MR. D.I.Y. Holding Thailand And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets experience a dynamic shift, with small-cap stocks notably outperforming their larger peers, the spotlight turns to Asia where economic resilience and technological innovation continue to capture investor interest. In this environment, identifying promising companies requires a keen eye for those that demonstrate strong fundamentals and adaptability in the face of evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Allmed Medical ProductsLtd | 13.03% | -2.37% | -30.93% | ★★★★★★ |

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| OpenWork | NA | 30.11% | 29.99% | ★★★★★★ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| MNtech | 69.81% | 10.24% | -13.03% | ★★★★★☆ |

| Kung Sing Engineering | 15.19% | 10.12% | -35.75% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Suzhou Fengbei Biotech Stock | 42.33% | 18.50% | 13.12% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

MR. D.I.Y. Holding (Thailand) (SET:MRDIYT)

Simply Wall St Value Rating: ★★★★★☆

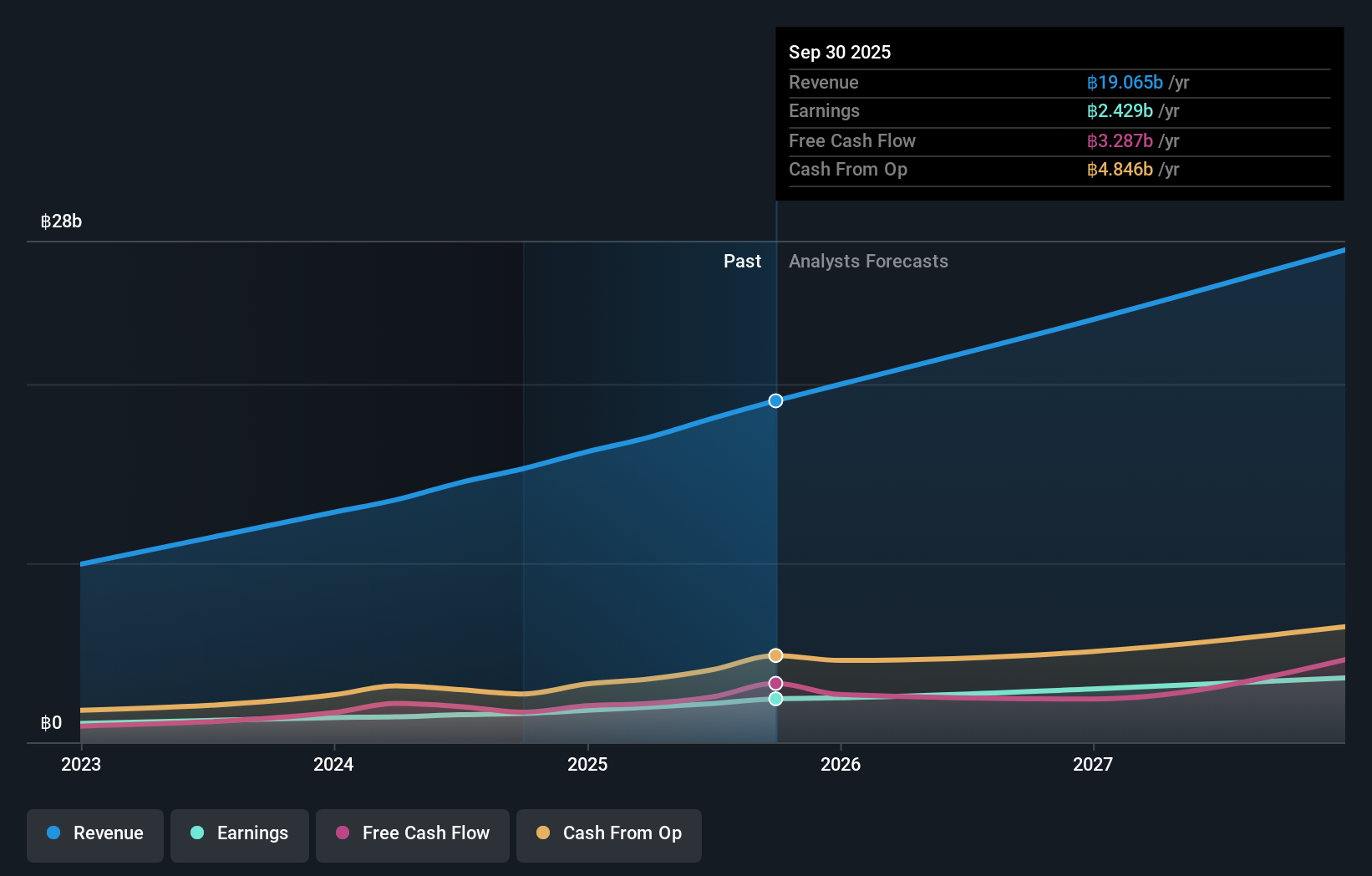

Overview: MR. D.I.Y. Holding (Thailand) Public Company Limited, along with its subsidiaries, functions as a home improvement and lifestyle retailer in Thailand with a market capitalization of THB55.06 billion.

Operations: MR. D.I.Y. Holding (Thailand) generates revenue primarily through its retail segment in consumer products, amounting to THB19.07 billion. The company's financial performance can be assessed by examining its net profit margin, which reflects the efficiency of converting revenue into actual profit after expenses are deducted.

MR. D.I.Y. Holding (Thailand) has been making waves with its recent performance and strategic moves. This small cap player in the specialty retail sector saw earnings grow by an impressive 50.9% over the past year, outpacing industry growth of 21.3%. The company's net debt to equity ratio stands at a satisfactory 38.8%, indicating sound financial health, while its interest payments are well-covered by EBIT at 9.2 times coverage, showcasing robust operational efficiency. Recently, MRDIYT declared its first interim dividend post-listing of THB 0.05 per share, signaling confidence in future cash flows and profitability prospects as it continues to expand its footprint in Asia's dynamic market landscape.

Zhejiang Jinggong Integration Technology (SZSE:002006)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Jinggong Integration Technology Co., Ltd. operates in the technology sector with a focus on providing integrated solutions, and it has a market capitalization of approximately CN¥11.11 billion.

Operations: Jinggong Integration Technology's revenue model is centered around its technology solutions, with a gross profit margin of 21.5%. The company reported revenue of CN¥3.45 billion, reflecting its scale in the market.

Zhejiang Jinggong Integration Technology, a smaller player in the Machinery industry, has demonstrated impressive earnings growth of 93.4% over the past year, outpacing the industry's average of 6.1%. The company reported sales of ¥1.34 billion for the first nine months of 2025, up from ¥1.18 billion a year prior, with net income reaching ¥144.74 million compared to ¥73.03 million previously. Despite shareholder dilution last year and recent volatility in its share price, Jinggong's debt-to-equity ratio improved from 25 to 14 over five years and it holds more cash than total debt, suggesting financial resilience amidst ongoing changes in corporate governance.

Jiangsu Jujie Microfiber Technology Group (SZSE:300819)

Simply Wall St Value Rating: ★★★★★★

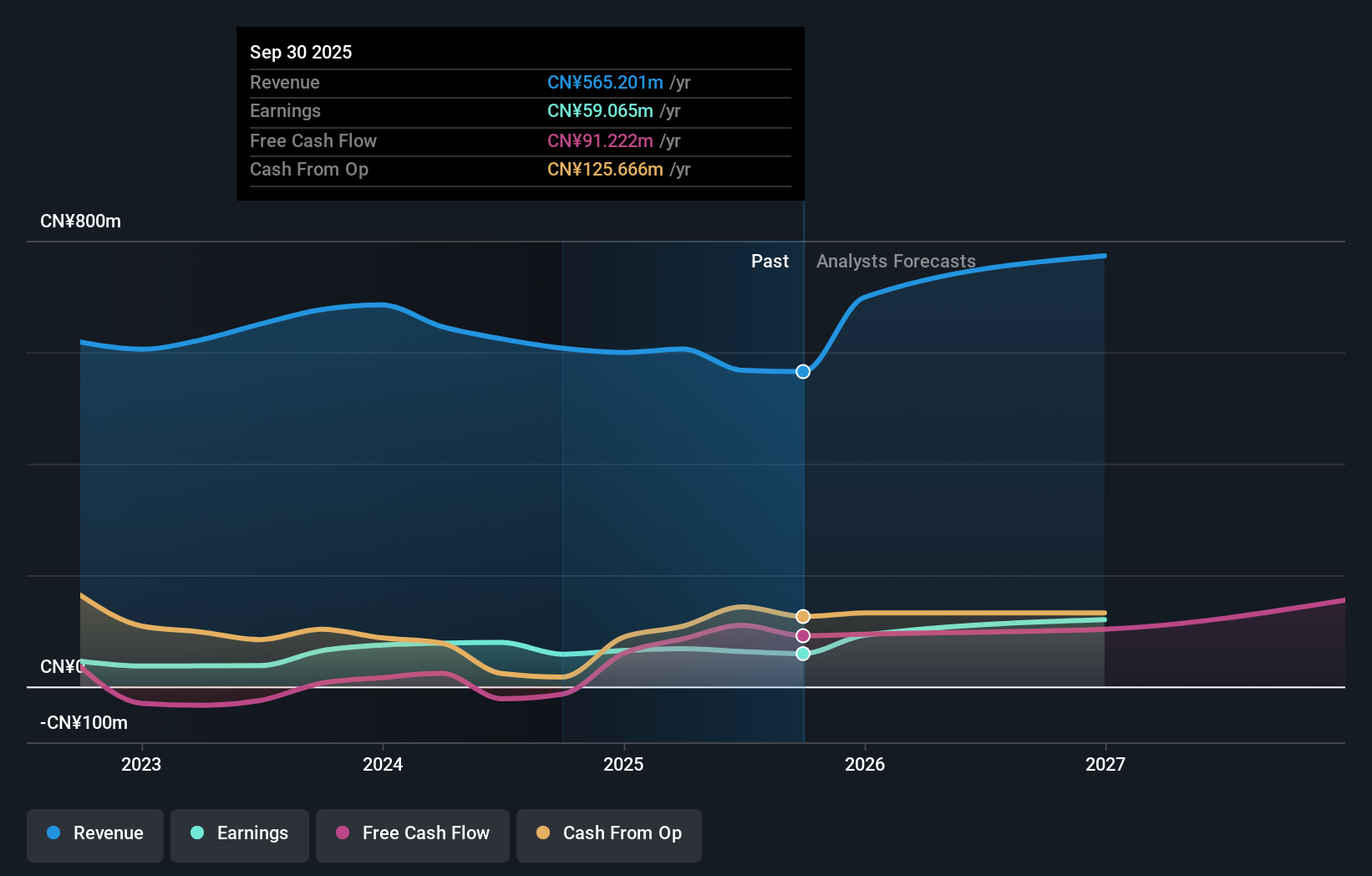

Overview: Jiangsu Jujie Microfiber Technology Group Co., Ltd. is a company engaged in the production and sale of microfiber products, with a market cap of approximately CN¥4.34 billion.

Operations: The company's primary revenue stream is derived from its Textile and Clothing Business, generating CN¥565.20 million.

Jiangsu Jujie Microfiber Technology Group, a small player in the microfiber industry, has seen its earnings grow by 1.8% over the past year, outpacing the luxury sector's -1.2%. The company's debt to equity ratio improved significantly from 3% to 1.3% over five years, indicating better financial health. Despite a dip in sales and net income for the nine months ending September 2025—CNY 448 million and CNY 52 million respectively—the firm remains profitable with high-quality earnings and positive free cash flow. Earnings are projected to surge by an impressive 47% annually, suggesting robust future growth potential.

Key Takeaways

- Access the full spectrum of 2506 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300819

Jiangsu Jujie Microfiber Technology Group

Jiangsu Jujie Microfiber Technology Group Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026