As global markets continue to reach new heights, with the Russell 2000 Index hitting record levels, investor sentiment remains buoyed by a mix of geopolitical developments and robust consumer spending despite ongoing manufacturing challenges. Amid this backdrop, identifying stocks with strong potential involves looking for companies that can leverage current economic conditions and navigate policy shifts effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. is involved in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €828.92 million.

Operations: Heijmans generates revenue primarily from its Connecting segment, which accounts for €871.03 million. The company has a Segment Adjustment of €1.83 billion impacting its financials.

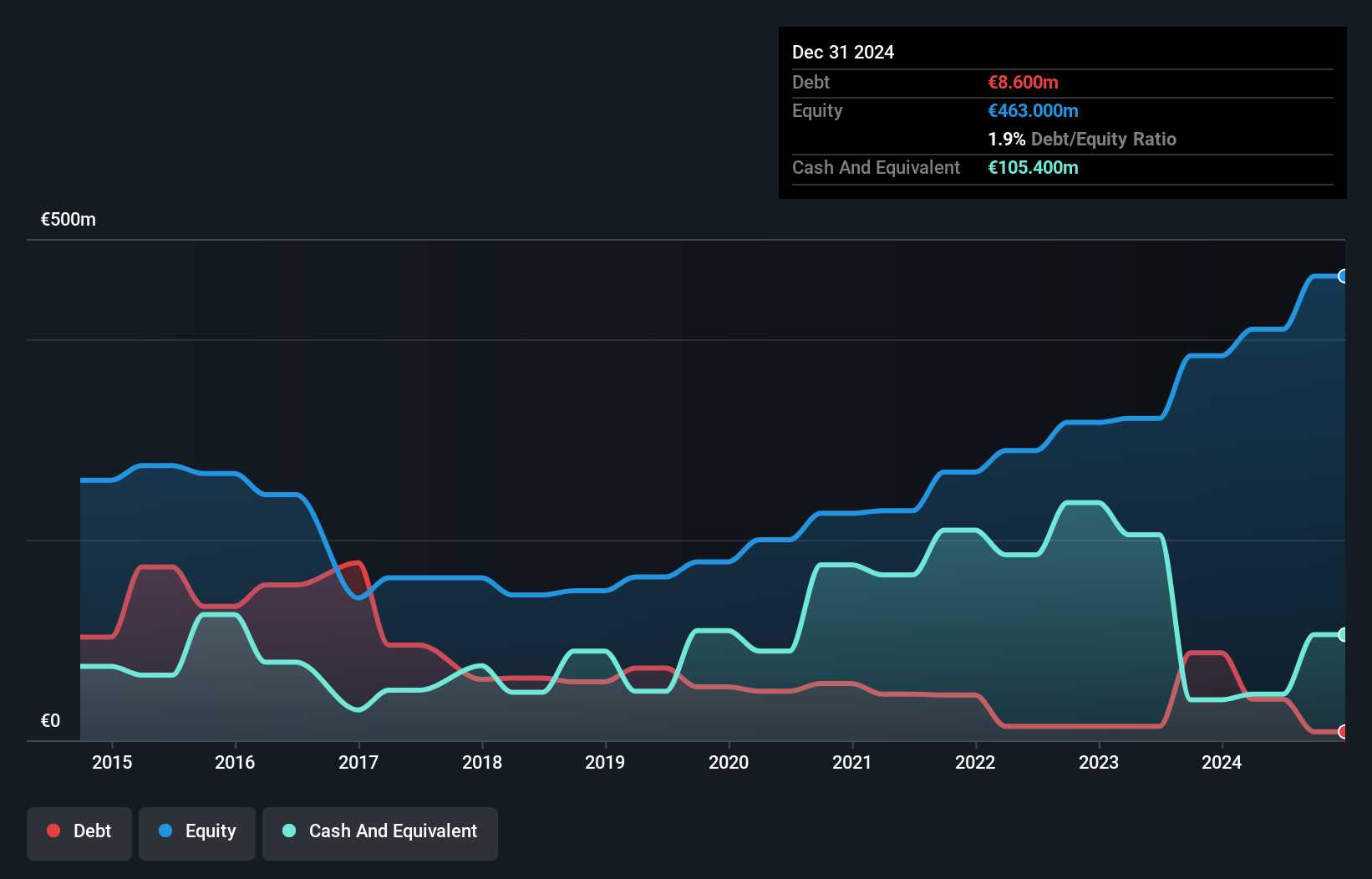

Koninklijke Heijmans, a notable player in the construction sector, has shown impressive financial health with its debt to equity ratio dropping from 44.2% to 10% over five years. The company boasts high-quality earnings, with a remarkable 65.5% growth in the past year, significantly outpacing the industry average of 7.4%. Trading at a substantial discount of 66.1% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Despite recent shareholder dilution and share price volatility, Heijmans remains free cash flow positive and maintains strong interest coverage with EBIT covering interest payments by 16.7 times.

- Delve into the full analysis health report here for a deeper understanding of Koninklijke Heijmans.

Gain insights into Koninklijke Heijmans' past trends and performance with our Past report.

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. operates in various industries and has a market capitalization of CN¥11.21 billion.

Operations: Shanghai Zijiang Enterprise Group's business model involves diverse revenue streams across multiple industries. The company's financial performance is influenced by its ability to manage costs effectively, impacting its profitability metrics such as net profit margin.

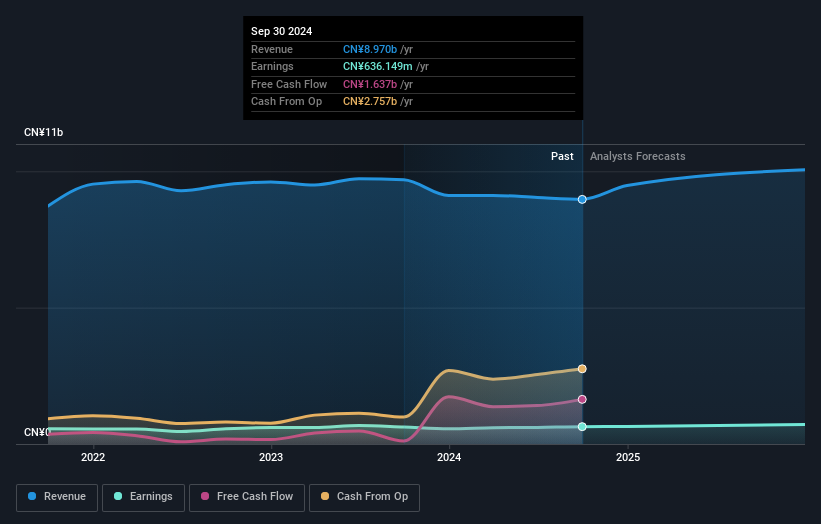

Shanghai Zijiang Enterprise Group, a notable player in the packaging sector, demonstrates financial resilience with a satisfactory net debt to equity ratio of 19.6%, reflecting prudent debt management as it has decreased from 79% to 56.4% over five years. The company showcases strong earnings quality and profitability, with interest payments well-covered by EBIT at 45.5 times, indicating robust financial health. Despite sales dipping slightly from CNY 7,333 million to CNY 7,188 million year-over-year for the nine months ending September 2024, net income rose to CNY 528 million from CNY 451 million, suggesting improved operational efficiency and value potential amid industry challenges.

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Value Rating: ★★★★★☆

Overview: MCLON JEWELLERY Co., Ltd. engages in jewelry retail both in China and internationally, with a market cap of CN¥3.38 billion.

Operations: MCLON JEWELLERY Co., Ltd. generates its revenue primarily through jewelry retail operations in China and international markets. The company's financial performance is influenced by its ability to manage costs effectively, impacting its overall profitability.

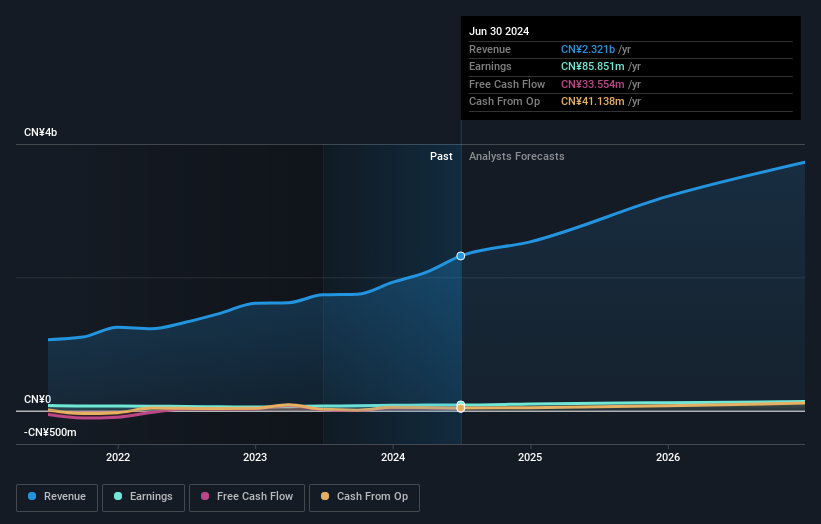

MCLON Jewellery, a small cap player in the luxury industry, has shown impressive growth with earnings increasing by 21.7% over the past year, outpacing the industry's 3.3% rise. The company reported sales of CNY 1.67 billion for the nine months ending September 2024, up from CNY 1.22 billion last year, reflecting its robust market presence and operational efficiency. Despite a slight dip in basic earnings per share to CNY 0.29 from CNY 0.32, its net income rose to CNY 77 million compared to CNY 68 million previously, indicating solid profitability amidst competitive pressures and strategic investments in innovation initiatives.

Turning Ideas Into Actions

- Embark on your investment journey to our 4642 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300945

Excellent balance sheet with proven track record.