As Asia's markets navigate a complex landscape of economic shifts and investor sentiment, opportunities continue to emerge for those looking beyond the major indices. Penny stocks, although an older term, still hold relevance as they represent smaller or newer companies that can offer growth potential at lower price points. These stocks may surprise investors with their ability to combine solid fundamentals and strong balance sheets, presenting intriguing opportunities in today's market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.78 | HK$2.27B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.67 | HK$2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.43 | SGD13.5B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.96 | NZ$248.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tongdao Liepin Group (SEHK:6100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tongdao Liepin Group is an investment holding company that offers talent acquisition services in the People’s Republic of China, with a market cap of approximately HK$2.01 billion.

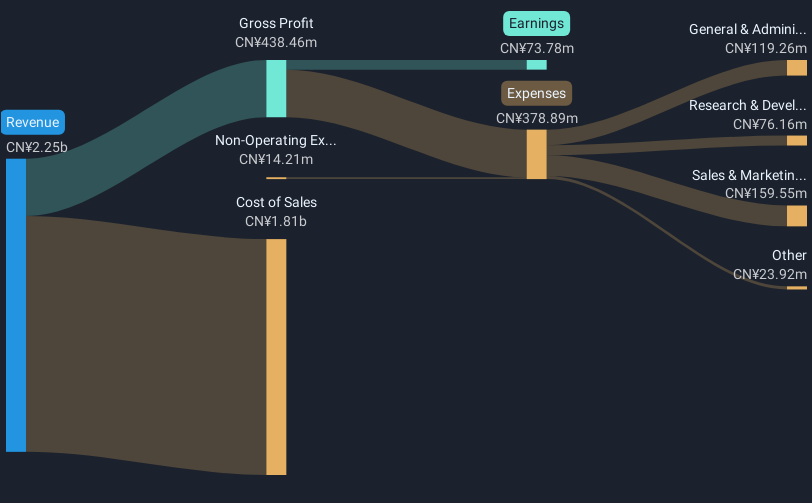

Operations: The company generates revenue primarily through its Talent Services segment, which reported CN¥2 billion.

Market Cap: HK$2.01B

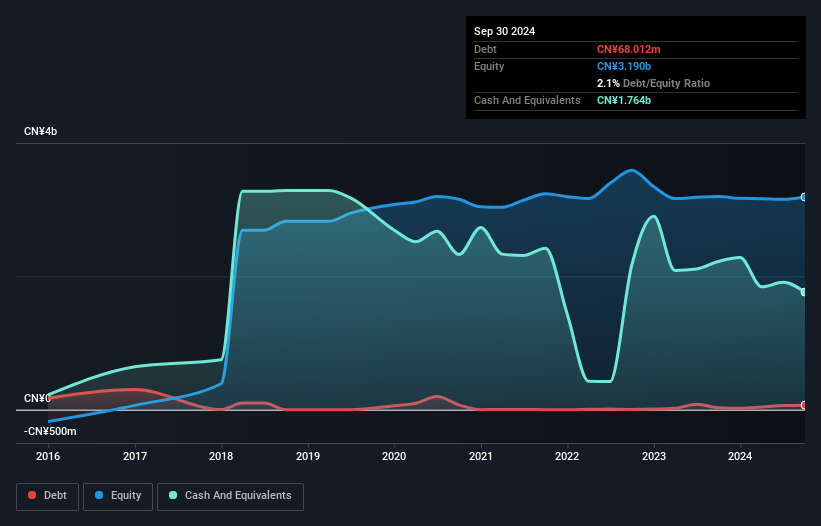

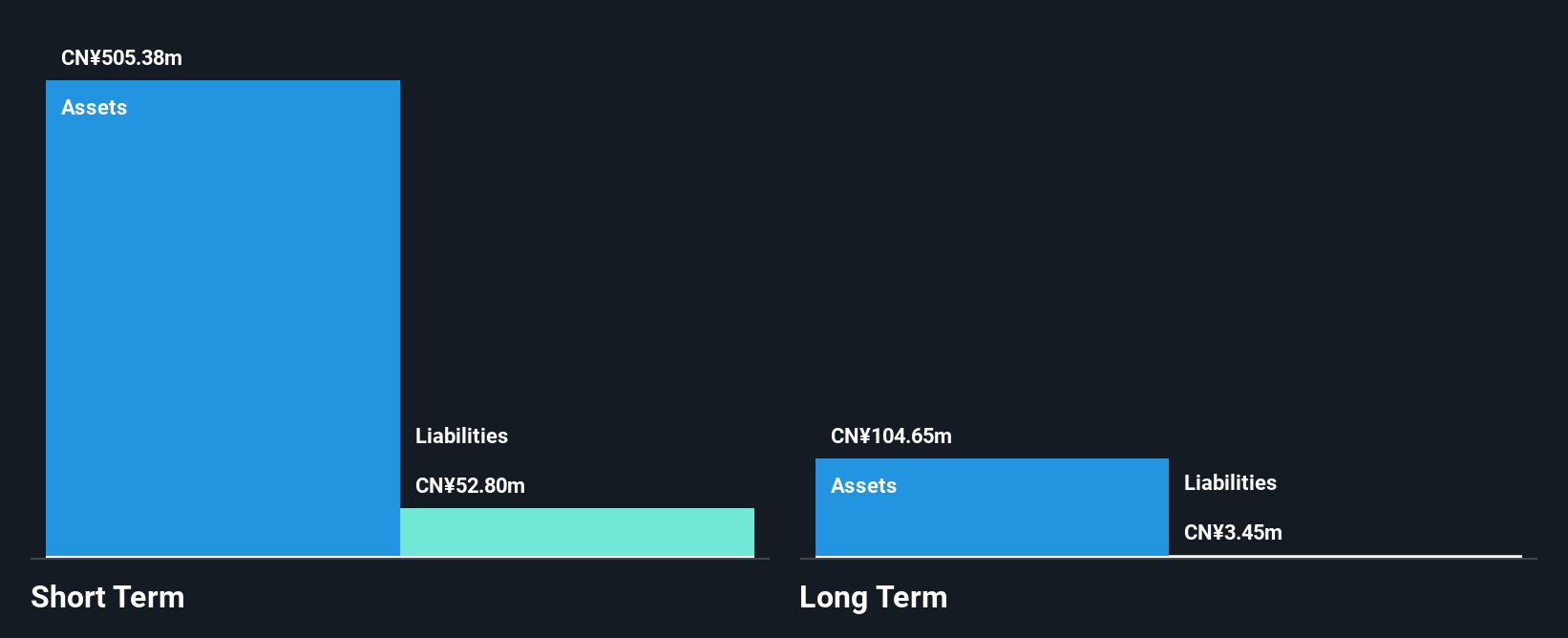

Tongdao Liepin Group, with a market cap of approximately HK$2.01 billion, has demonstrated significant earnings growth of 345.7% over the past year, surpassing the Interactive Media and Services industry average. The company's short-term assets (CN¥3 billion) comfortably cover both its short- and long-term liabilities, indicating strong financial health. Despite a low Return on Equity at 6.8%, Tongdao Liepin trades at an attractive Price-To-Earnings ratio of 10.8x compared to the Hong Kong market average. Its debt is well-managed with more cash than total debt and operating cash flow covering it by a large margin, reflecting prudent financial management practices.

- Click to explore a detailed breakdown of our findings in Tongdao Liepin Group's financial health report.

- Gain insights into Tongdao Liepin Group's outlook and expected performance with our report on the company's earnings estimates.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liuzhou Chemical Industry Co., Ltd. is a Chinese company that produces and sells hydrogen peroxide, with a market capitalization of CN¥3.29 billion.

Operations: The company generates revenue of CN¥148.27 million from its chemical industry segment.

Market Cap: CN¥3.29B

Liuzhou Chemical Industry Co., Ltd., with a market cap of CN¥3.29 billion, reported declining earnings for the nine months ending September 2025, with sales at CN¥106.66 million and net income dropping significantly to CN¥7.01 million from the previous year. Despite negative earnings growth over the past year, the company maintains strong liquidity, as short-term assets of CN¥512.5 million exceed both short- and long-term liabilities substantially. The firm is debt-free, eliminating concerns about interest coverage or cash flow adequacy for debt service; however, its Return on Equity remains low at 1.1%, raising questions about profitability efficiency amidst volatile profit margins impacted by a large one-off loss of CN¥5.8 million in recent financial results.

- Click here to discover the nuances of Liuzhou Chemical Industry with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Liuzhou Chemical Industry's track record.

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the manufacturing sector, focusing on producing mining machinery and equipment, with a market cap of CN¥6.61 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥6.61B

Shandong Mining Machinery Group Co., Ltd., with a market cap of CN¥6.61 billion, has demonstrated strong earnings growth, with a 53.9% increase over the past year, surpassing the industry average. The company maintains robust liquidity, as short-term assets of CN¥3.6 billion exceed both short- and long-term liabilities significantly. Despite this financial strength, Return on Equity remains low at 3.8%, indicating potential inefficiencies in profitability management. Recent amendments to the company's articles of association were approved during an extraordinary general meeting in November 2025, reflecting ongoing governance adjustments amidst stable net profit margins and no meaningful shareholder dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Shandong Mining Machinery Group.

- Assess Shandong Mining Machinery Group's previous results with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 955 companies by clicking here.

- Searching for a Fresh Perspective? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002526

Shandong Mining Machinery Group

Shandong Mining Machinery Group Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026