Guangdong Hongtu Technology (holdings) Co.,Ltd.'s (SZSE:002101) Shares Bounce 27% But Its Business Still Trails The Market

Those holding Guangdong Hongtu Technology (holdings) Co.,Ltd. (SZSE:002101) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

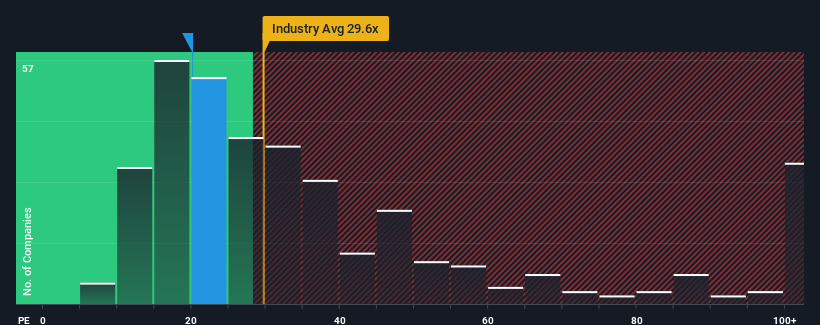

In spite of the firm bounce in price, Guangdong Hongtu Technology (holdings)Ltd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.1x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Guangdong Hongtu Technology (holdings)Ltd as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Guangdong Hongtu Technology (holdings)Ltd

Is There Any Growth For Guangdong Hongtu Technology (holdings)Ltd?

Guangdong Hongtu Technology (holdings)Ltd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Still, the latest three year period has seen an excellent 119% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 32% over the next year. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that Guangdong Hongtu Technology (holdings)Ltd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Guangdong Hongtu Technology (holdings)Ltd's P/E?

Guangdong Hongtu Technology (holdings)Ltd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Guangdong Hongtu Technology (holdings)Ltd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Guangdong Hongtu Technology (holdings)Ltd that you need to take into consideration.

If these risks are making you reconsider your opinion on Guangdong Hongtu Technology (holdings)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Guangdong Hongtu Technology (holdings)Ltd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002101

Guangdong Hongtu Technology (holdings)Ltd

Designs, develops, manufactures, and sells precision aluminum alloy die castings and related accessories used in automotive, communication, and electromechanical products in China.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives