- China

- /

- Electrical

- /

- SZSE:002309

Jiangsu Zhongli GroupLtd (SZSE:002309) shareholders are up 10% this past week, but still in the red over the last three years

Jiangsu Zhongli Group Co.,Ltd (SZSE:002309) shareholders will doubtless be very grateful to see the share price up 33% in the last quarter. But over the last three years we've seen a quite serious decline. Regrettably, the share price slid 62% in that period. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Jiangsu Zhongli GroupLtd

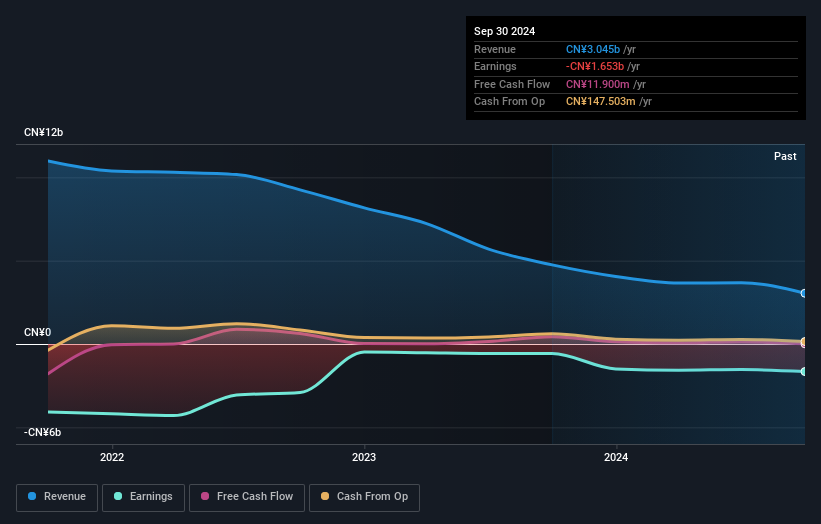

Because Jiangsu Zhongli GroupLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Jiangsu Zhongli GroupLtd saw its revenue shrink by 43% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 17% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Jiangsu Zhongli GroupLtd had a tough year, with a total loss of 6.6%, against a market gain of about 6.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Jiangsu Zhongli GroupLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Jiangsu Zhongli GroupLtd , and understanding them should be part of your investment process.

We will like Jiangsu Zhongli GroupLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002309

Jiangsu Zhongli GroupLtd

Manufactures and sells cables and photovoltaic products in China and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives