3 Value Stocks Estimated To Be Trading Up To 48.8% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating corporate earnings and geopolitical concerns, investors are increasingly focused on identifying value opportunities amidst the turbulence. In this environment, stocks trading below their intrinsic value can offer potential for growth, as they may not fully reflect the underlying business fundamentals or market potential.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Reach Subsea (OB:REACH) | NOK8.06 | NOK16.12 | 50% |

| TF Bank (OM:TFBANK) | SEK376.00 | SEK750.28 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK82.94 | SEK165.72 | 50% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.86 | CN¥41.56 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$5.97 | CA$11.89 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.23 | US$26.31 | 49.7% |

| Groupe Dynamite (TSX:GRGD) | CA$16.11 | CA$32.07 | 49.8% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | US$37.70 | US$75.20 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.04 | US$51.68 | 49.6% |

| Kyndryl Holdings (NYSE:KD) | US$43.45 | US$86.66 | 49.9% |

Let's dive into some prime choices out of the screener.

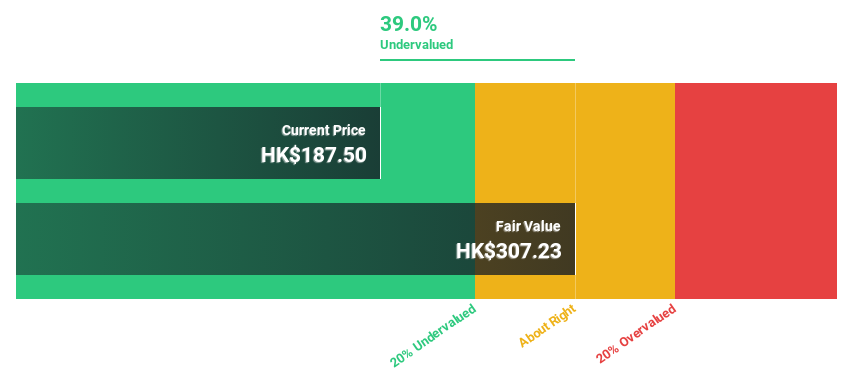

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs for unmet medical needs in China and internationally, with a market cap of approximately HK$36.86 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which amounted to CN¥1.88 billion.

Estimated Discount To Fair Value: 47.2%

Sichuan Kelun-Biotech Biopharmaceutical is currently trading at HK$173.1, significantly below its estimated fair value of HK$327.81, suggesting it may be undervalued based on cash flows. Analysts expect the company to become profitable in three years with revenue growth forecasted at 24.5% annually, outpacing the Hong Kong market average. Recent marketing authorization for tagitanlimab and a lucrative licensing deal with Windward Bio highlight potential future revenue streams despite low return on equity forecasts.

- In light of our recent growth report, it seems possible that Sichuan Kelun-Biotech Biopharmaceutical's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Sichuan Kelun-Biotech Biopharmaceutical stock in this financial health report.

