- China

- /

- Aerospace & Defense

- /

- SZSE:002025

Market Participants Recognise Guizhou Space Appliance Co., LTD's (SZSE:002025) Earnings Pushing Shares 27% Higher

Those holding Guizhou Space Appliance Co., LTD (SZSE:002025) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 43%.

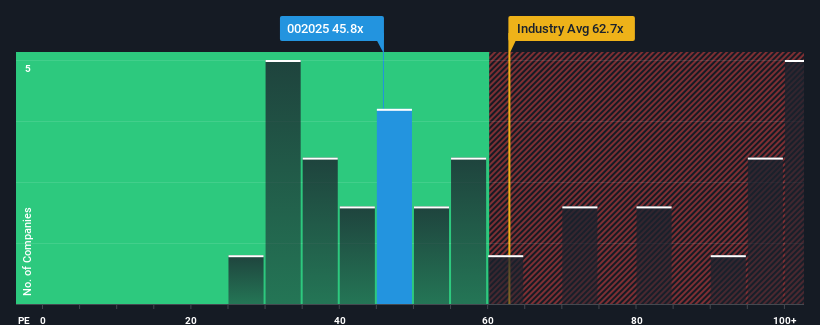

Since its price has surged higher, Guizhou Space Appliance's price-to-earnings (or "P/E") ratio of 45.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 38x and even P/E's below 21x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Guizhou Space Appliance as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Guizhou Space Appliance

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Guizhou Space Appliance's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 48% during the coming year according to the seven analysts following the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Guizhou Space Appliance's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Guizhou Space Appliance's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guizhou Space Appliance maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Guizhou Space Appliance that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002025

Guizhou Space Appliance

Engages in the research and development, production, and sale of connectors, micro-motors and control components, relays, optoelectronic and optical communication devices, and cable assemblies in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives