- China

- /

- Electrical

- /

- SZSE:002533

Baoxiniao Holding Leads Our Top 3 Dividend Stocks

Reviewed by Simply Wall St

In the midst of a bustling week for global markets, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing highs before retreating, investors are navigating a landscape marked by cautious earnings reports and mixed economic signals. As growth stocks lag behind value shares, partly due to tech giants' earnings announcements, dividend stocks emerge as a stable option for those seeking consistent returns amidst market volatility. A good dividend stock typically offers reliable payouts and demonstrates resilience in fluctuating economic conditions, making it an attractive choice in today's uncertain market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.42% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. is involved in the research, development, production, and sale of branded clothing products in China with a market cap of CN¥6.14 billion.

Operations: Baoxiniao Holding Co., Ltd. generates its revenue through the research, development, production, and sale of branded clothing products in China.

Dividend Yield: 3.3%

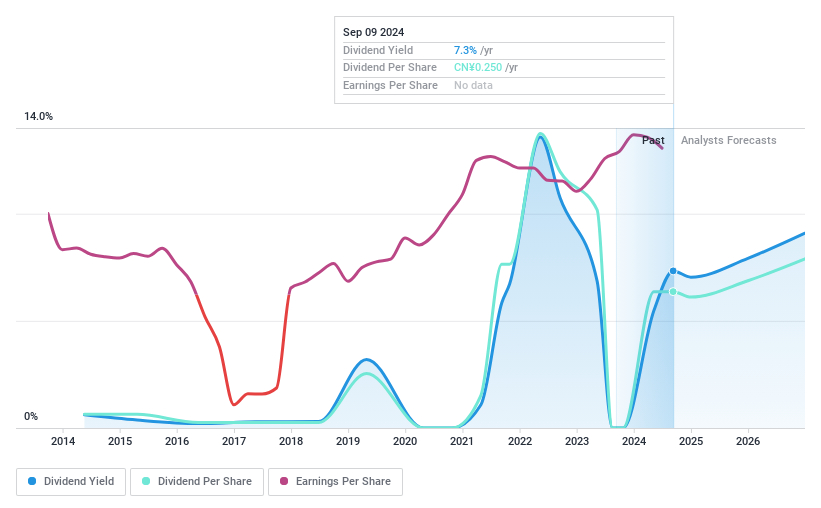

Baoxiniao Holding's dividend yield of 3.33% ranks in the top 25% of CN market payers, supported by a reasonable payout ratio of 65.9%. However, its dividend history is volatile and unreliable, with fluctuations exceeding 20% annually over the past decade. Despite this instability, dividends are well-covered by cash flows (35.8%). Recent earnings show a decline in net income to CNY 415.27 million for nine months ending September 2024 from CNY 555.12 million year-on-year, potentially impacting future payouts.

- Get an in-depth perspective on Baoxiniao Holding's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Baoxiniao Holding's share price might be too pessimistic.

Gold cup Electric ApparatusLtd (SZSE:002533)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gold cup Electric Apparatus Co., Ltd. is engaged in the research, development, manufacturing, and sale of wires and cables both in China and internationally, with a market cap of CN¥7.37 billion.

Operations: Gold cup Electric Apparatus Co., Ltd. generates its revenue primarily through the production and distribution of wires and cables both domestically in China and on an international scale.

Dividend Yield: 3.9%

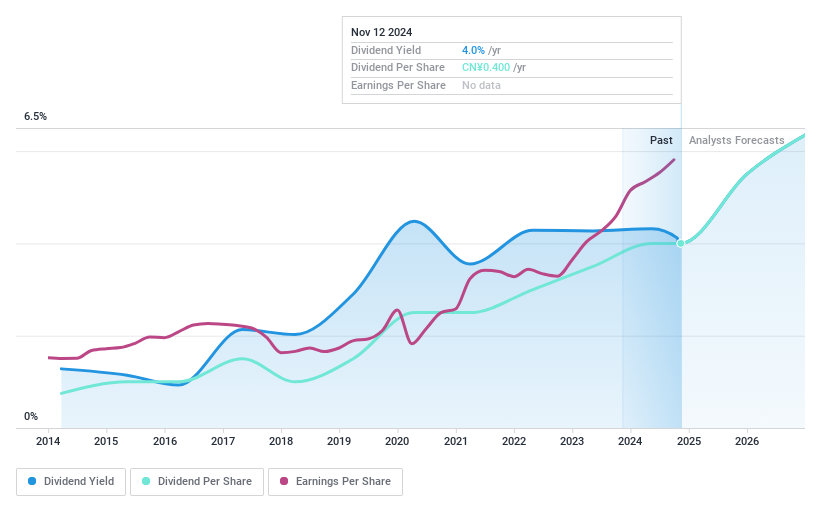

Gold cup Electric Apparatus Co., Ltd. offers a dividend yield of 3.95%, placing it in the top 25% of CN market payers, with dividends covered by earnings (payout ratio: 74.6%) and cash flows (cash payout ratio: 65.8%). Despite past volatility, recent earnings growth to CNY 426.76 million for nine months ending September 2024 supports sustainability. An interim cash dividend was approved at CNY 2 per 10 shares, reflecting ongoing shareholder returns commitment amidst stable financial performance.

- Dive into the specifics of Gold cup Electric ApparatusLtd here with our thorough dividend report.

- The analysis detailed in our Gold cup Electric ApparatusLtd valuation report hints at an deflated share price compared to its estimated value.

Chengdu Kanghua Biological Products (SZSE:300841)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Kanghua Biological Products Co., Ltd. operates in the biotechnology sector, focusing on the development and production of biological products, with a market capitalization of approximately CN¥8.13 billion.

Operations: Chengdu Kanghua Biological Products Co., Ltd. generates its revenue through various segments within the biotechnology sector, focusing on the development and production of biological products.

Dividend Yield: 3.2%

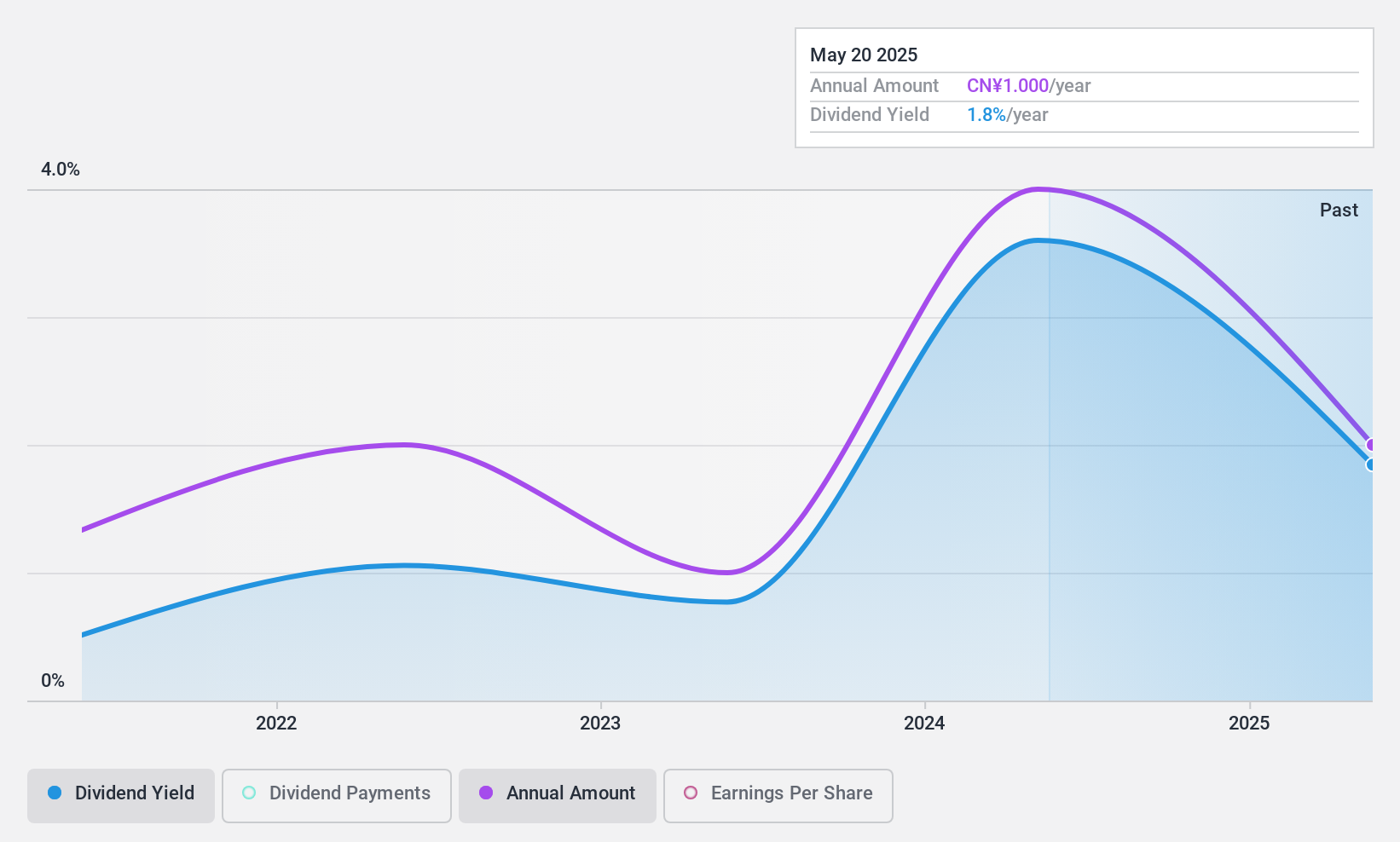

Chengdu Kanghua Biological Products offers a dividend yield of 3.2%, ranking in the top 25% of CN market payers, with dividends well-covered by earnings (payout ratio: 48.6%) and cash flows (cash payout ratio: 62.8%). Despite a volatile dividend history over its four-year payment period, recent earnings growth to CNY 405.9 million for nine months ending September 2024 indicates potential sustainability, supported by trading at good value relative to peers and industry standards.

- Click here and access our complete dividend analysis report to understand the dynamics of Chengdu Kanghua Biological Products.

- Our expertly prepared valuation report Chengdu Kanghua Biological Products implies its share price may be lower than expected.

Turning Ideas Into Actions

- Embark on your investment journey to our 1947 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002533

Gold cup Electric ApparatusLtd

Researches, develops, manufactures, and sells wires and cables in China and internationally.

Very undervalued with solid track record and pays a dividend.