- China

- /

- Electrical

- /

- SZSE:002531

Titan Wind Energy (Suzhou) Co.,Ltd's (SZSE:002531) P/E Is Still On The Mark Following 43% Share Price Bounce

Titan Wind Energy (Suzhou) Co.,Ltd (SZSE:002531) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

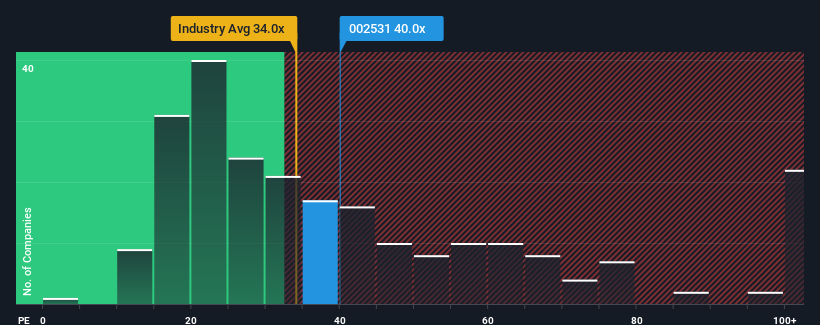

After such a large jump in price, Titan Wind Energy (Suzhou)Ltd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 40x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Titan Wind Energy (Suzhou)Ltd has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Titan Wind Energy (Suzhou)Ltd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Titan Wind Energy (Suzhou)Ltd would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 55%. This means it has also seen a slide in earnings over the longer-term as EPS is down 68% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 68% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 18% each year, which is noticeably less attractive.

With this information, we can see why Titan Wind Energy (Suzhou)Ltd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Titan Wind Energy (Suzhou)Ltd's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Titan Wind Energy (Suzhou)Ltd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Titan Wind Energy (Suzhou)Ltd has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Titan Wind Energy (Suzhou)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002531

Titan Wind Energy (Suzhou)Ltd

Produces, develops, and sells wind towers and components in China.

High growth potential low.

Market Insights

Community Narratives