- China

- /

- Electrical

- /

- SZSE:002249

Discover 3 Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields and the Federal Reserve's cautious approach to rate cuts, investors are navigating a landscape marked by mixed economic signals and modest equity performance. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance growth with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems business in China, with a market cap of CN¥13.63 billion.

Operations: Zhongshan Broad-Ocean Motor Co., Ltd. generates its revenue from the motor systems business in China.

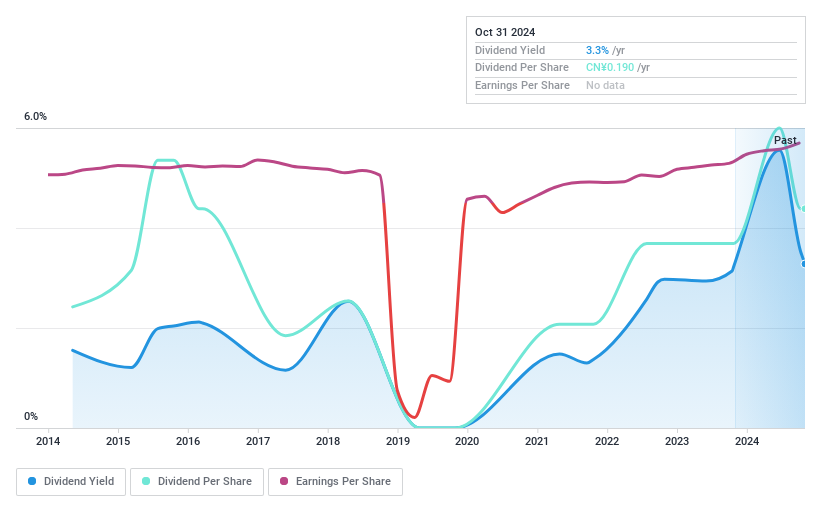

Dividend Yield: 3.3%

Zhongshan Broad-Ocean Motor has shown a mixed performance for dividend investors. Despite a strong earnings growth of CNY 670.59 million for the nine months ended September 2024, its dividend history is unstable with notable volatility over the past decade. The payout ratio of 59.5% indicates dividends are covered by earnings, and a low cash payout ratio of 30.3% suggests good coverage by cash flows. However, recent dividend decreases highlight potential reliability concerns despite being in the top tier of CN market yields at 3.28%.

- Get an in-depth perspective on Zhongshan Broad-Ocean Motor's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Zhongshan Broad-Ocean Motor's current price could be quite moderate.

Yantai Zhenghai Biotechnology (SZSE:300653)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yantai Zhenghai Biotechnology Co., Ltd. is involved in the research, development, production, and marketing of regenerative medical materials in China, with a market cap of CN¥4.19 billion.

Operations: Yantai Zhenghai Biotechnology Co., Ltd. generates its revenue primarily from the research, development, production, and sales of bio-renewable materials, amounting to CN¥383.22 million.

