- China

- /

- Real Estate

- /

- SZSE:000718

Suning UniversalLtd And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced fluctuations, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic data, while European indices showed resilience despite similar concerns. In such a climate, investors often seek opportunities in less conventional areas of the market, including penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer significant value and growth potential when supported by strong financials. This article will explore three promising penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,697 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suning Universal Co., Ltd is a real estate development company in China with a market cap of CN¥7.16 billion.

Operations: Suning Universal Co., Ltd does not report specific revenue segments.

Market Cap: CN¥7.16B

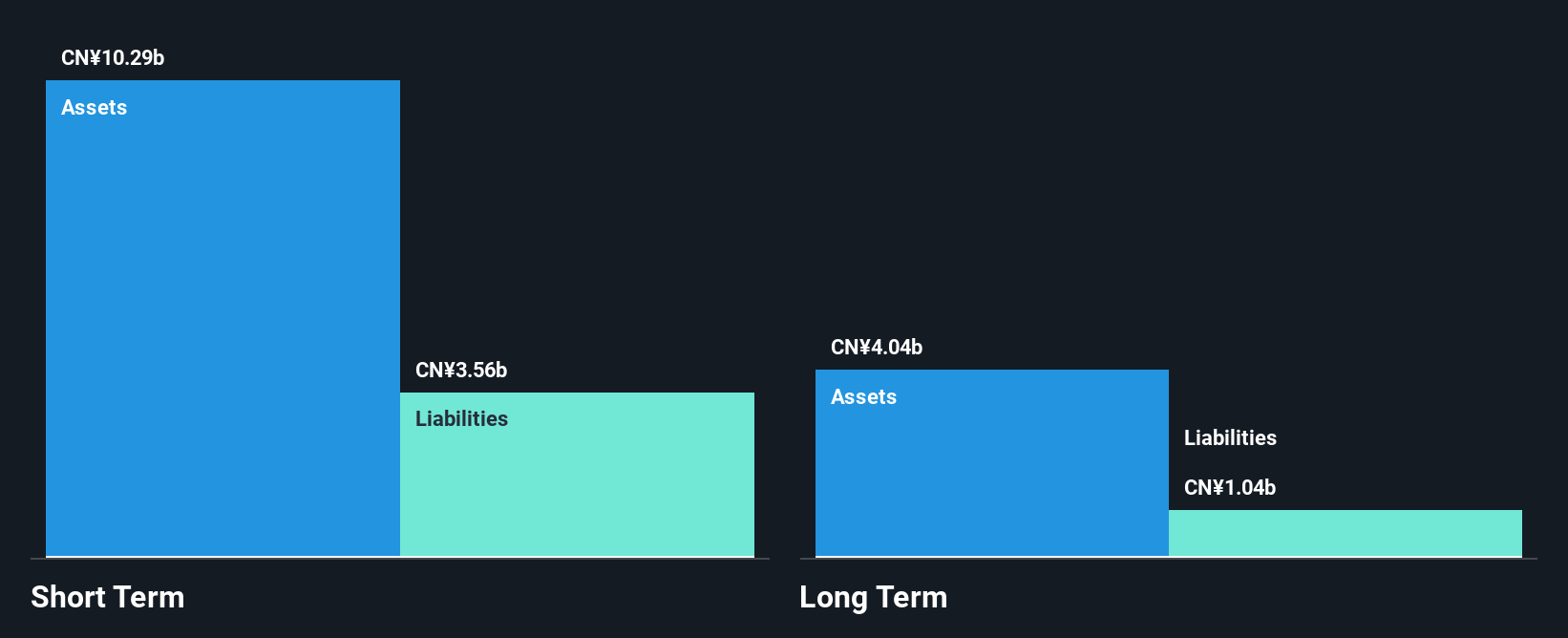

Suning Universal Co., Ltd, a real estate development company in China with a market cap of CN¥7.16 billion, presents both opportunities and challenges for investors interested in penny stocks. The company's net debt to equity ratio is satisfactory at 11.2%, and its short-term assets exceed both long-term (CN¥817.7M) and short-term liabilities (CN¥3.8B). However, earnings have declined by 41.6% annually over the past five years, with recent profit margins dropping to 6.4% from last year's 13.1%. Despite stable weekly volatility at 6%, operating cash flow remains negative, affecting debt coverage capabilities.

- Click here to discover the nuances of Suning UniversalLtd with our detailed analytical financial health report.

- Gain insights into Suning UniversalLtd's past trends and performance with our report on the company's historical track record.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. specializes in the design and construction of interior decoration, curtain walls, furniture, and landscape projects in China, with a market cap of CN¥93.47 billion.

Operations: The company generates its revenue of CN¥18.33 billion primarily from its operations within China.

Market Cap: CN¥9.35B

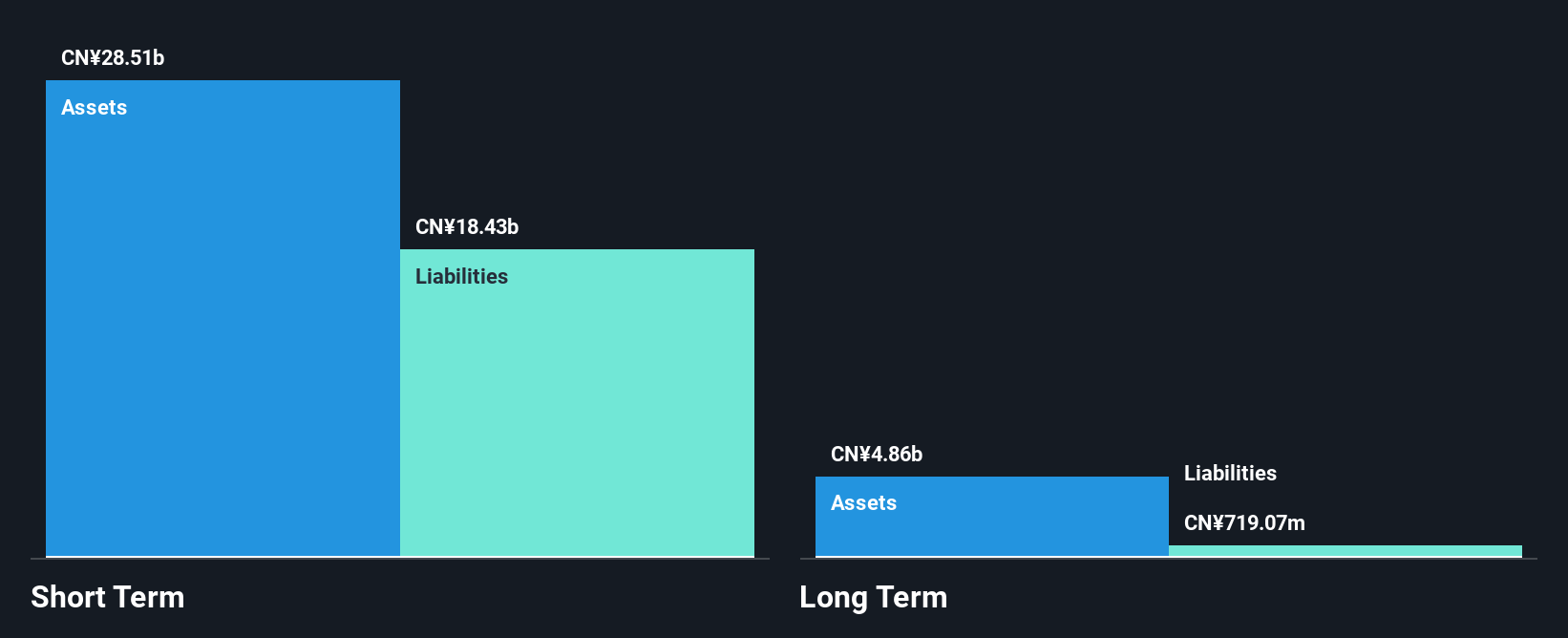

Suzhou Gold Mantis Construction Decoration Co., Ltd. presents a mixed picture for investors in penny stocks. While the company boasts a substantial market cap of CN¥93.47 billion and has reduced its debt-to-equity ratio from 8.6% to 4.8% over five years, its earnings have declined by an average of 19.7% annually during this period, with recent net profit margins falling to 3.5%. Short-term assets comfortably cover both short-term and long-term liabilities, but negative earnings growth and low return on equity at 4.8% highlight ongoing challenges despite stable weekly volatility at 5%.

- Click to explore a detailed breakdown of our findings in Suzhou Gold Mantis Construction Decoration's financial health report.

- Review our growth performance report to gain insights into Suzhou Gold Mantis Construction Decoration's future.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building decoration, curtain wall decoration, and intelligent system integration, with a market cap of CN¥5.18 billion.

Operations: No specific revenue segments are reported for Zhejiang Yasha Decoration Co., Ltd.

Market Cap: CN¥5.18B

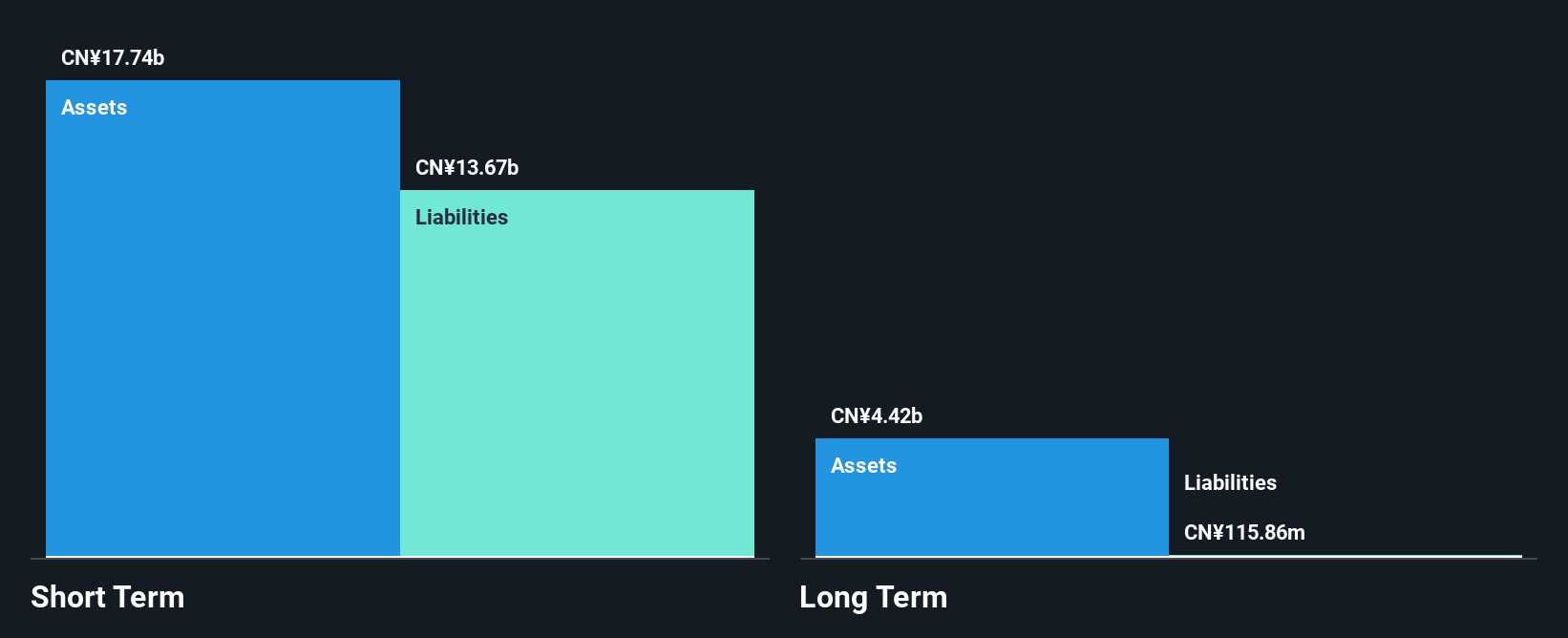

Zhejiang Yasha Decoration Co., Ltd. offers a compelling case for penny stock investors with a market cap of CN¥5.18 billion and strong financial stability, as its short-term assets of CN¥17.7 billion exceed both short-term and long-term liabilities. The company's debt is well-covered by operating cash flow, and interest payments are comfortably managed with EBIT coverage at 7.5 times. Despite low return on equity at 3.1%, earnings have grown by 24.6% over the past year, surpassing industry growth rates, while profit margins improved to 2.1%. Additionally, the company has reduced its debt-to-equity ratio over five years.

- Navigate through the intricacies of Zhejiang Yasha DecorationLtd with our comprehensive balance sheet health report here.

- Learn about Zhejiang Yasha DecorationLtd's historical performance here.

Key Takeaways

- Unlock our comprehensive list of 5,697 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000718

Suning UniversalLtd

Operates as a real estate development company in China.

Excellent balance sheet slight.

Market Insights

Community Narratives