- China

- /

- Communications

- /

- SZSE:300563

Exploring Zhejiang Communications Technology And 2 Other Undiscovered Gems With Solid Foundations

Reviewed by Simply Wall St

In a market environment characterized by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience with the S&P MidCap 400 and Russell 2000 indices posting gains despite broader market volatility. As investors navigate these uncertain waters, identifying stocks with solid foundations becomes crucial, as these companies often possess the strong fundamentals needed to weather economic shifts and capitalize on future growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi | 56.22% | 44.24% | 26.23% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Communications Technology (SZSE:002061)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Communications Technology Co., Ltd. operates in the infrastructure sector, focusing on construction and engineering services, with a market cap of CN¥10.97 billion.

Operations: The company generates revenue primarily from construction and engineering services within the infrastructure sector. It has a market capitalization of CN¥10.97 billion.

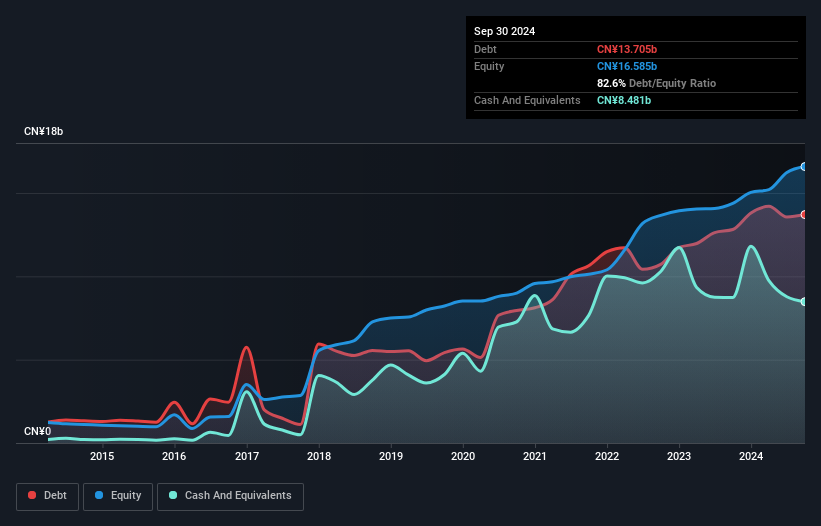

Zhejiang Communications Technology, a relatively small player in the industry, showcases promising financial metrics. Its price-to-earnings ratio of 7.7x is notably below the CN market average of 36.1x, suggesting potential value for investors. Over the past year, earnings grew by 8.7%, outpacing the construction industry's -3.9%. However, its debt-to-equity ratio has risen from 66% to 82.6% over five years, which might warrant attention despite satisfactory interest coverage and high-quality earnings reports. Recently reported net income for nine months increased to CNY 838 million from CNY 758 million last year, reflecting steady performance amidst sector challenges.

- Unlock comprehensive insights into our analysis of Zhejiang Communications Technology stock in this health report.

Learn about Zhejiang Communications Technology's historical performance.

Shenyu Communication Technology (SZSE:300563)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyu Communication Technology Inc. focuses on the research and development, production, and sale of radio frequency coaxial cables in China, with a market cap of CN¥12.23 billion.

Operations: The company's primary revenue stream is from the production and sales of coaxial cable products, generating CN¥856.53 million.

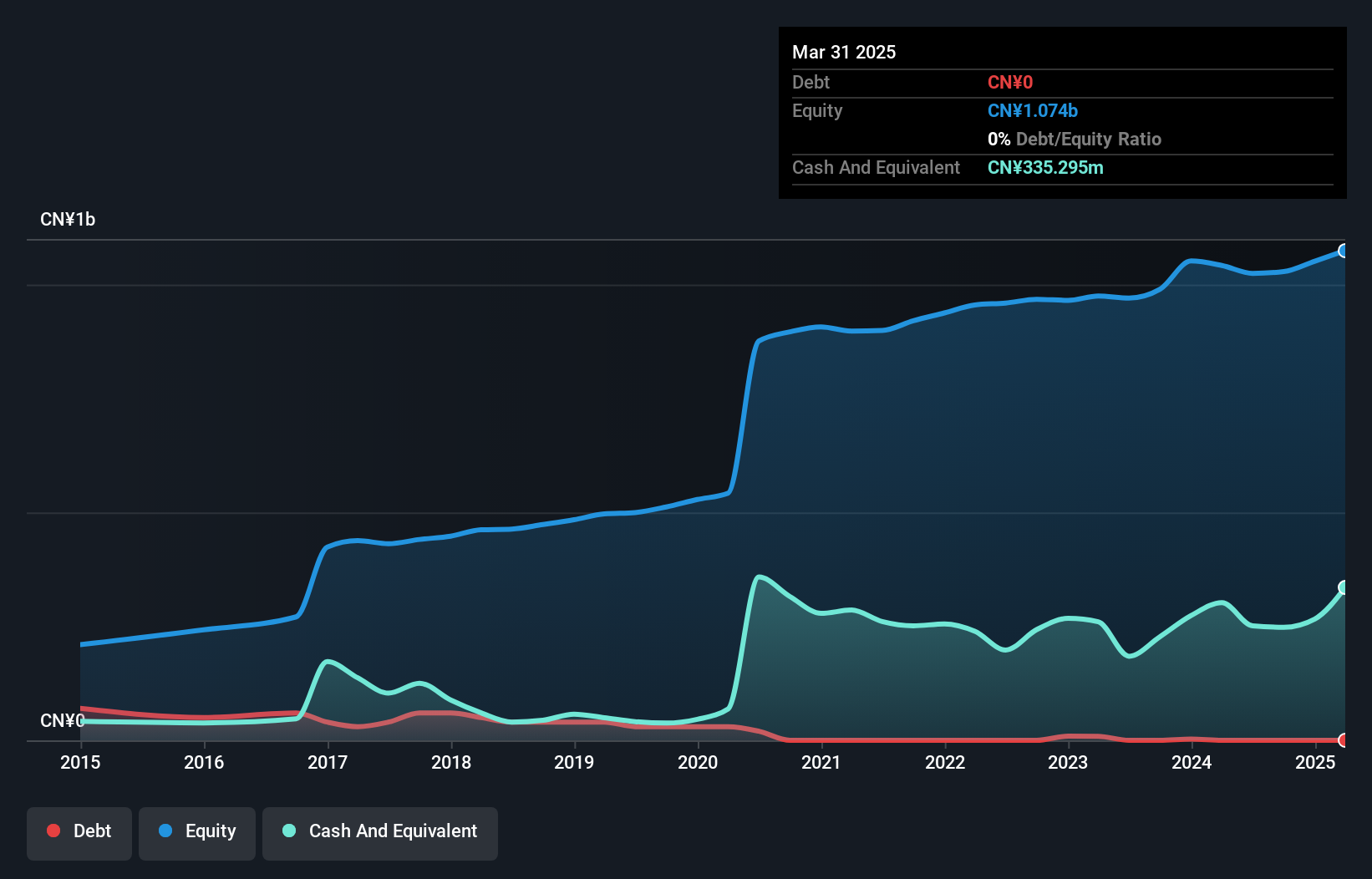

Shenyu Communication Technology, a nimble player in its field, has shown impressive financial strides recently. Earnings surged by 104% over the past year, outpacing the communications industry's -3%. The company reported CNY 642.51 million in revenue for the nine months ending September 2024, up from CNY 540.98 million a year prior. Net income also rose to CNY 67.36 million from CNY 40.13 million last year, reflecting strong operational performance and high-quality earnings despite share price volatility over recent months. Notably debt-free now compared to five years ago when its debt-to-equity ratio was at 5.9%, Shenyu seems well-positioned financially with positive free cash flow and no concerns about covering interest payments due to zero debt obligations.

Chengdu RML Technology (SZSE:301050)

Simply Wall St Value Rating: ★★★★★★

Overview: Chengdu RML Technology Co., Ltd. focuses on the research, development, manufacture, and testing of millimeter-wave microsystems with a market cap of CN¥13.40 billion.

Operations: RML Technology generates revenue primarily from the development and sale of millimeter-wave microsystems. The company's financial performance is influenced by its cost structure, with particular attention to production and operational expenses. Notably, RML's gross profit margin has shown fluctuations over recent reporting periods, reflecting changes in cost efficiency and pricing strategies.

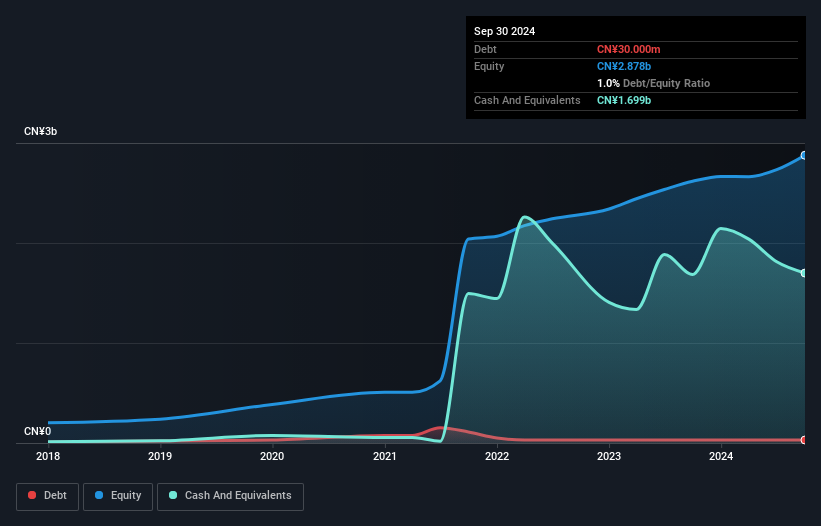

Chengdu RML Technology is making waves with notable financial strides. The company reported a substantial increase in sales, reaching CNY 1.17 billion for the first nine months of 2024, up from CNY 725 million the previous year. Net income also saw a boost to CNY 373.8 million compared to last year's CNY 264.28 million, reflecting strong performance relative to its industry peers with earnings growth of 41%. Its price-to-earnings ratio stands at an attractive 32x, lower than the CN market average of 36x, suggesting potential undervaluation. Despite recent share price volatility, Chengdu RML's debt-to-equity ratio has impressively decreased from 7.9% to just over one percent over five years, indicating improved financial health and stability in managing obligations efficiently while maintaining high-quality earnings and positive free cash flow.

- Click here and access our complete health analysis report to understand the dynamics of Chengdu RML Technology.

Understand Chengdu RML Technology's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 4630 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300563

Shenyu Communication Technology

Engages in the research and development, production, and sale of radio frequency coaxial cables in China.

Flawless balance sheet with solid track record.