What Shenyang Yuanda Intellectual Industry Group Co.,Ltd's (SZSE:002689) 41% Share Price Gain Is Not Telling You

Those holding Shenyang Yuanda Intellectual Industry Group Co.,Ltd (SZSE:002689) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

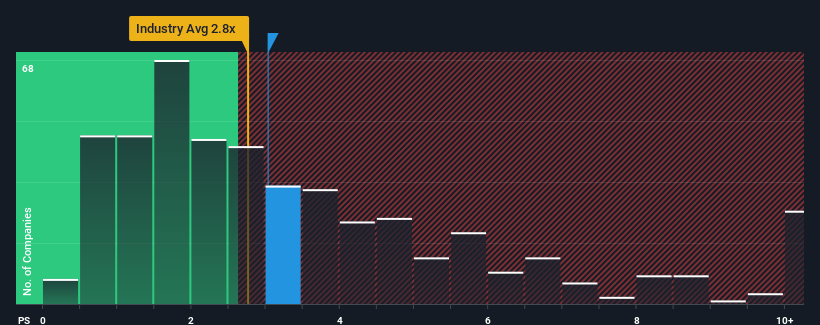

In spite of the firm bounce in price, it's still not a stretch to say that Shenyang Yuanda Intellectual Industry GroupLtd's price-to-sales (or "P/S") ratio of 3x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Shenyang Yuanda Intellectual Industry GroupLtd

How Shenyang Yuanda Intellectual Industry GroupLtd Has Been Performing

With revenue growth that's exceedingly strong of late, Shenyang Yuanda Intellectual Industry GroupLtd has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenyang Yuanda Intellectual Industry GroupLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Shenyang Yuanda Intellectual Industry GroupLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 63% gain to the company's top line. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Shenyang Yuanda Intellectual Industry GroupLtd's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Shenyang Yuanda Intellectual Industry GroupLtd's P/S

Its shares have lifted substantially and now Shenyang Yuanda Intellectual Industry GroupLtd's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenyang Yuanda Intellectual Industry GroupLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 1 warning sign for Shenyang Yuanda Intellectual Industry GroupLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002689

Shenyang Yuanda Intellectual Industry GroupLtd

Researches, develops, manufactures, installs, and sells elevators in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives