Shandong Weida Machinery Co., Ltd. (SZSE:002026) Held Back By Insufficient Growth Even After Shares Climb 26%

Shandong Weida Machinery Co., Ltd. (SZSE:002026) shareholders have had their patience rewarded with a 26% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

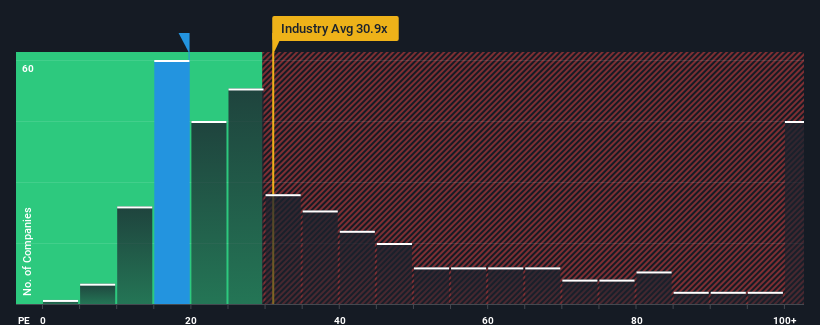

Although its price has surged higher, Shandong Weida Machinery's price-to-earnings (or "P/E") ratio of 19.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 61x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Shandong Weida Machinery has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Shandong Weida Machinery

How Is Shandong Weida Machinery's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shandong Weida Machinery's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. Still, incredibly EPS has fallen 38% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 17% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we can see why Shandong Weida Machinery is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Shandong Weida Machinery's P/E?

The latest share price surge wasn't enough to lift Shandong Weida Machinery's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shandong Weida Machinery maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shandong Weida Machinery that you should be aware of.

Of course, you might also be able to find a better stock than Shandong Weida Machinery. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002026

Shandong Weida Machinery

Engages in the manufacture and sale of drill chucks in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives