- China

- /

- Electrical

- /

- SZSE:002322

Ningbo Ligong Environment And Energy Technology Co.,Ltd's (SZSE:002322) Shares Climb 31% But Its Business Is Yet to Catch Up

Those holding Ningbo Ligong Environment And Energy Technology Co.,Ltd (SZSE:002322) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 6.1% isn't as attractive.

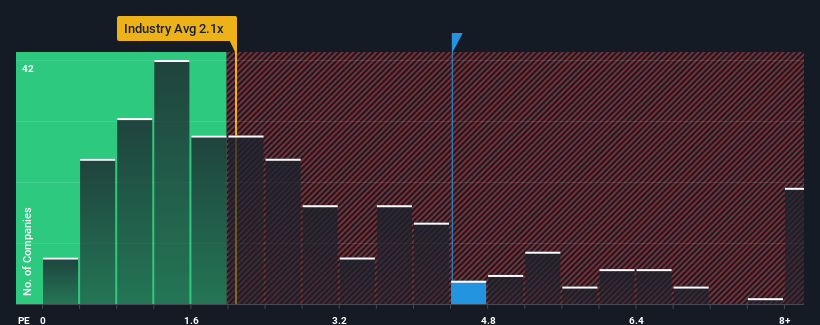

After such a large jump in price, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Ningbo Ligong Environment And Energy TechnologyLtd as a stock not worth researching with its 4.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ningbo Ligong Environment And Energy TechnologyLtd

What Does Ningbo Ligong Environment And Energy TechnologyLtd's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Ningbo Ligong Environment And Energy TechnologyLtd, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ningbo Ligong Environment And Energy TechnologyLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Ningbo Ligong Environment And Energy TechnologyLtd?

Ningbo Ligong Environment And Energy TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.8% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 3.0% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Ningbo Ligong Environment And Energy TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Ningbo Ligong Environment And Energy TechnologyLtd's P/S

Ningbo Ligong Environment And Energy TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ningbo Ligong Environment And Energy TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about this 1 warning sign we've spotted with Ningbo Ligong Environment And Energy TechnologyLtd.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Ligong Environment And Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002322

Ningbo Ligong Environment And Energy TechnologyLtd

Engages in the research and development, production, sale, and service of online monitoring equipment for electric power industry in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives