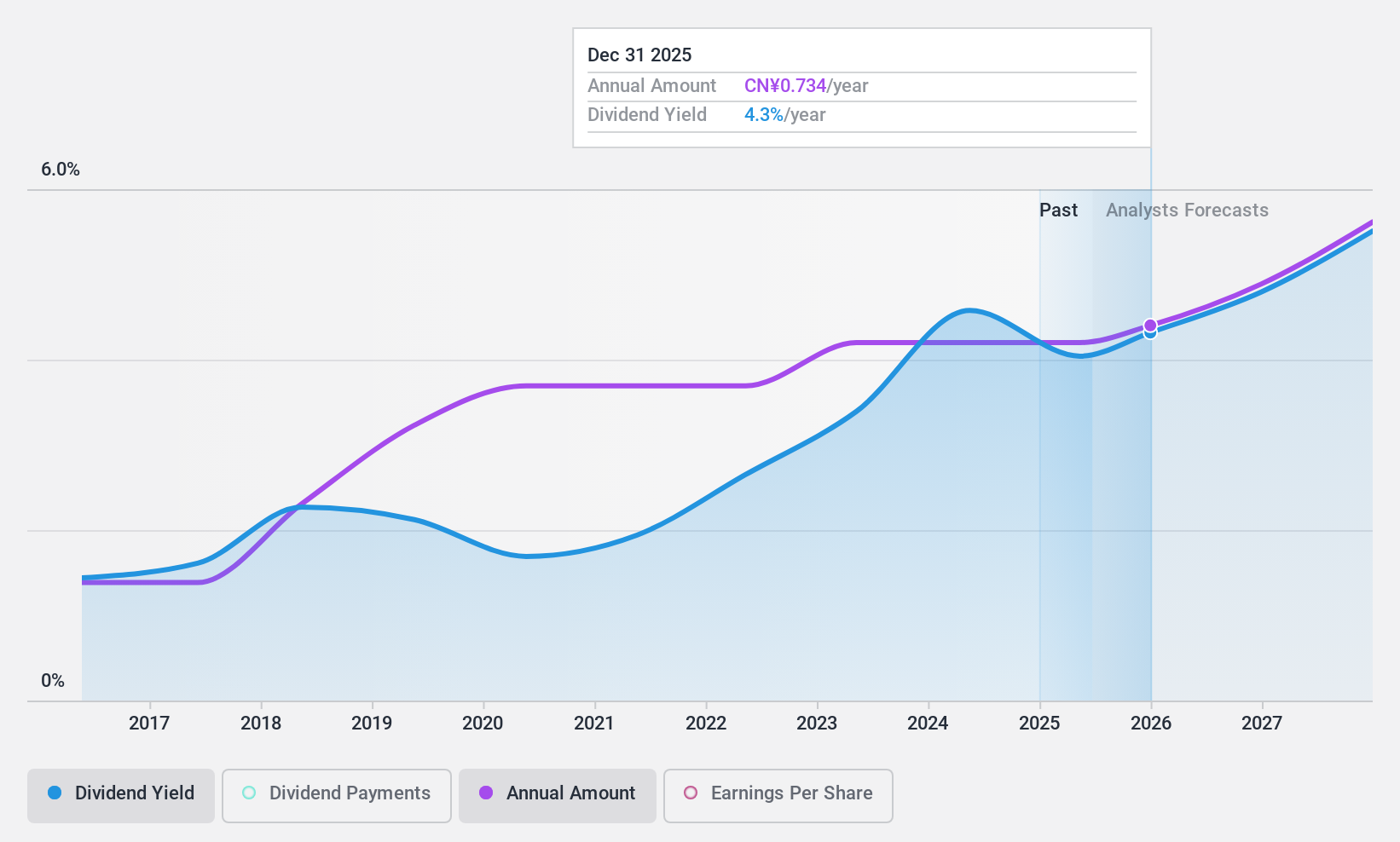

Dividend Yield: 4.3%

Hefei Meyer Optoelectronic Technology's dividend yield of 4.35% ranks in the top 25% of CN market payers, but its sustainability is questionable due to a high payout ratio of 97.6%, indicating dividends are not well covered by earnings. However, dividends have been stable and reliable over the past decade, with payments increasing consistently. Despite recent earnings declines, cash flow coverage remains adequate with an 84.5% cash payout ratio, supporting current dividend levels.

- Take a closer look at Hefei Meyer Optoelectronic Technology's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hefei Meyer Optoelectronic Technology shares in the market.

SK-ElectronicsLTD (TSE:6677)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SK-Electronics CO., LTD. manufactures and sells large-format photomasks in Japan and internationally, with a market cap of ¥25.21 billion.

Operations: SK-Electronics CO., LTD. generates revenue primarily from its Large Photomask Business, which accounts for ¥26.66 billion, and its Solution Business, contributing ¥81.60 million.

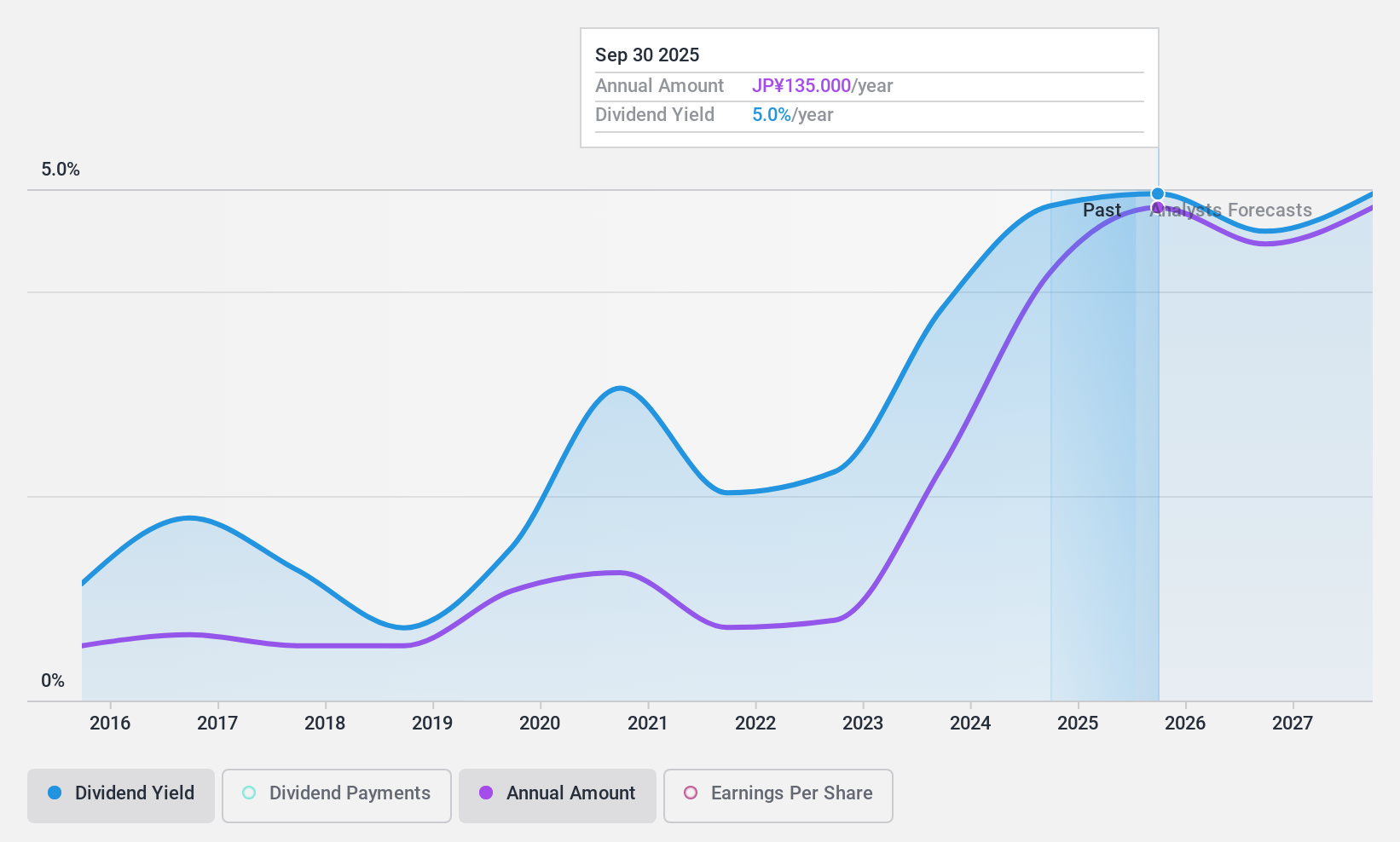

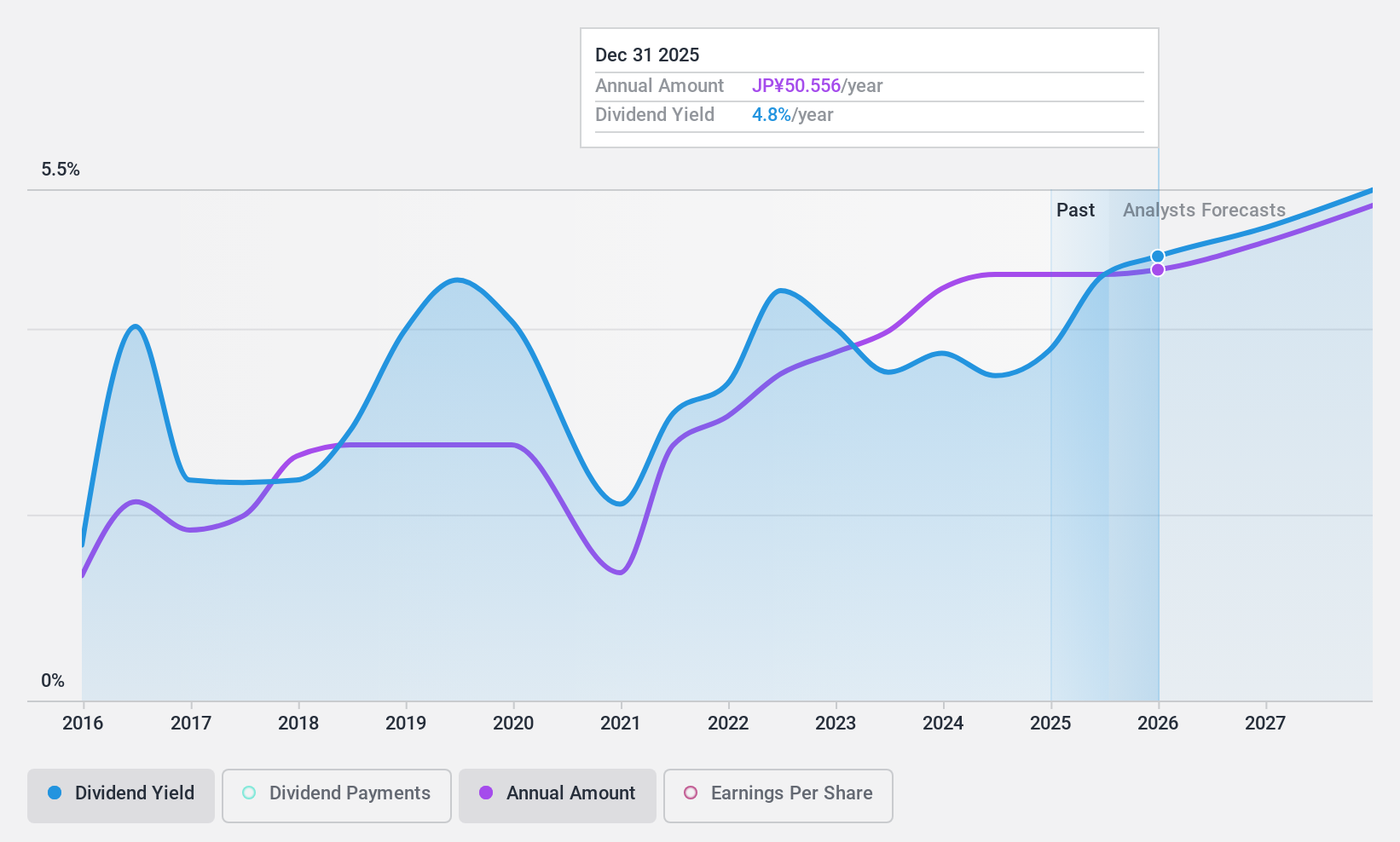

Dividend Yield: 4.8%

SK-Electronics LTD's dividend yield of 4.82% places it among the top 25% in Japan, yet its dividends have been volatile over the past decade. The company recently decreased its dividend to ¥117 per share, down from ¥162 last year, reflecting an unstable track record. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 61.7% and 63.6%, respectively, suggesting current payments are sustainable despite historical volatility.

- Delve into the full analysis dividend report here for a deeper understanding of SK-ElectronicsLTD.

- Upon reviewing our latest valuation report, SK-ElectronicsLTD's share price might be too pessimistic.

Yamaha Motor (TSE:7272)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamaha Motor Co., Ltd. operates in land mobility, marine products, robotics, financial services, and other sectors globally with a market cap of ¥13.69 trillion.

Operations: Yamaha Motor Co., Ltd.'s revenue segments include Land Mobility at ¥1.71 billion, Marine Products at ¥0.53 billion, Robotics at ¥0.11 billion, and Financial Services at ¥0.11 billion.

Dividend Yield: 3.6%

Yamaha Motor's dividend yield of 3.57% is below the top 25% in Japan, and its dividends have been volatile over the past decade. Despite this instability, dividends are covered by earnings with a low payout ratio of 32.1%, although cash flow coverage is tighter at 87.4%. Recent executive changes may impact strategy, but the company trades at a significant discount to estimated fair value, potentially offering long-term appeal for investors seeking undervalued stocks with growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Yamaha Motor.

- Our expertly prepared valuation report Yamaha Motor implies its share price may be lower than expected.

Where To Now?

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1937 more companies for you to explore.Click here to unveil our expertly curated list of 1940 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6677

SK-ElectronicsLTD

Manufactures and sells large-format photomasks in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives