- China

- /

- Construction

- /

- SZSE:002061

Undiscovered Gems Three Stocks To Watch This November 2024

Reviewed by Simply Wall St

As global markets continue to navigate geopolitical tensions and economic shifts, U.S. indexes are approaching record highs with smaller-cap stocks outperforming their larger counterparts, driven by strong labor market data and stabilizing mortgage rates. In this dynamic environment, identifying undiscovered gems among small-cap stocks can offer unique opportunities for investors seeking growth potential in a landscape where broader macroeconomic factors play a significant role.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Spic Yuanda Environmental-ProtectionLtd (SHSE:600292)

Simply Wall St Value Rating: ★★★★★☆

Overview: Spic Yuanda Environmental-Protection Co., Ltd. operates in the environmental protection sector and has a market capitalization of CN¥11 billion.

Operations: The company generates revenue primarily from its environmental protection services, with a focus on cost-effective operations. Its net profit margin is 5.6%, reflecting the efficiency of its financial management in relation to revenues and expenses.

Spic Yuanda Environmental-Protection Ltd. shows a dynamic profile with its recent sales reaching CNY 3.10 billion, up from CNY 2.90 billion the previous year, highlighting notable growth despite earnings staying relatively flat at CNY 88.37 million compared to CNY 88.66 million last year. The company’s net debt to equity ratio stands at a satisfactory 14.1%, indicating prudent financial management amidst an increase in debt to equity from 23% to 26% over five years, while maintaining high-quality earnings and positive free cash flow of approximately CNY 539 million as of September this year, reflecting robust operational efficiency.

Zhejiang Communications Technology (SZSE:002061)

Simply Wall St Value Rating: ★★★★☆☆

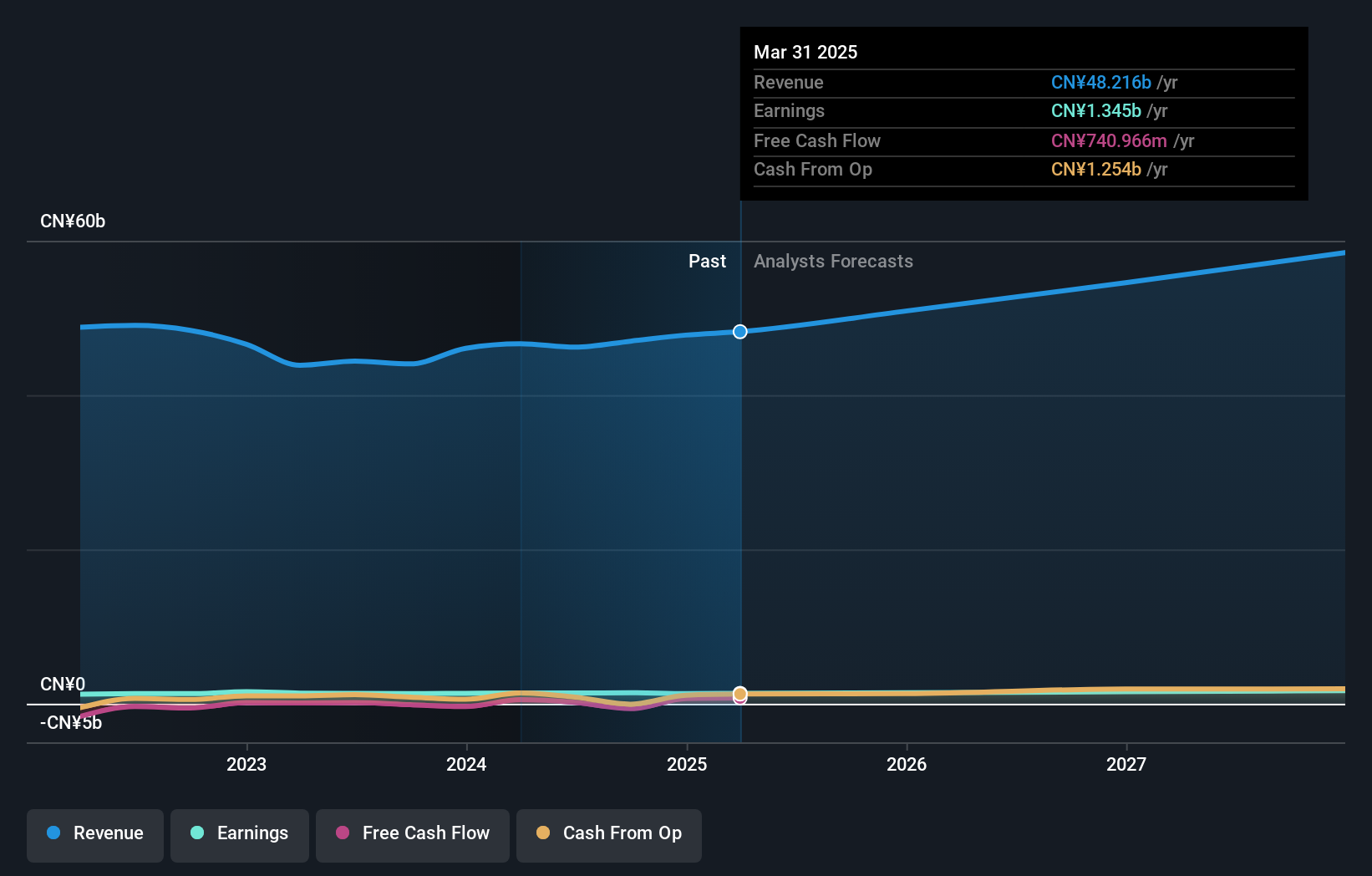

Overview: Zhejiang Communications Technology Co., Ltd. operates in the infrastructure sector, focusing on the development and construction of transportation projects, with a market cap of CN¥11.38 billion.

Operations: Zhejiang Communications Technology generates revenue primarily from its infrastructure projects in the transportation sector. The company has a market cap of CN¥11.38 billion, reflecting its significant presence in this industry.

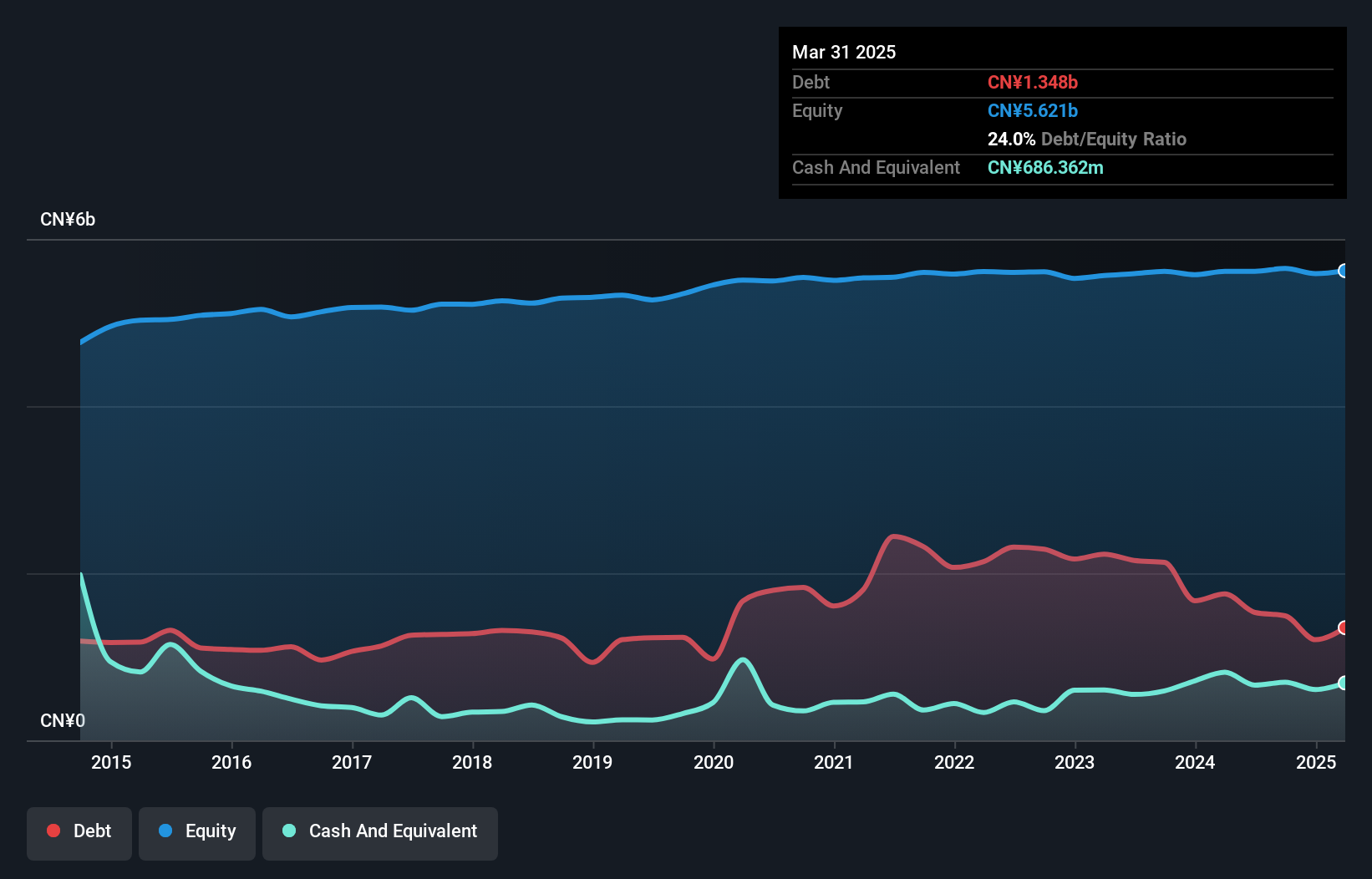

Zhejiang Communications Technology, a promising player in the construction industry, showcases strong earnings growth of 8.7% over the past year, outpacing the industry's -4.1%. With a satisfactory net debt to equity ratio of 31.5%, financial stability seems robust despite an increase in overall debt to equity from 66% to 82.6% over five years. The company trades at a favorable price-to-earnings ratio of 8.1x compared to the CN market's average of 35.5x, indicating potential value for investors seeking opportunities in smaller companies with high-quality earnings and solid interest coverage capabilities.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Communications Technology.

Learn about Zhejiang Communications Technology's historical performance.

Shenyu Communication Technology (SZSE:300563)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyu Communication Technology Inc. is involved in the research and development, production, and sale of radio frequency coaxial cables in China, with a market cap of CN¥8.52 billion.

Operations: Shenyu Communication Technology generates revenue primarily from the production and sale of coaxial cable products, amounting to CN¥856.53 million.

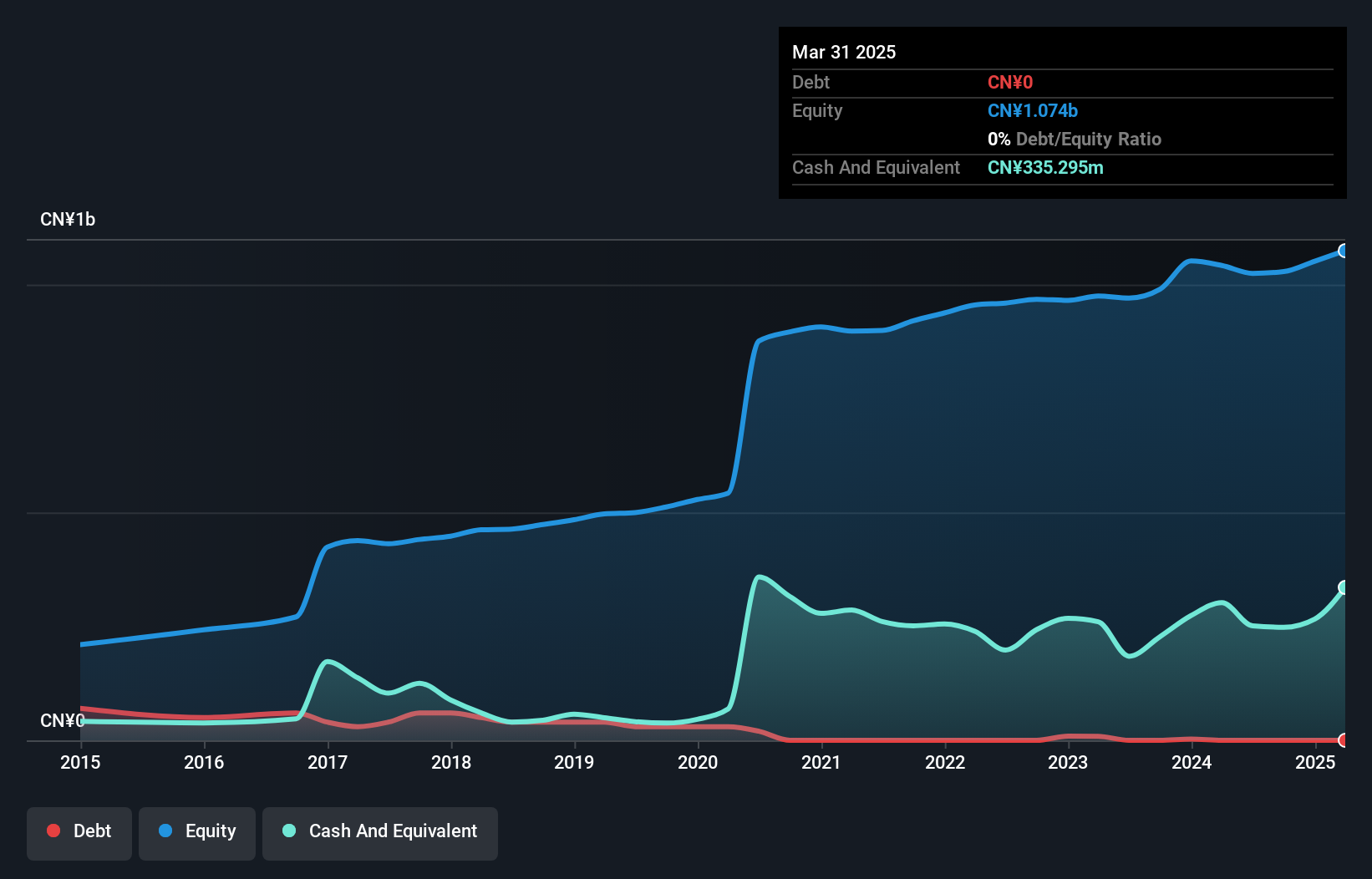

Shenyu Communication Technology, a dynamic player in the communications sector, has shown impressive earnings growth of 104% over the past year, outpacing its industry peers. The company is debt-free, showcasing financial prudence and reducing risk concerns. Despite a volatile share price recently, Shenyu's strong performance is highlighted by sales reaching CNY 642.51 million for the first nine months of 2024 compared to CNY 540.98 million previously. Net income also rose to CNY 67.36 million from CNY 40.13 million last year, reflecting robust operational efficiency and strategic execution in an evolving market landscape.

Key Takeaways

- Navigate through the entire inventory of 4621 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Communications Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002061

Zhejiang Communications Technology

Zhejiang Communications Technology Co., Ltd.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives