- China

- /

- Construction

- /

- SZSE:002431

Some Confidence Is Lacking In Palm Eco-Town Development Co., Ltd (SZSE:002431) As Shares Slide 25%

To the annoyance of some shareholders, Palm Eco-Town Development Co., Ltd (SZSE:002431) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

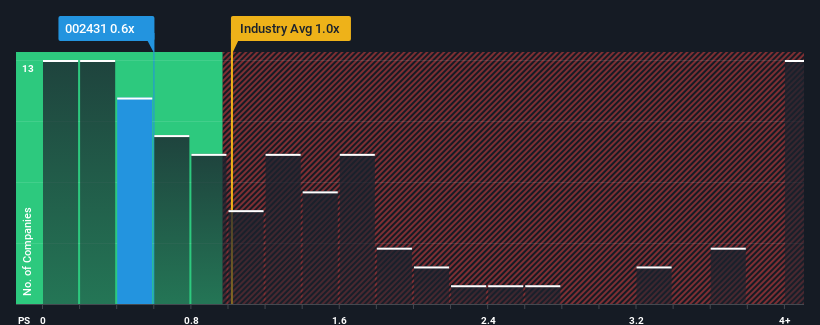

In spite of the heavy fall in price, it's still not a stretch to say that Palm Eco-Town Development's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Construction industry in China, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Palm Eco-Town Development

What Does Palm Eco-Town Development's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Palm Eco-Town Development has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Palm Eco-Town Development will help you shine a light on its historical performance.How Is Palm Eco-Town Development's Revenue Growth Trending?

Palm Eco-Town Development's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. As a result, it also grew revenue by 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Palm Eco-Town Development is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Palm Eco-Town Development's P/S Mean For Investors?

Palm Eco-Town Development's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Palm Eco-Town Development revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Plus, you should also learn about this 1 warning sign we've spotted with Palm Eco-Town Development.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002431

Palm Eco-Town Development

Engages in the design, planning, construction, and operation of eco-towns in China.

Good value with worrying balance sheet.

Market Insights

Community Narratives