- China

- /

- Electrical

- /

- SZSE:002638

3 Asian Penny Stocks With Market Caps Over US$600M

Reviewed by Simply Wall St

As global markets continue to respond to central bank policies and economic data, investors are increasingly looking towards Asia for potential opportunities. Penny stocks, a term often associated with smaller or newer companies, remain relevant due to their potential for growth at lower price points. This article explores three Asian penny stocks that stand out for their financial strength and resilience, offering compelling opportunities in today's market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.94 | THB3.89B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.03 | HK$2.47B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.59 | HK$983.45M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.38 | HK$1.97B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.91 | SGD368.81M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.82 | THB2.89B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.20 | SGD12.59B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.96 | THB10.02B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 977 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Autostreets Development (SEHK:2443)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Autostreets Development Limited, with a market cap of HK$3.65 billion, is an investment holding company that offers used vehicle transaction services in China.

Operations: The company generates revenue of CN¥359.13 million from its transportation and related services segment.

Market Cap: HK$3.65B

Autostreets Development Limited has shown financial improvement, reporting a net income of CN¥5.46 million for the first half of 2025, reversing a net loss from the previous year. The company benefits from strong liquidity, with short-term assets of CN¥1.2 billion covering both short and long-term liabilities comfortably. Although its return on equity is low at 4.7%, interest payments are well covered by EBIT. Despite significant insider selling recently, Autostreets has not diluted shareholders over the past year and maintains more cash than total debt, although operating cash flow coverage is weak at 7.5%.

- Click here to discover the nuances of Autostreets Development with our detailed analytical financial health report.

- Assess Autostreets Development's previous results with our detailed historical performance reports.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD777.01 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.32 billion, followed by Heating Power at CN¥194.94 million and Waste Treatment at CN¥27.89 million.

Market Cap: SGD777.01M

China Sunsine Chemical Holdings Ltd. demonstrates financial resilience with a robust revenue stream, primarily from its Rubber Chemicals segment, generating CN¥4.32 billion. Recent earnings show an increase in net income to CN¥242.7 million for the first half of 2025, reflecting improved profit margins and earnings growth of 30.3% over the past year, outpacing industry averages. The company operates debt-free with short-term assets significantly exceeding liabilities and maintains a stable weekly volatility of 5%. Despite an unstable dividend track record, it declared both interim and special dividends payable in September 2025 to reward shareholders on its anniversary milestone.

- Click here and access our complete financial health analysis report to understand the dynamics of China Sunsine Chemical Holdings.

- Explore China Sunsine Chemical Holdings' analyst forecasts in our growth report.

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. manufactures and sells LED lighting products both in China and internationally, with a market cap of CN¥3.75 billion.

Operations: The company generates revenue from its semiconductor lighting segment, which amounts to CN¥420.10 million.

Market Cap: CN¥3.75B

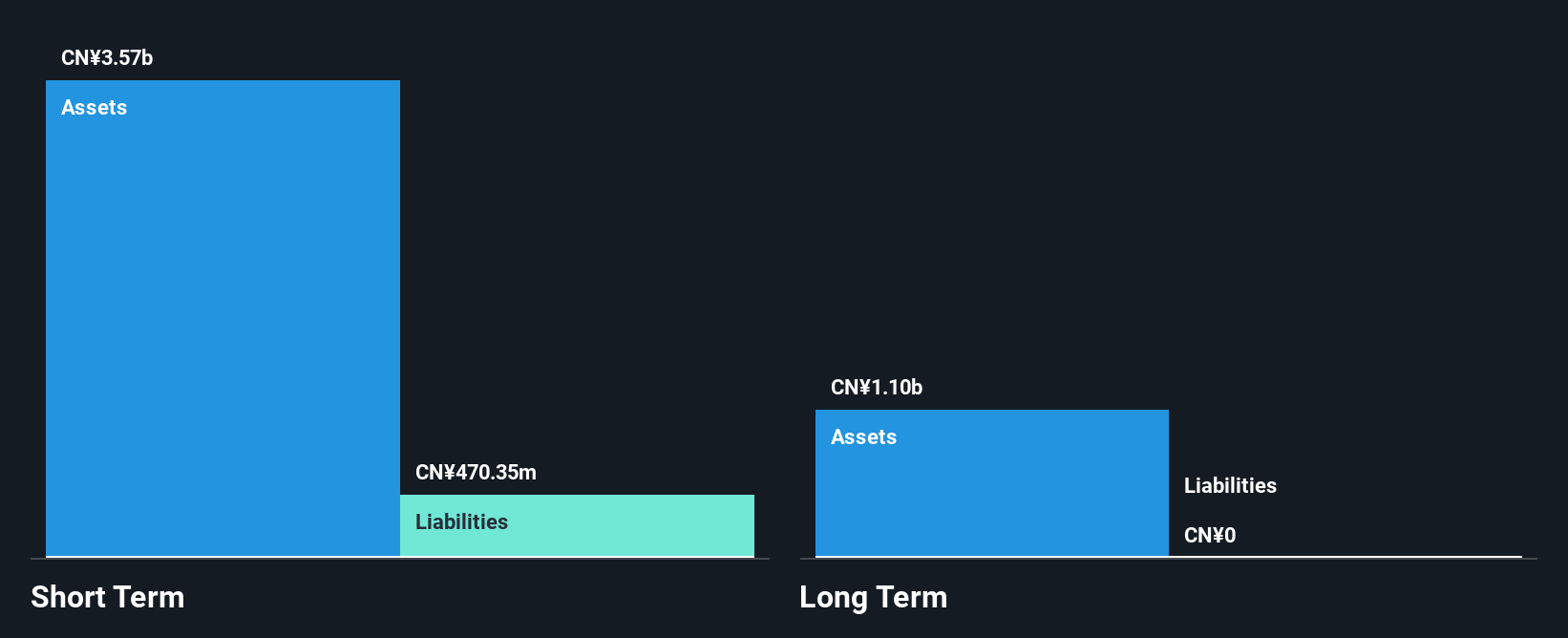

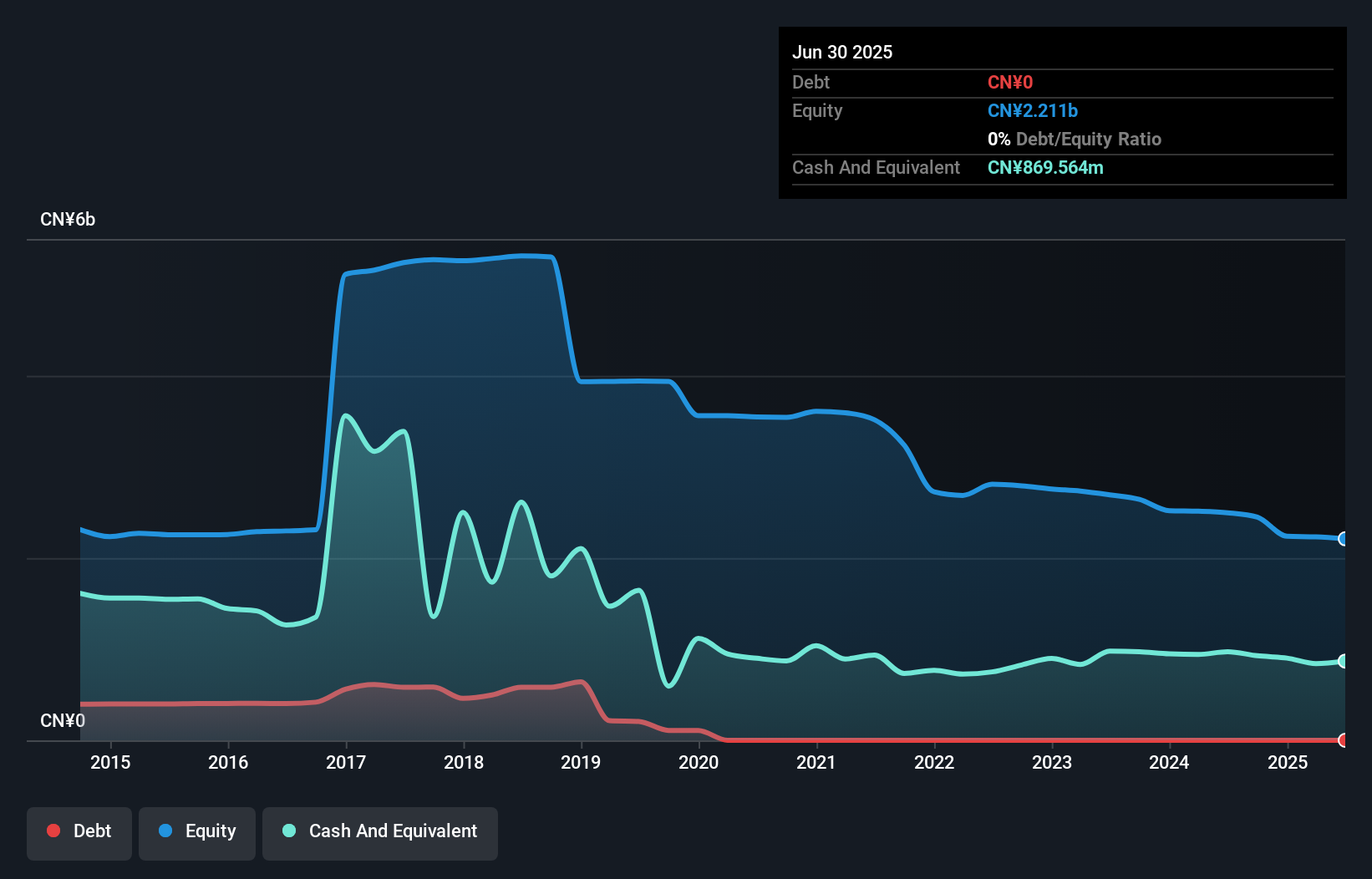

Dongguan Kingsun Optoelectronic Co., Ltd. remains unprofitable, with a negative return on equity of -11.53%, yet shows potential through reduced losses at an annual rate of 12.3% over five years and a solid cash runway exceeding three years based on current free cash flow trends. The company is debt-free, with short-term assets (CN¥1.4 billion) comfortably covering liabilities and stable weekly volatility at 5%. Despite experienced management, the board's average tenure suggests inexperience. Recent earnings for the first half of 2025 indicate increased revenue to CN¥263.35 million but also a widened net loss of CN¥28.12 million year-over-year.

- Jump into the full analysis health report here for a deeper understanding of Dongguan Kingsun OptoelectronicLtd.

- Learn about Dongguan Kingsun OptoelectronicLtd's historical performance here.

Next Steps

- Take a closer look at our Asian Penny Stocks list of 977 companies by clicking here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002638

Dongguan Kingsun OptoelectronicLtd

Manufactures and sells LED lighting products in China and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives