Exploring Shandong Bailong Chuangyuan Bio-Tech And 2 Promising Small Caps In Global Markets

Reviewed by Simply Wall St

As global markets experience a rally with key indices like the S&P 500 and Nasdaq Composite reaching all-time highs, small-cap stocks are navigating a complex landscape marked by modest inflation upticks and mixed economic indicators. In this dynamic environment, identifying promising small-cap companies involves looking for those with strong fundamentals and potential growth drivers that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AIC | NA | 26.88% | 54.47% | ★★★★★★ |

| CTCI Advanced Systems | 39.96% | 21.96% | 24.04% | ★★★★★★ |

| Advanced International Multitech | 35.32% | 3.62% | 1.11% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Mechema Chemicals International | 55.74% | -4.23% | -5.72% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector and has a market capitalization of CN¥8.80 billion.

Operations: The company generates revenue primarily from its biotechnology operations. It has a market capitalization of approximately CN¥8.80 billion, indicating its significant presence in the sector.

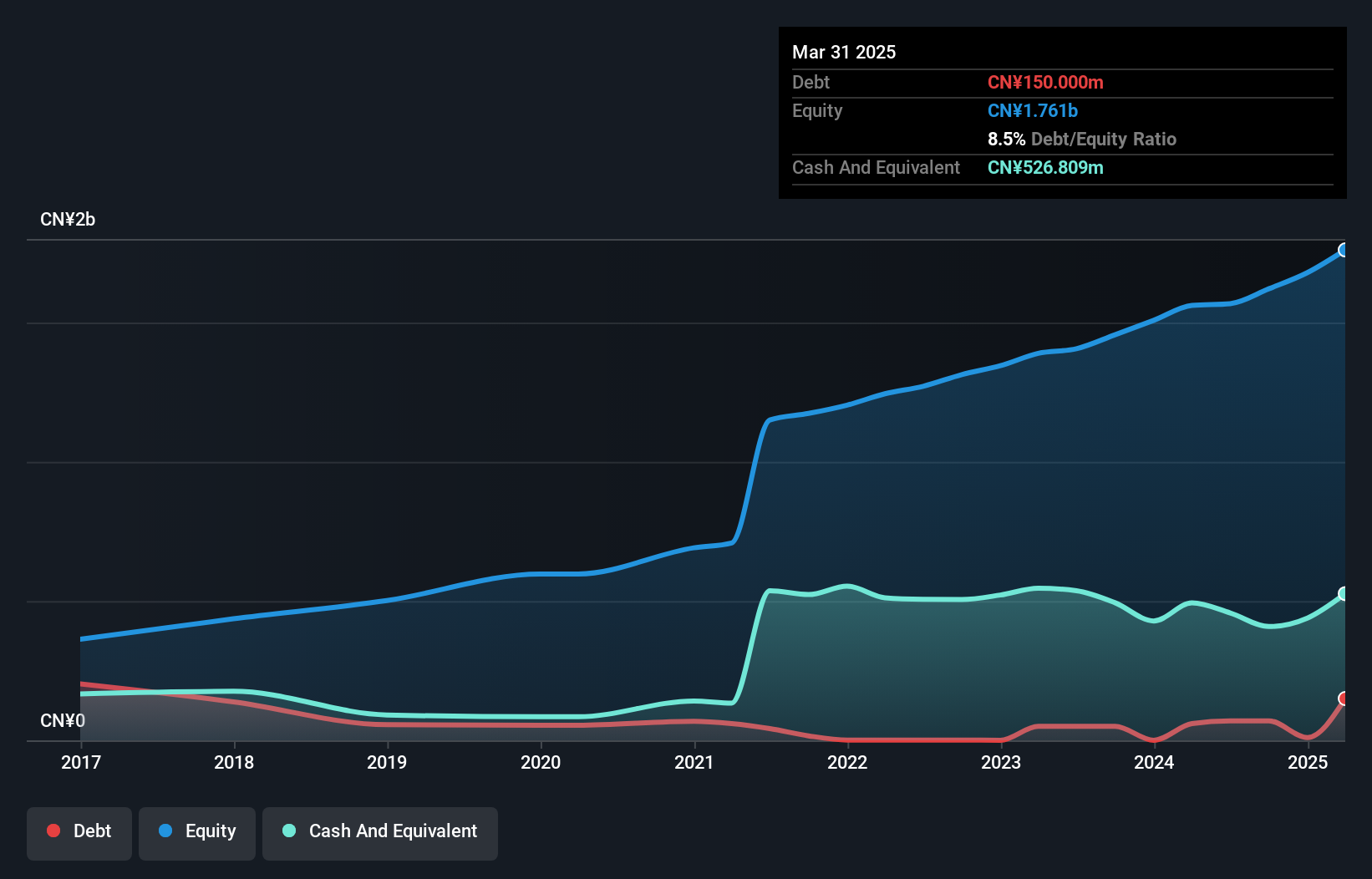

Shandong Bailong Chuangyuan Bio-Tech, a nimble player in the bio-tech sector, has shown impressive earnings growth of 35.3% over the past year, outpacing its industry peers who faced a downturn. The company trades at 7.1% below its estimated fair value, suggesting potential undervaluation. With more cash than total debt and a reduced debt-to-equity ratio from 9% to 8.5% over five years, financial health seems robust. Recent quarterly results highlight strong performance with sales climbing to CNY 313 million from CNY 252 million and net income rising to CNY 81 million from CNY 54 million year-on-year.

Dalian Huarui Heavy Industry Group (SZSE:002204)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dalian Huarui Heavy Industry Group Co., Ltd. operates in the special-purpose equipment manufacturing sector and has a market capitalization of approximately CN¥11.57 billion.

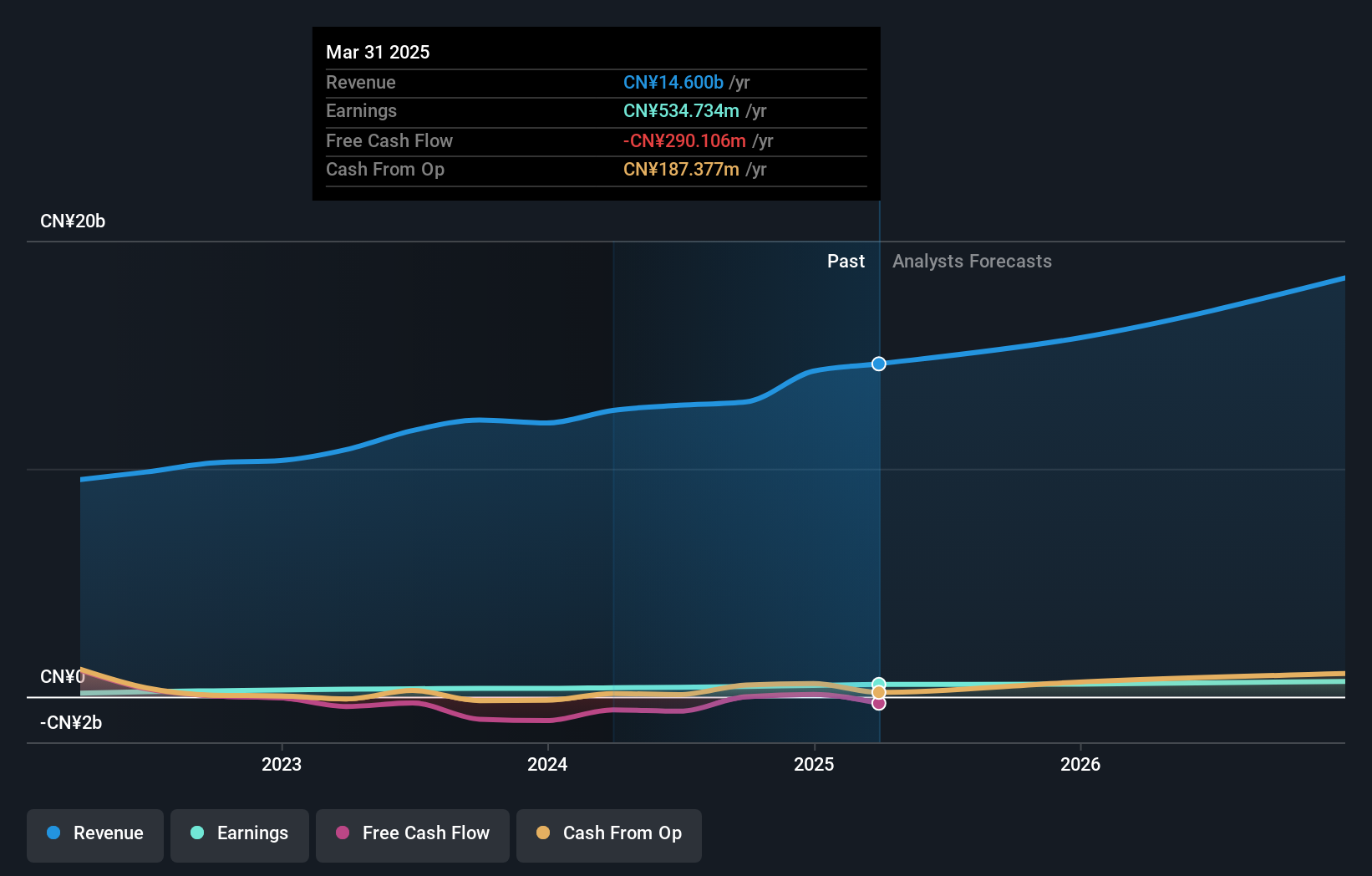

Operations: The company generated revenue of CN¥14.60 billion from its special-purpose equipment manufacturing segment.

Dalian Huarui Heavy Industry Group has shown impressive earnings growth of 36.6% over the past year, outpacing the Machinery industry's 1%. Despite a rise in its debt to equity ratio from 7.6% to 22.3% over five years, it holds more cash than total debt, ensuring financial stability. The company's price-to-earnings ratio stands at a favorable 23.8x compared to the CN market's 39.6x, suggesting potential undervaluation. Recent developments include a dividend increase with CNY 0.50 per share for 2024 and amendments to its articles of association approved during their AGM in April this year.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing SDL Technology Co., Ltd. and its subsidiaries develop and sell environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥5.38 billion.

Operations: The company's revenue primarily comes from the sale of environmental monitoring equipment and solutions. Its financial performance is highlighted by a net profit margin that reflects its ability to manage costs effectively relative to its revenue.

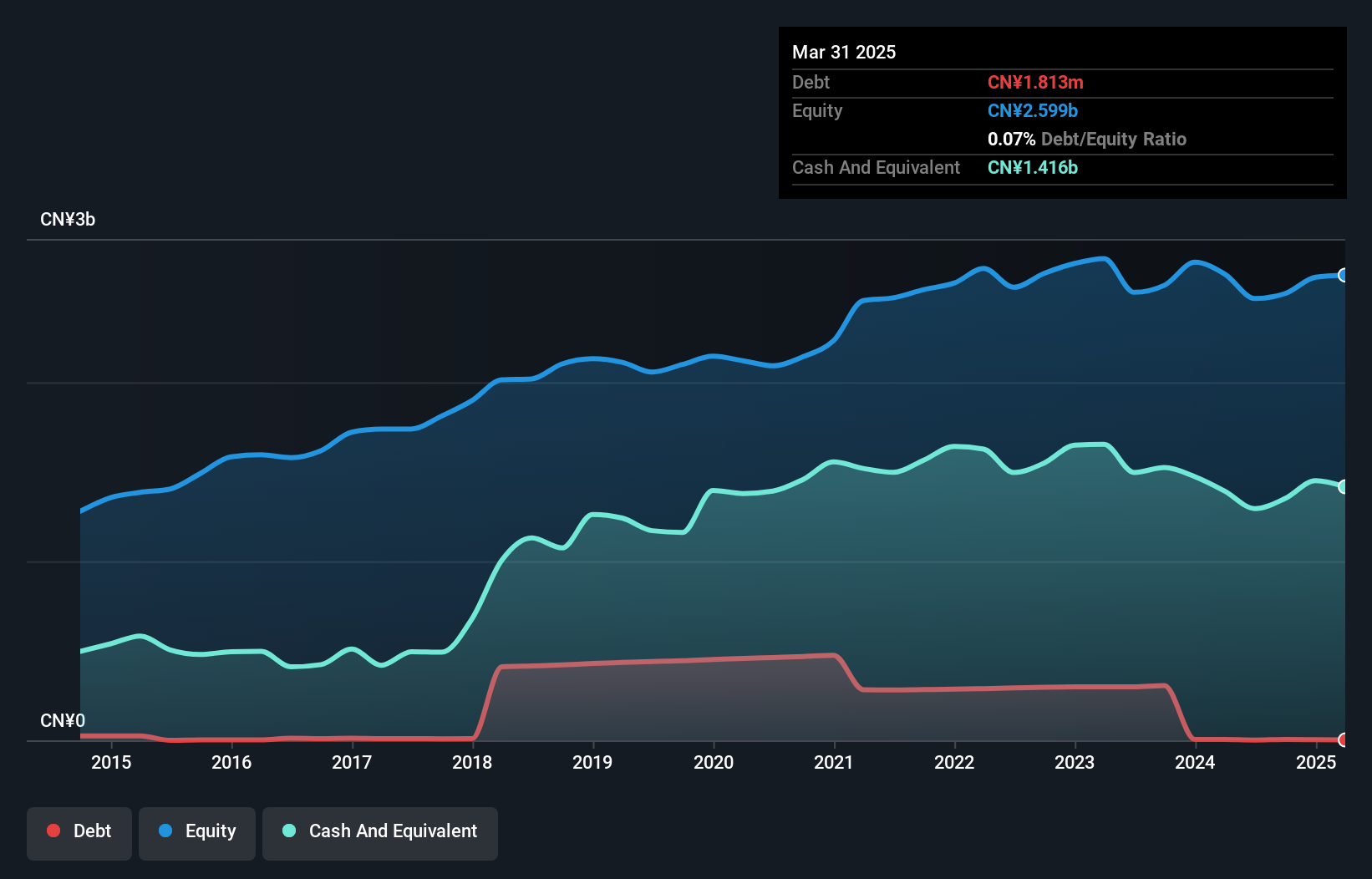

Beijing SDL Technology has been making waves with a notable earnings growth of 10% over the past year, outpacing the electronic industry's 2.9%. The company's debt to equity ratio impressively dropped from 21.5% to just 0.07% in five years, showcasing strong financial discipline. Its price-to-earnings ratio stands at 32x, which is attractive compared to the CN market's average of 39.6x. Recent reports highlight a turnaround in profitability, with net income reaching CNY 10 million versus a loss last year and sales climbing from CNY 231 million to CNY 254 million for Q1 of this year.

- Unlock comprehensive insights into our analysis of Beijing SDL TechnologyLtd stock in this health report.

Understand Beijing SDL TechnologyLtd's track record by examining our Past report.

Make It Happen

- Delve into our full catalog of 3161 Global Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002204

Dalian Huarui Heavy Industry Group

Dalian Huarui Heavy Industry Group Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives