As global markets continue to experience gains, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are keeping a close eye on domestic policy changes and geopolitical events that could impact future market dynamics. In this environment of economic optimism tempered by uncertainty, dividend stocks offer a compelling option for investors seeking stability and income potential in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

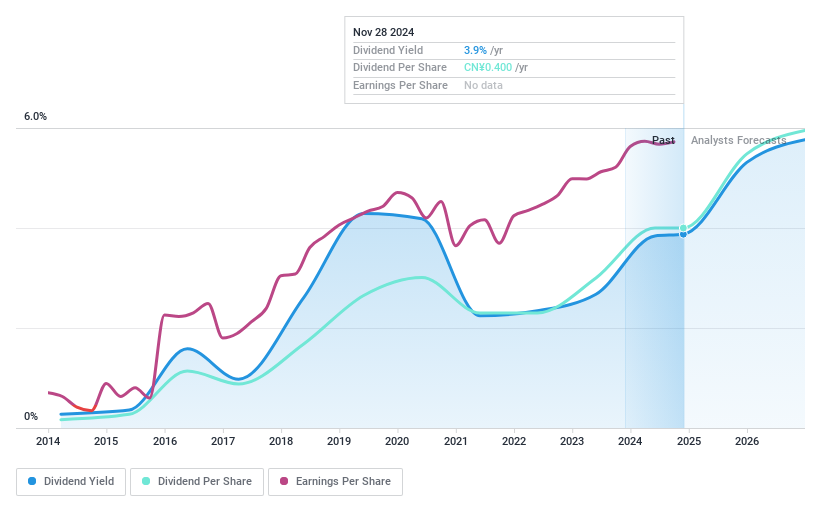

Sinoma International EngineeringLtd (SHSE:600970)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinoma International Engineering Co., Ltd operates in engineering, equipment manufacturing, and supply both in China and globally, with a market cap of CN¥28.19 billion.

Operations: Sinoma International Engineering Co., Ltd generates revenue primarily from its Heavy Construction segment, amounting to CN¥46.02 billion.

Dividend Yield: 3.7%

Sinoma International Engineering Ltd. offers a dividend yield of 3.75%, placing it in the top 25% of dividend payers in China, with dividends well-covered by earnings (35.1% payout ratio) and cash flows (41.8% cash payout ratio). Despite a history of volatility and unreliability in dividends over the past decade, recent earnings growth supports sustainability prospects. The stock trades below fair value estimates, suggesting potential for capital appreciation alongside its dividend income stream.

- Click here to discover the nuances of Sinoma International EngineeringLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sinoma International EngineeringLtd's current price could be quite moderate.

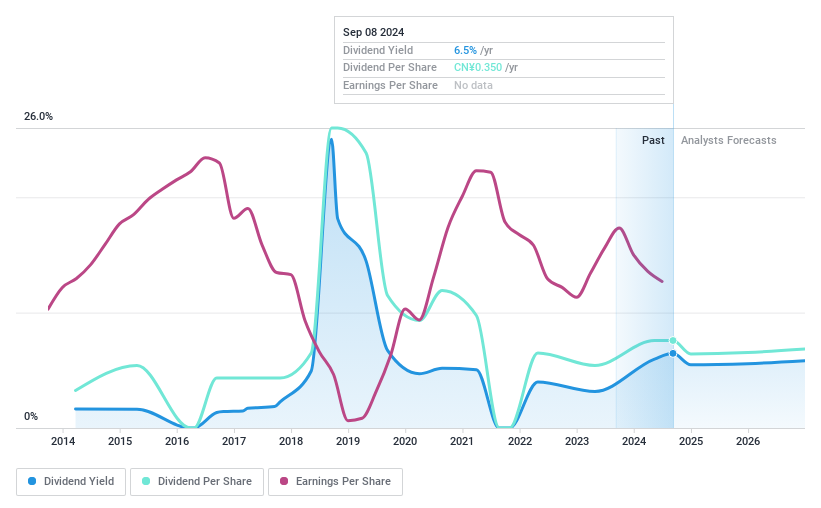

Luyang Energy-Saving Materials (SZSE:002088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luyang Energy-Saving Materials Co., Ltd. engages in the research, development, production, and sale of energy-saving products such as ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick both in China and internationally with a market cap of CN¥6.33 billion.

Operations: Luyang Energy-Saving Materials Co., Ltd. generates revenue through the production and sale of energy-efficient materials, including ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick for both domestic and international markets.

Dividend Yield: 6.5%

Luyang Energy-Saving Materials offers a dividend yield of 6.47%, ranking in the top 25% of Chinese dividend payers, though its dividends have been volatile over the past decade. The company's payout ratio is high at 87.1%, indicating dividends are covered by earnings but not by free cash flow, with a cash payout ratio at 123.4%. Despite trading at a favorable price-to-earnings ratio of 13.5x, sustainability concerns persist due to inconsistent dividend reliability and coverage issues.

- Click to explore a detailed breakdown of our findings in Luyang Energy-Saving Materials' dividend report.

- Our valuation report unveils the possibility Luyang Energy-Saving Materials' shares may be trading at a discount.

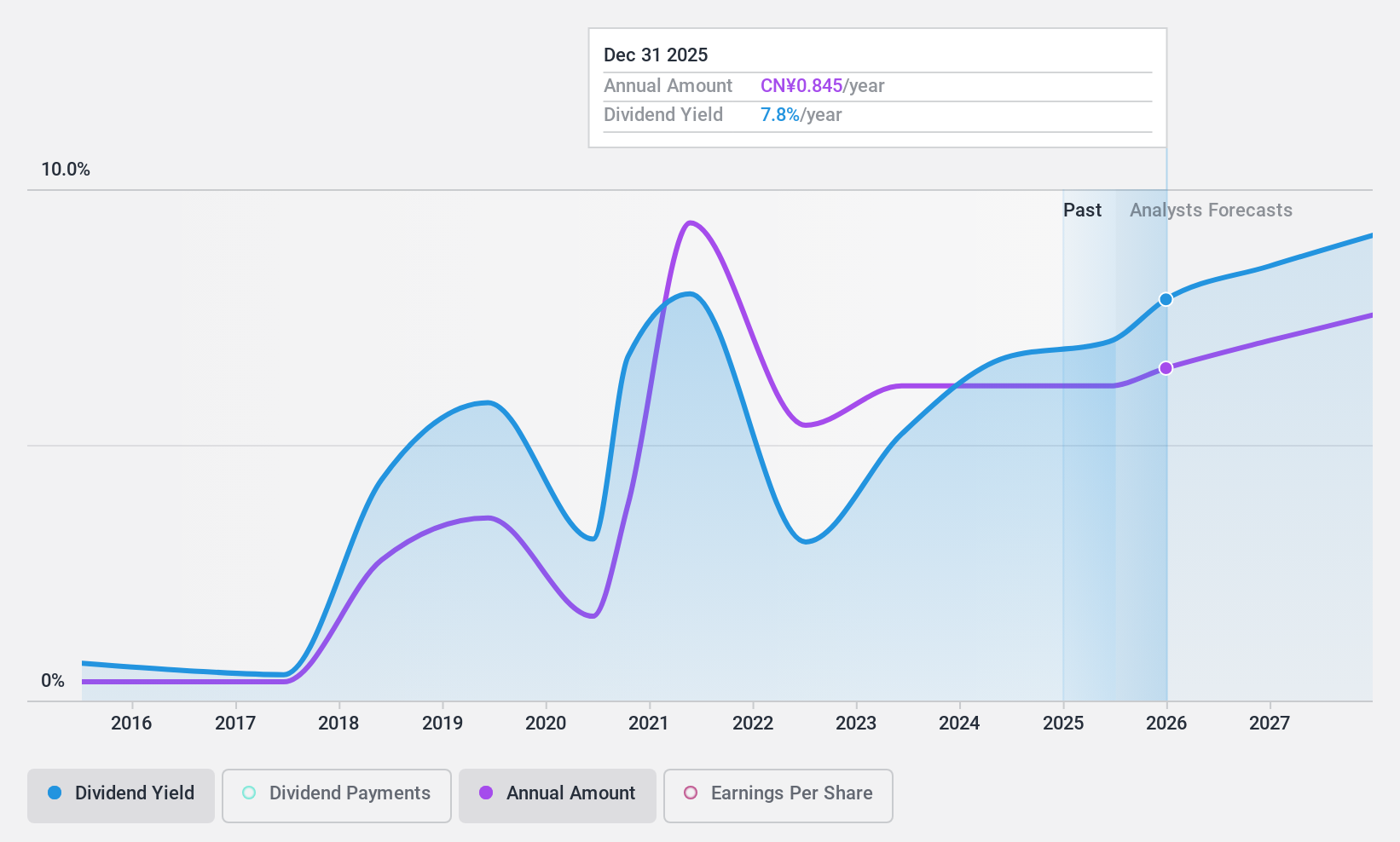

Canny Elevator (SZSE:002367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canny Elevator Co., Ltd. operates in China, focusing on the research and development, manufacturing, production, sale, installation, repair, and maintenance of elevators with a market cap of CN¥5.63 billion.

Operations: Canny Elevator Co., Ltd.'s revenue primarily comes from its elevator segment, which generated CN¥4.34 billion.

Dividend Yield: 4.9%

Canny Elevator's dividend yield of 4.92% places it in the top 25% of Chinese dividend payers, but its dividends have been volatile and unreliable over the past decade. The high payout ratio of 94.3% suggests dividends are not well covered by earnings, though a reasonable cash payout ratio of 54.5% indicates coverage by cash flows. Recent earnings show a decline in revenue and net income compared to last year, raising sustainability concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Canny Elevator.

- Our valuation report here indicates Canny Elevator may be overvalued.

Taking Advantage

- Get an in-depth perspective on all 1946 Top Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002367

Canny Elevator

Engages in the research and development, manufacturing, production, sale, installation, repair, and maintenance of elevators in China.

Flawless balance sheet average dividend payer.