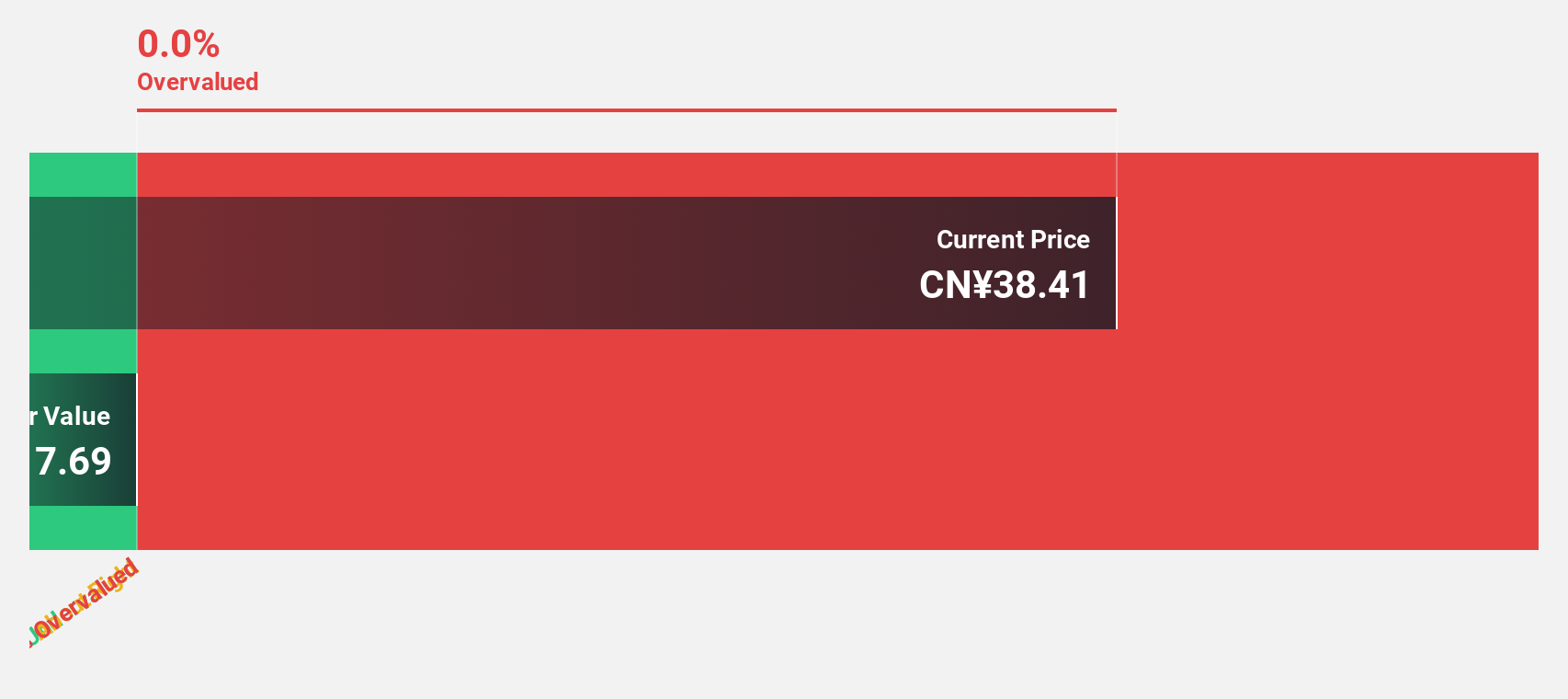

Qi An Xin Technology Group (SHSE:688561)

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and institutions in China and internationally, with a market cap of CN¥19.21 billion.

Operations: The company's revenue primarily comes from the Information Security Industry segment, generating CN¥5.47 billion.

Estimated Discount To Fair Value: 48.8%

Qi An Xin Technology Group is trading at CN¥31.52, well below its estimated fair value of CN¥61.59, reflecting potential undervaluation based on cash flows. Despite large one-off items affecting financial results, earnings are forecasted to grow significantly at 38.48% annually, surpassing the broader Chinese market's growth expectations. However, revenue growth is slower than desired and return on equity remains low in forecasts for three years ahead.

- Upon reviewing our latest growth report, Qi An Xin Technology Group's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Qi An Xin Technology Group's balance sheet by reading our health report here.

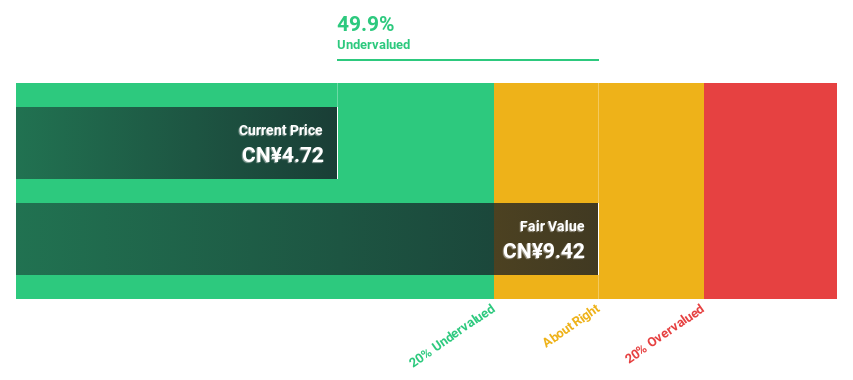

Beijing LeiKe Defense Technology (SZSE:002413)

Overview: Beijing LeiKe Defense Technology Co., Ltd. operates in the defense technology sector and has a market cap of approximately CN¥5.42 billion.

Operations: The company generates revenue primarily from the Computer, Communications and Other Electronic Equipment Manufacturing segment, amounting to CN¥1.18 billion.

Estimated Discount To Fair Value: 47.1%

Beijing LeiKe Defense Technology is trading at CN¥4.58, significantly below its estimated fair value of CN¥8.66, indicating potential undervaluation based on cash flows. The company is expected to become profitable within three years with earnings projected to grow over 100% annually and revenue growth forecasted at 21.9% per year, outpacing the broader Chinese market. However, future return on equity remains low at an anticipated 2.8%. Recent board changes might influence strategic direction positively.

- Our comprehensive growth report raises the possibility that Beijing LeiKe Defense Technology is poised for substantial financial growth.

- Click here to discover the nuances of Beijing LeiKe Defense Technology with our detailed financial health report.

Next Steps

- Navigate through the entire inventory of 928 Undervalued Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Qi An Xin Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cyber-security company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives