As global markets experience mixed performances with major U.S. indexes reaching record highs and geopolitical events in Europe creating some uncertainty, investors are closely watching economic indicators and central bank decisions. In such a dynamic environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to balance growth potential with regular returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.54% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1929 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

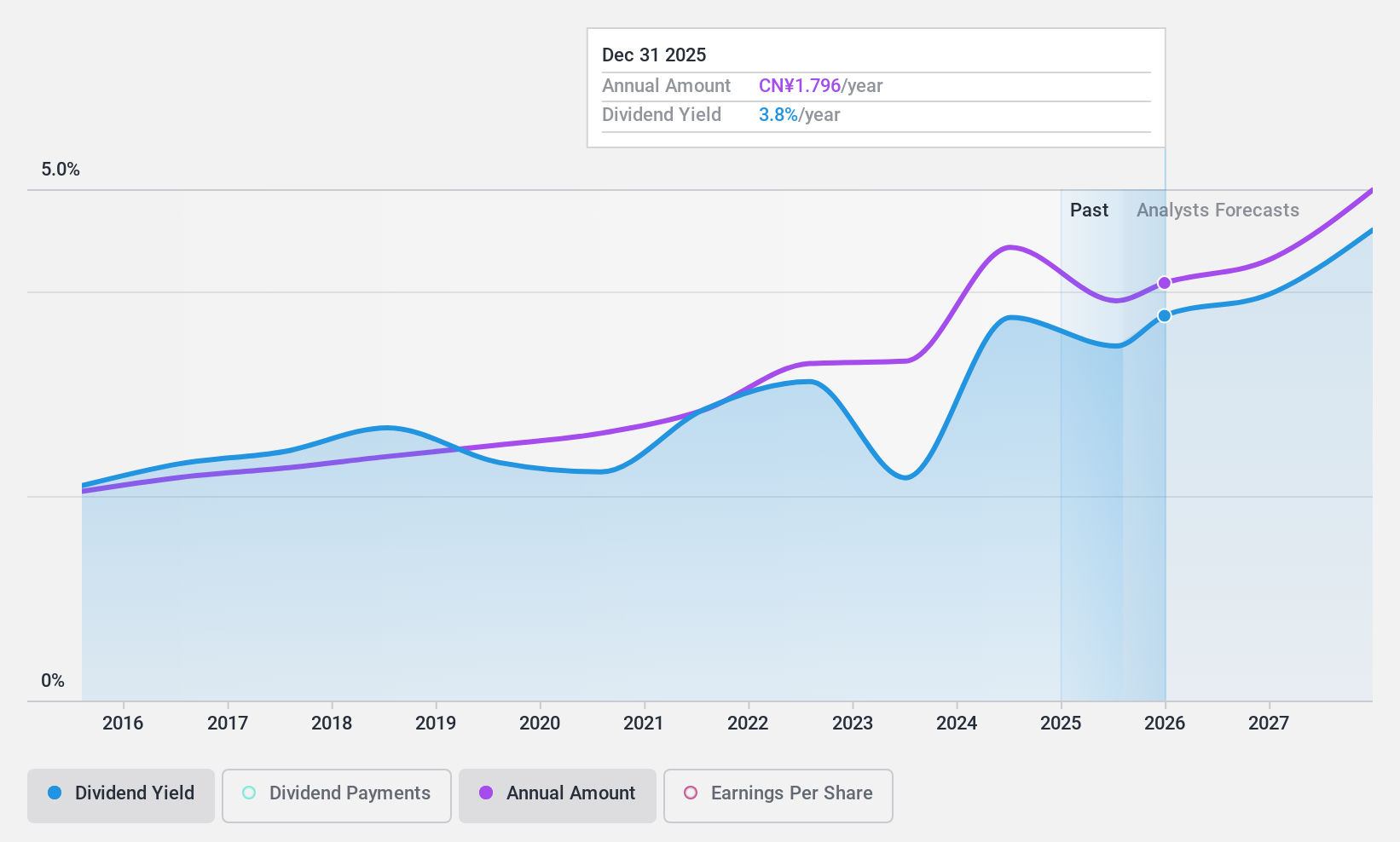

Lao Feng Xiang (SHSE:600612)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Lao Feng Xiang Co., Ltd. operates in the jewelry industry both within the People's Republic of China and internationally, with a market cap of CN¥21.65 billion.

Operations: Lao Feng Xiang Co., Ltd. generates its revenue primarily from its operations in the jewelry industry, serving both domestic and international markets.

Dividend Yield: 3.6%

Lao Feng Xiang's dividend strategy shows stability and growth, with payments increasing over the past decade. The company maintains a sustainable payout ratio of 50.4%, ensuring dividends are well-covered by earnings and cash flows, with a low cash payout ratio of 15.9%. Despite recent declines in sales and net income for the nine months ending September 2024, Lao Feng Xiang offers an attractive dividend yield of 3.59%, placing it among the top tier in the CN market.

- Delve into the full analysis dividend report here for a deeper understanding of Lao Feng Xiang.

- Our valuation report unveils the possibility Lao Feng Xiang's shares may be trading at a discount.

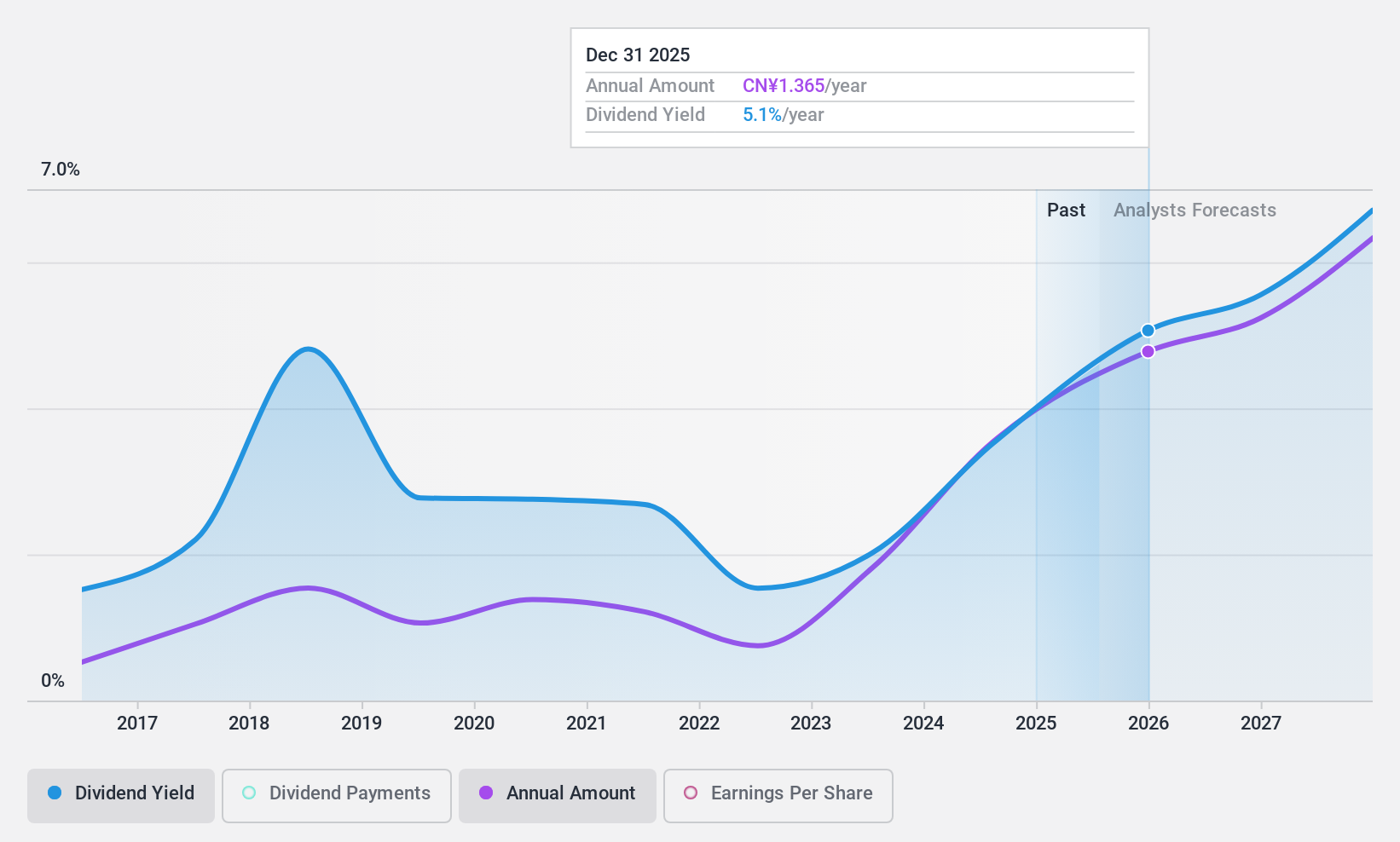

Hisense Home Appliances Group (SZSE:000921)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hisense Home Appliances Group Co., Ltd. manufactures and sells household electrical appliances under various brands, including Hisense, Ronshen, Kelon, Hitachi, and York in China and internationally, with a market cap of CN¥35.36 billion.

Operations: Hisense Home Appliances Group Co., Ltd. generates revenue from the manufacturing and sale of household electrical appliances under its various brands in both domestic and international markets.

Dividend Yield: 3.5%

Hisense Home Appliances Group's dividend yield is among the top 25% in the CN market, supported by a low payout ratio of 43.1%, ensuring dividends are well-covered by earnings and cash flows. Despite only nine years of dividend history with volatility, recent earnings growth of CNY 2.79 billion for the first nine months of 2024 suggests potential stability. Executive changes, including a new CFO and chairperson, may influence future financial strategies.

- Click to explore a detailed breakdown of our findings in Hisense Home Appliances Group's dividend report.

- Our comprehensive valuation report raises the possibility that Hisense Home Appliances Group is priced lower than what may be justified by its financials.

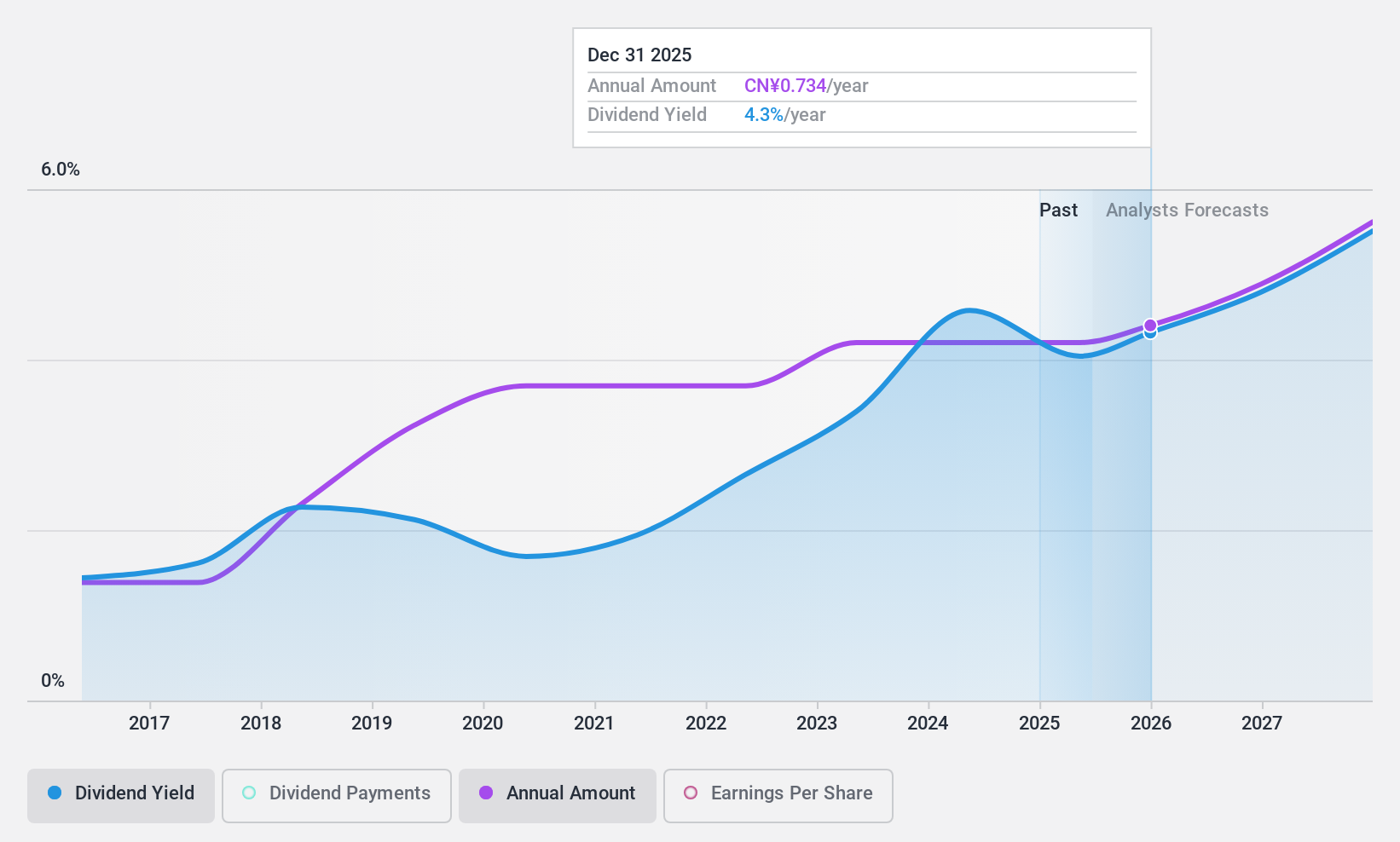

Hefei Meyer Optoelectronic Technology (SZSE:002690)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc. operates in the optoelectronic industry, focusing on the development and production of intelligent sorting equipment, with a market cap of CN¥13.66 billion.

Operations: Hefei Meyer Optoelectronic Technology Inc. generates revenue primarily from the production and sales of photoelectric detection equipment, amounting to CN¥2.35 billion.

Dividend Yield: 4.4%

Hefei Meyer Optoelectronic Technology's dividend yield is in the top 25% of CN market payers, yet its high payout ratio of 97.6% raises concerns about sustainability as dividends are not covered by earnings. Despite stable and growing dividends over the past decade, recent earnings declined to CNY 450.03 million for nine months ending September 2024, suggesting potential pressure on future payouts. The stock trades slightly below its estimated fair value, but cash flows currently cover dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Hefei Meyer Optoelectronic Technology.

- The analysis detailed in our Hefei Meyer Optoelectronic Technology valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Explore the 1929 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Meyer Optoelectronic Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002690

Hefei Meyer Optoelectronic Technology

Hefei Meyer Optoelectronic Technology Inc.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives