Global markets have recently experienced upward movement, with small-cap stocks outperforming their larger counterparts and technology shares rebounding amid optimism about growth potential. In this context, investing in penny stocks—though the term may seem outdated—remains a viable strategy for those seeking opportunities in smaller or newer companies. By focusing on firms with solid financials and clear growth prospects, investors can uncover potential value in these lesser-known stocks.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £465.29M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.67 | HK$2.18B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €230.2M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.96 | NZ$252.29M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,572 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm that invests in small and medium-sized companies across various stages, with a market cap of approximately HK$2.07 billion.

Operations: The company's revenue primarily comes from its asset management segment, which generated CN¥198.78 million.

Market Cap: HK$2.07B

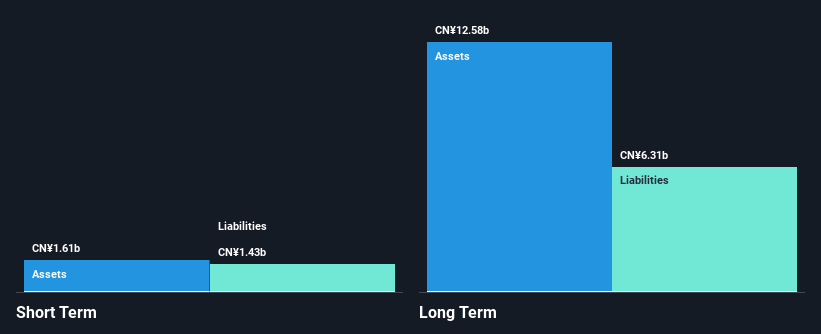

Tian Tu Capital, with a market cap of approximately HK$2.07 billion, primarily generates revenue from its asset management segment, amounting to CN¥198.78 million. Despite having more cash than total debt and short-term assets exceeding liabilities, the company faces financial challenges with a negative return on equity and unprofitable status as losses have increased significantly over five years. Although the board is experienced and debt levels have decreased over time, interest payments are not well covered by EBIT. Volatility has remained stable, but earnings growth remains elusive in comparison to industry standards.

- Get an in-depth perspective on Tian Tu Capital's performance by reading our balance sheet health report here.

- Explore historical data to track Tian Tu Capital's performance over time in our past results report.

SanluxLtd (SZSE:002224)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sanlux Co., Ltd specializes in the research, development, production, and sale of rubber V-belts both in China and internationally, with a market cap of CN¥4.14 billion.

Operations: The company generates revenue from its construction industry segment, amounting to CN¥1.02 billion.

Market Cap: CN¥4.14B

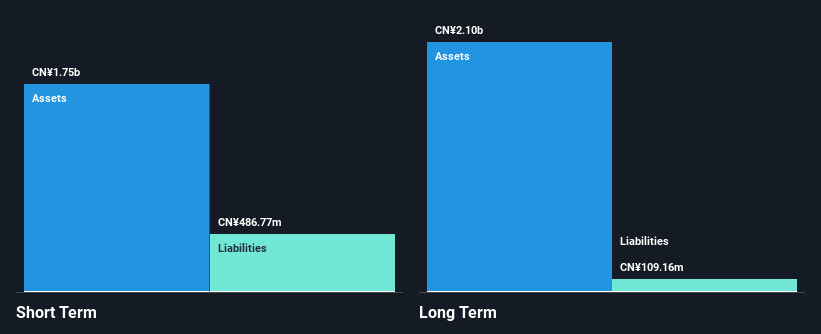

Sanlux Co., Ltd, with a market cap of CN¥4.14 billion, has seen its earnings decline by 35.4% annually over the past five years, reflecting challenges in profitability despite revenue growth to CN¥714.3 million for the first nine months of 2025. The company's short-term assets exceed both its short and long-term liabilities, yet debt is not well covered by operating cash flow at only 11.7%. Recent initiatives include a share buyback program worth CN¥60 million aimed at equity incentives or employee plans, while amendments to company bylaws have been approved to potentially streamline operations further.

- Click here and access our complete financial health analysis report to understand the dynamics of SanluxLtd.

- Gain insights into SanluxLtd's historical outcomes by reviewing our past performance report.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhefu Holding Group Co., Ltd. operates through its subsidiaries to manufacture and sell hydropower equipment both in China and internationally, with a market cap of CN¥20.61 billion.

Operations: Zhefu Holding Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥20.61B

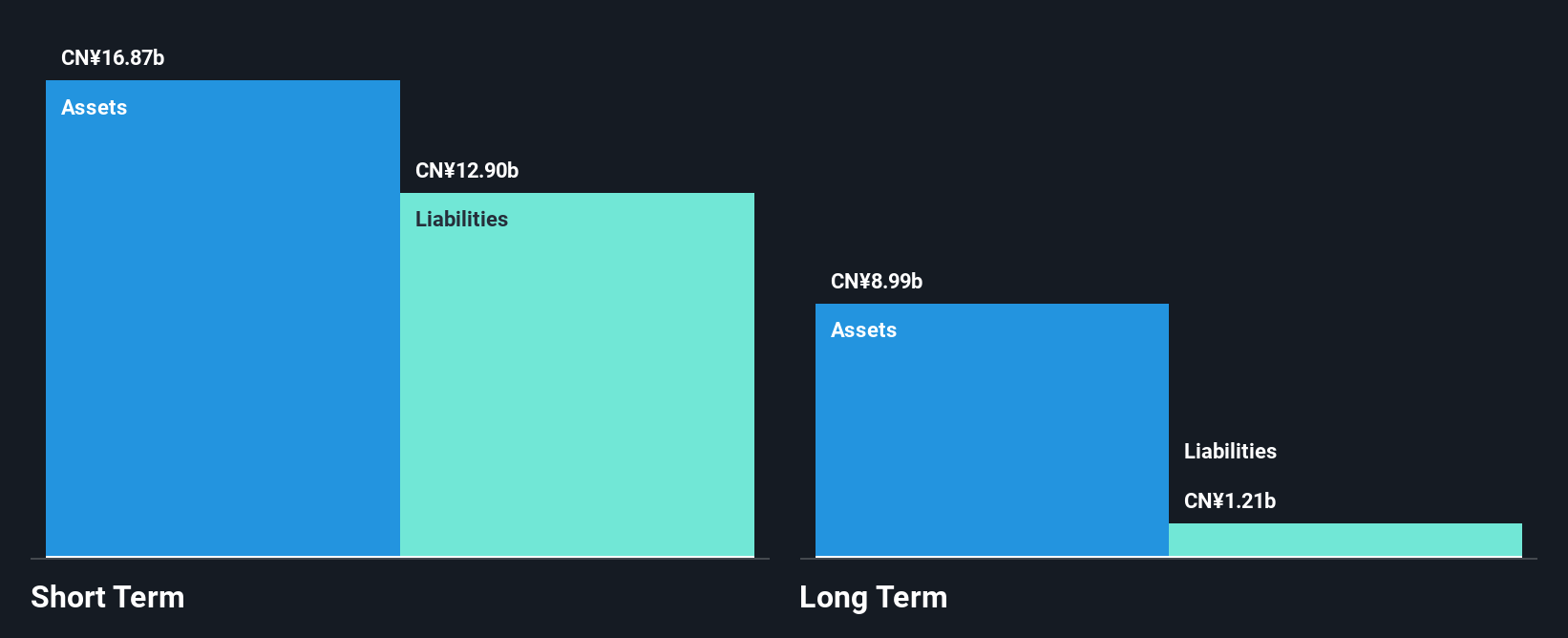

Zhefu Holding Group, with a market cap of CN¥20.61 billion, has demonstrated steady revenue growth, reporting CN¥16.15 billion for the first nine months of 2025 compared to CN¥15.26 billion the previous year. Despite a slight decline in net income to CN¥738.79 million from CN¥775.69 million, its earnings growth outpaced the industry average significantly over the past year. The company's debt is not well covered by operating cash flow but remains manageable with a satisfactory net debt to equity ratio of 2%. Amendments to its articles of association were recently approved, possibly indicating strategic shifts ahead.

- Unlock comprehensive insights into our analysis of Zhefu Holding Group stock in this financial health report.

- Evaluate Zhefu Holding Group's prospects by accessing our earnings growth report.

Summing It All Up

- Unlock our comprehensive list of 3,572 Global Penny Stocks by clicking here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002224

SanluxLtd

Engages in the research and development, production, and sale of rubber V-belts in China and internationally.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026