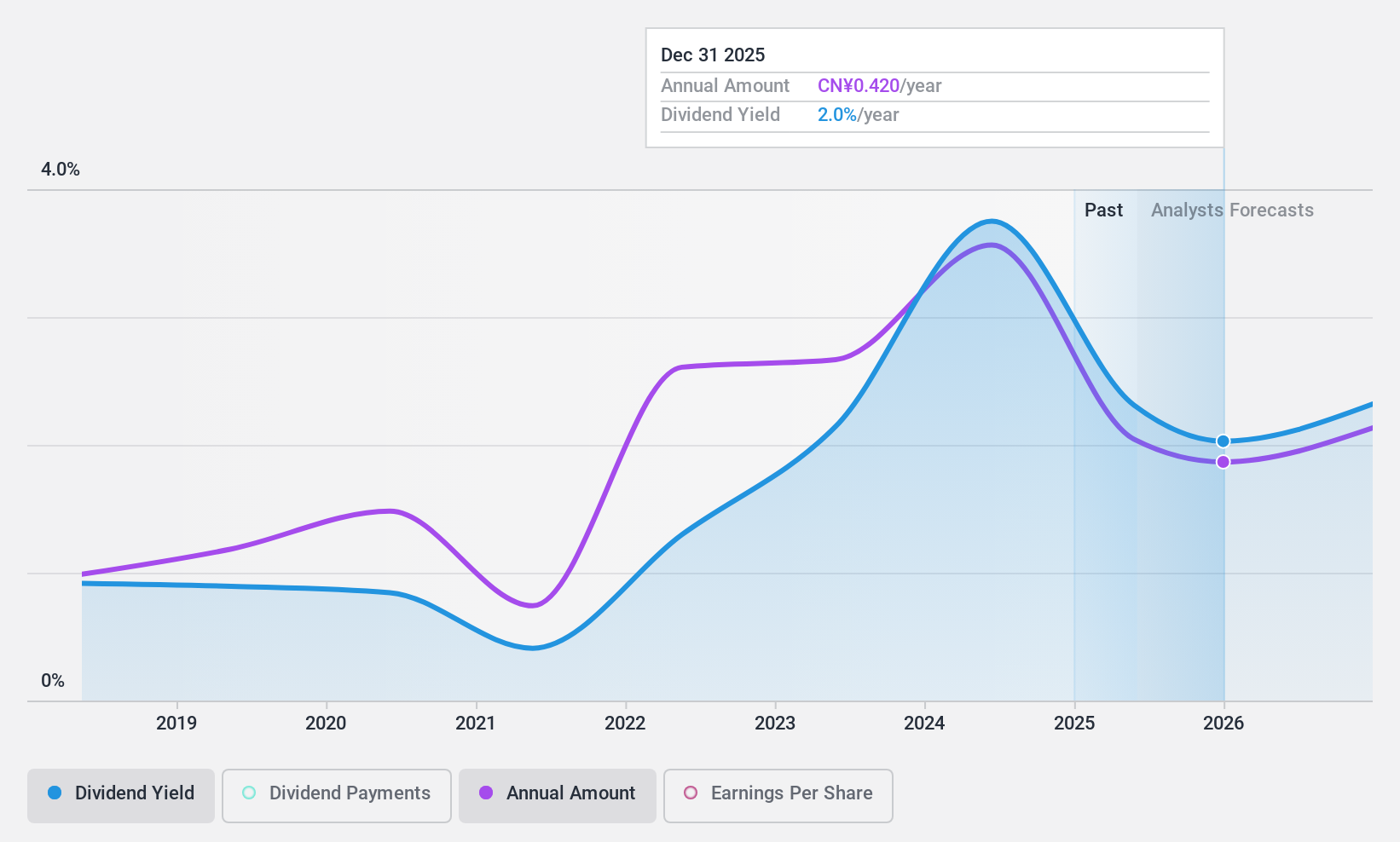

Dividend Yield: 3.3%

Yantai Zhenghai Biotechnology's dividend profile is marked by volatility, despite being in the top 25% of CN market yields at 3.3%. The payout ratio of 86.3% indicates dividends are covered by earnings, and a cash payout ratio of 89% shows coverage by cash flows. However, its unstable dividend history over seven years may be concerning for some investors. Recent earnings show a decline with net income at CNY 125.06 million compared to CNY 148.34 million last year.

- Delve into the full analysis dividend report here for a deeper understanding of Yantai Zhenghai Biotechnology.

- Our valuation report here indicates Yantai Zhenghai Biotechnology may be overvalued.

Krosaki Harima (TSE:5352)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Krosaki Harima Corporation, along with its subsidiaries, manufactures and sells refractory and ceramic products both in Japan and internationally, with a market cap of ¥82.11 billion.

Operations: Krosaki Harima Corporation generates revenue through its manufacturing and sale of refractory and ceramic products across domestic and international markets.

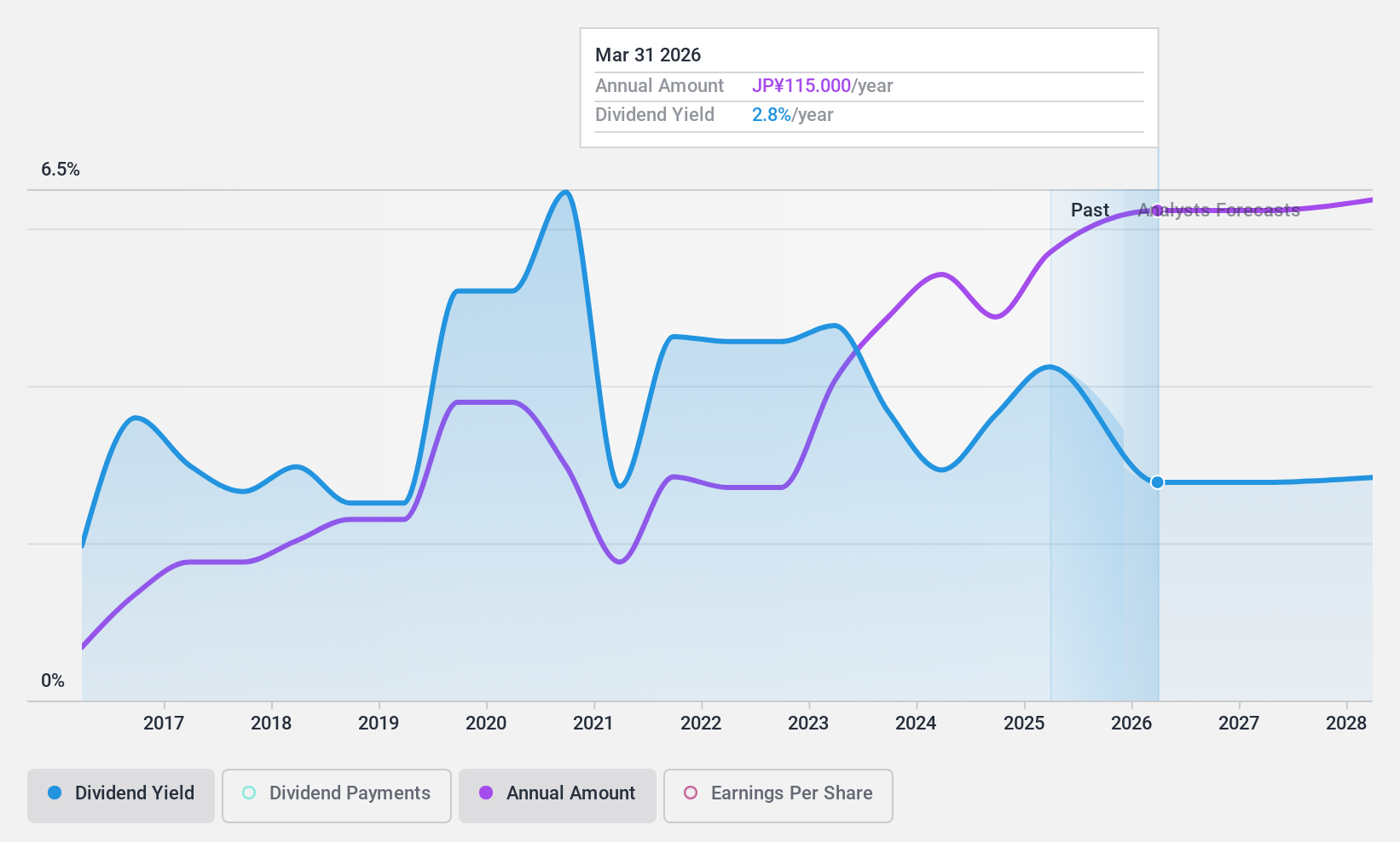

Dividend Yield: 3.7%

Krosaki Harima's dividend yield is slightly below the top 25% of JP market payers, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 33.8% and 42.5%, respectively. The stock trades significantly below its estimated fair value, although recent share price volatility may concern some investors. Earnings are expected to grow annually by 5.75%.

- Unlock comprehensive insights into our analysis of Krosaki Harima stock in this dividend report.

- In light of our recent valuation report, it seems possible that Krosaki Harima is trading behind its estimated value.

Key Takeaways

- Delve into our full catalog of 2013 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongshan Broad-Ocean Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002249

Zhongshan Broad-Ocean Motor

Engages in the motor systems business in China.

Flawless balance sheet established dividend payer.