- China

- /

- Electrical

- /

- SZSE:002130

We Ran A Stock Scan For Earnings Growth And ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for ShenZhen Woer Heat-Shrinkable MaterialLtd

How Fast Is ShenZhen Woer Heat-Shrinkable MaterialLtd Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. ShenZhen Woer Heat-Shrinkable MaterialLtd managed to grow EPS by 16% per year, over three years. That's a good rate of growth, if it can be sustained.

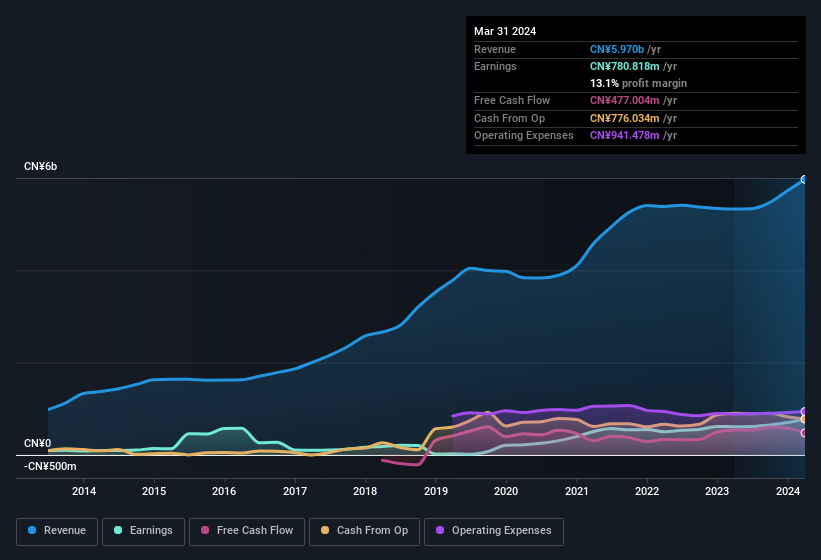

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of ShenZhen Woer Heat-Shrinkable MaterialLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The music to the ears of ShenZhen Woer Heat-Shrinkable MaterialLtd shareholders is that EBIT margins have grown from 14% to 17% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for ShenZhen Woer Heat-Shrinkable MaterialLtd?

Are ShenZhen Woer Heat-Shrinkable MaterialLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that ShenZhen Woer Heat-Shrinkable MaterialLtd insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth CN¥1.9b. That equates to 12% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to ShenZhen Woer Heat-Shrinkable MaterialLtd, with market caps between CN¥7.2b and CN¥23b, is around CN¥1.3m.

ShenZhen Woer Heat-Shrinkable MaterialLtd's CEO only received compensation totalling CN¥239k in the year to December 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is ShenZhen Woer Heat-Shrinkable MaterialLtd Worth Keeping An Eye On?

One positive for ShenZhen Woer Heat-Shrinkable MaterialLtd is that it is growing EPS. That's nice to see. Earnings growth might be the main attraction for ShenZhen Woer Heat-Shrinkable MaterialLtd, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. It is worth noting though that we have found 2 warning signs for ShenZhen Woer Heat-Shrinkable MaterialLtd (1 is a bit unpleasant!) that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002130

ShenZhen Woer Heat-Shrinkable MaterialLtd

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives