- China

- /

- Electrical

- /

- SZSE:002130

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd. (SZSE:002130) Surges 30% Yet Its Low P/E Is No Reason For Excitement

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd. (SZSE:002130) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 221% following the latest surge, making investors sit up and take notice.

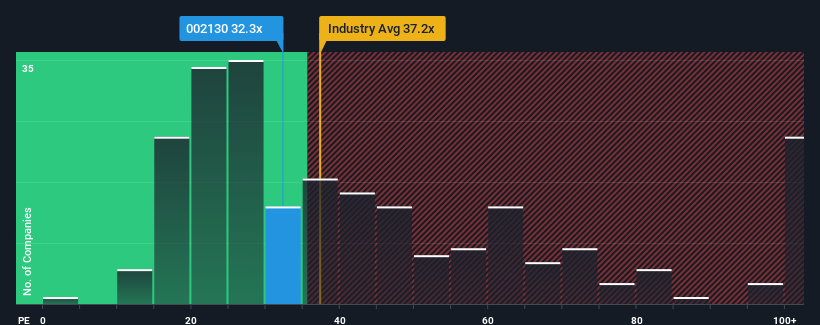

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may still consider ShenZhen Woer Heat-Shrinkable MaterialLtd as an attractive investment with its 32.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, ShenZhen Woer Heat-Shrinkable MaterialLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for ShenZhen Woer Heat-Shrinkable MaterialLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, ShenZhen Woer Heat-Shrinkable MaterialLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. The latest three year period has also seen an excellent 65% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 30% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we can see why ShenZhen Woer Heat-Shrinkable MaterialLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From ShenZhen Woer Heat-Shrinkable MaterialLtd's P/E?

Despite ShenZhen Woer Heat-Shrinkable MaterialLtd's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ShenZhen Woer Heat-Shrinkable MaterialLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ShenZhen Woer Heat-Shrinkable MaterialLtd that you need to be mindful of.

Of course, you might also be able to find a better stock than ShenZhen Woer Heat-Shrinkable MaterialLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002130

ShenZhen Woer Heat-Shrinkable MaterialLtd

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives