- China

- /

- Electrical

- /

- SZSE:002335

Market Participants Recognise Kehua Data Co., Ltd.'s (SZSE:002335) Earnings Pushing Shares 34% Higher

Despite an already strong run, Kehua Data Co., Ltd. (SZSE:002335) shares have been powering on, with a gain of 34% in the last thirty days. The last 30 days bring the annual gain to a very sharp 66%.

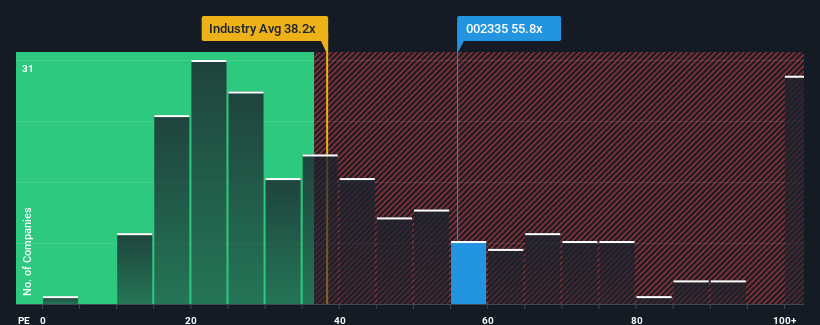

After such a large jump in price, Kehua Data's price-to-earnings (or "P/E") ratio of 55.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 36x and even P/E's below 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Kehua Data as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Kehua Data

Is There Enough Growth For Kehua Data?

Kehua Data's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 96% over the next year. That's shaping up to be materially higher than the 37% growth forecast for the broader market.

In light of this, it's understandable that Kehua Data's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Kehua Data's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kehua Data maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Kehua Data that we have uncovered.

If you're unsure about the strength of Kehua Data's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kehua Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002335

Kehua Data

Provides integrated solutions for power protection and energy conservation worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives