Exploring Three Promising Asian Small Caps with Strong Potential

Reviewed by Simply Wall St

In recent weeks, Asian markets have seen mixed performances amid global economic uncertainties and geopolitical tensions, with smaller-cap indexes showing resilience despite broader market fluctuations. As investors navigate this complex landscape, identifying promising small-cap stocks in Asia requires a keen eye for companies with solid fundamentals and growth potential that can withstand market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ve Wong | 11.74% | 0.90% | 4.16% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Komori | 8.92% | 9.67% | 68.95% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 28.52% | 11.19% | 6.51% | ★★★★★☆ |

| Hong Tai Electric Industrial | 2.14% | 8.92% | 1.39% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Mr Max Holdings | 48.68% | 1.03% | 0.97% | ★★★★☆☆ |

| Toho Bank | 112.58% | 4.43% | 32.71% | ★★★★☆☆ |

| Iljin DiamondLtd | 2.55% | -3.23% | 0.91% | ★★★★☆☆ |

| Sinomag Technology | 68.80% | 16.08% | 3.66% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Korea Information & Communications (KOSDAQ:A025770)

Simply Wall St Value Rating: ★★★★★★

Overview: Korea Information & Communications Co., Ltd. operates in the information and communication sector, small and medium business startup investment, and financial value-added network services, with a market capitalization of approximately ₩416.79 billion.

Operations: Korea Information & Communications generates revenue primarily from its Financial VAN Sector, with the Electronic Payment Agency Business contributing ₩513.05 billion and the Credit Card Value-Added Communication Business adding ₩266.39 billion. The Small and Medium Business Startup Investment Sector also contributes significantly with ₩6.52 billion in revenue, while the Information and Communication Sector adds ₩3.70 billion.

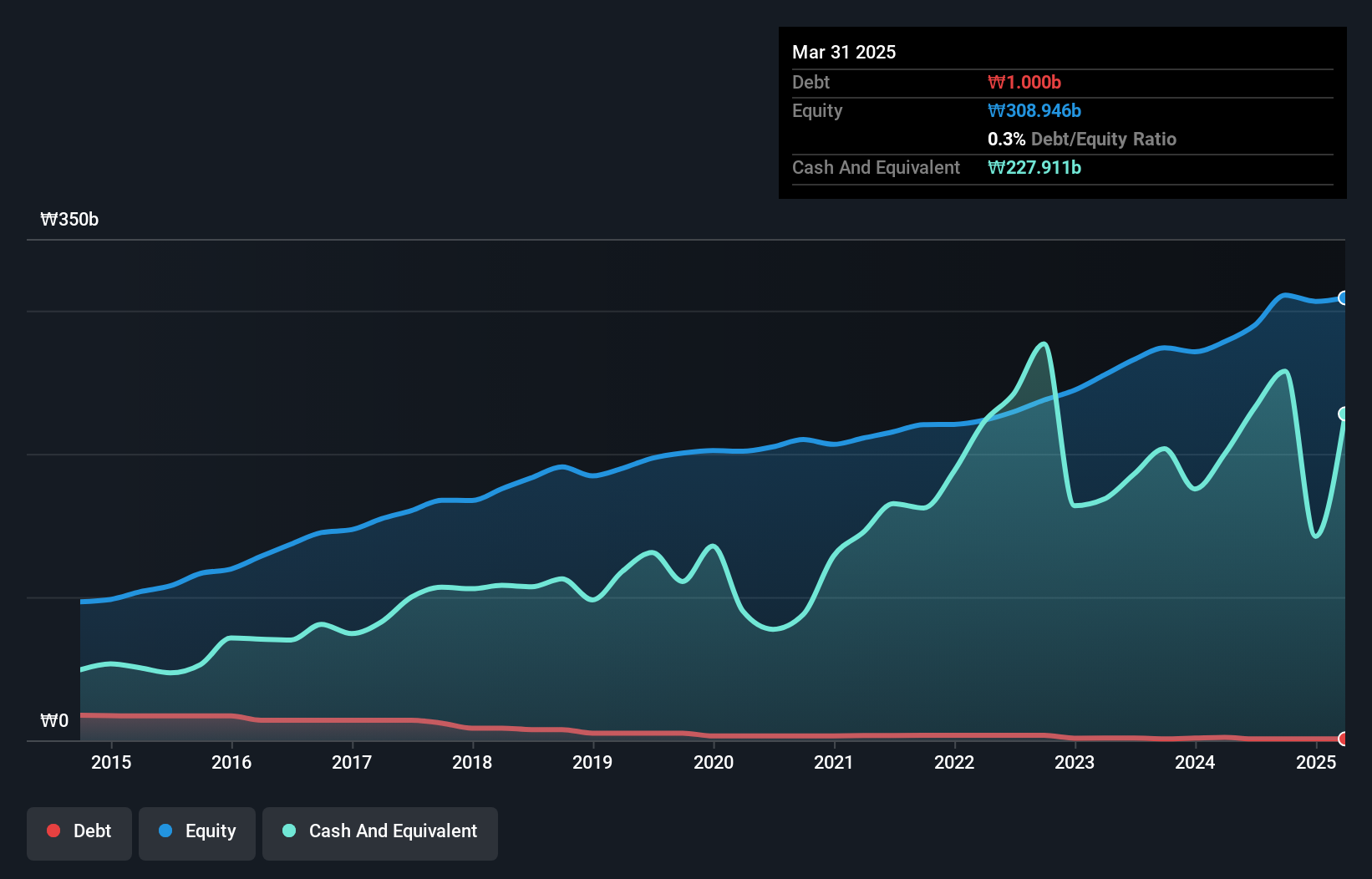

Korea Information & Communications, a small player in the tech space, is trading at a discount of 8.1% below its estimated fair value. The company has shown impressive earnings growth of 47.2% over the past year, outpacing the diversified financial industry average of -0.2%. A significant one-off gain of ₩16.6 billion impacted recent financial results, highlighting potential volatility in earnings quality. Notably, its debt-to-equity ratio improved from 1.5% to just 0.3% over five years, reflecting prudent financial management while maintaining more cash than total debt and completing a share buyback worth ₩1 billion this year for strategic capital allocation enhancement.

Weichai Heavy Machinery (SZSE:000880)

Simply Wall St Value Rating: ★★★★★★

Overview: Weichai Heavy Machinery Co., Ltd. specializes in the development, manufacturing, and sale of diesel engines, generating units, and power integration systems for ship power and power generation equipment in China with a market capitalization of approximately CN¥10.76 billion.

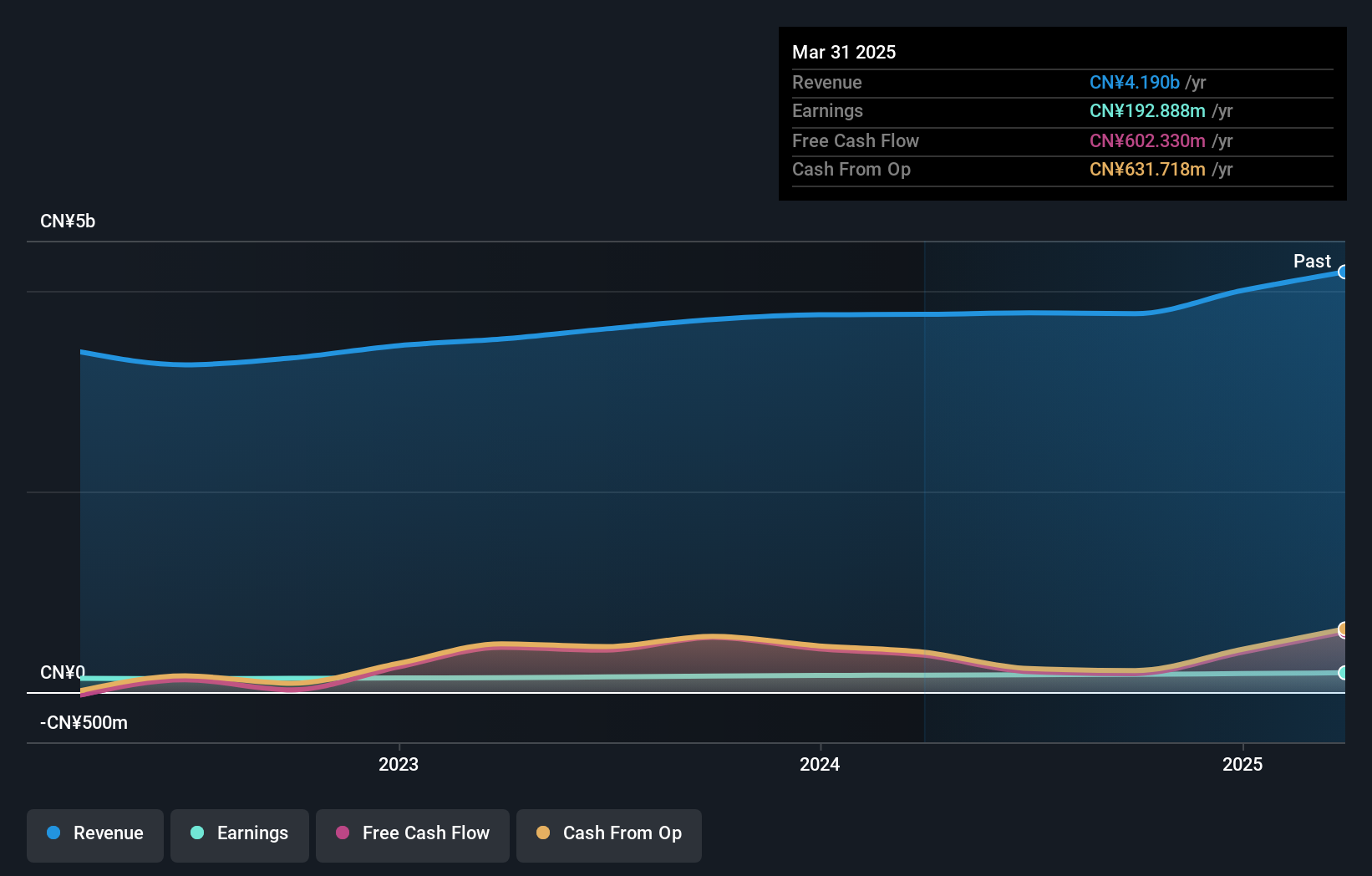

Operations: The primary revenue stream for Weichai Heavy Machinery comes from the General Equipment Manufacturing Industry, contributing approximately CN¥4.19 billion.

Weichai Heavy Machinery, a lesser-known player in the industry, has shown notable financial health with earnings growth of 14.1% over the past year, outpacing the machinery sector's 1% rise. The company is trading at 25.3% below its estimated fair value, suggesting potential undervaluation. Despite a volatile share price recently, it remains debt-free and boasts positive free cash flow. However, recent results were impacted by a one-off gain of CN¥37 million in its latest financials to March 2025. Its net income for Q1 2025 reached CNY 31.8 million from CNY 23.88 million last year, reflecting steady progress despite market fluctuations.

Nanjing Hanrui CobaltLtd (SZSE:300618)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing Hanrui Cobalt Co., Ltd. specializes in the extraction of cobalt and copper ores, with a market capitalization of CN¥11.04 billion.

Operations: Hanrui Cobalt generates revenue primarily from the extraction of cobalt and copper ores. The company's financial performance is influenced by its ability to manage costs associated with mining operations. Its net profit margin reflects the efficiency of these operations in generating profit relative to its total revenue.

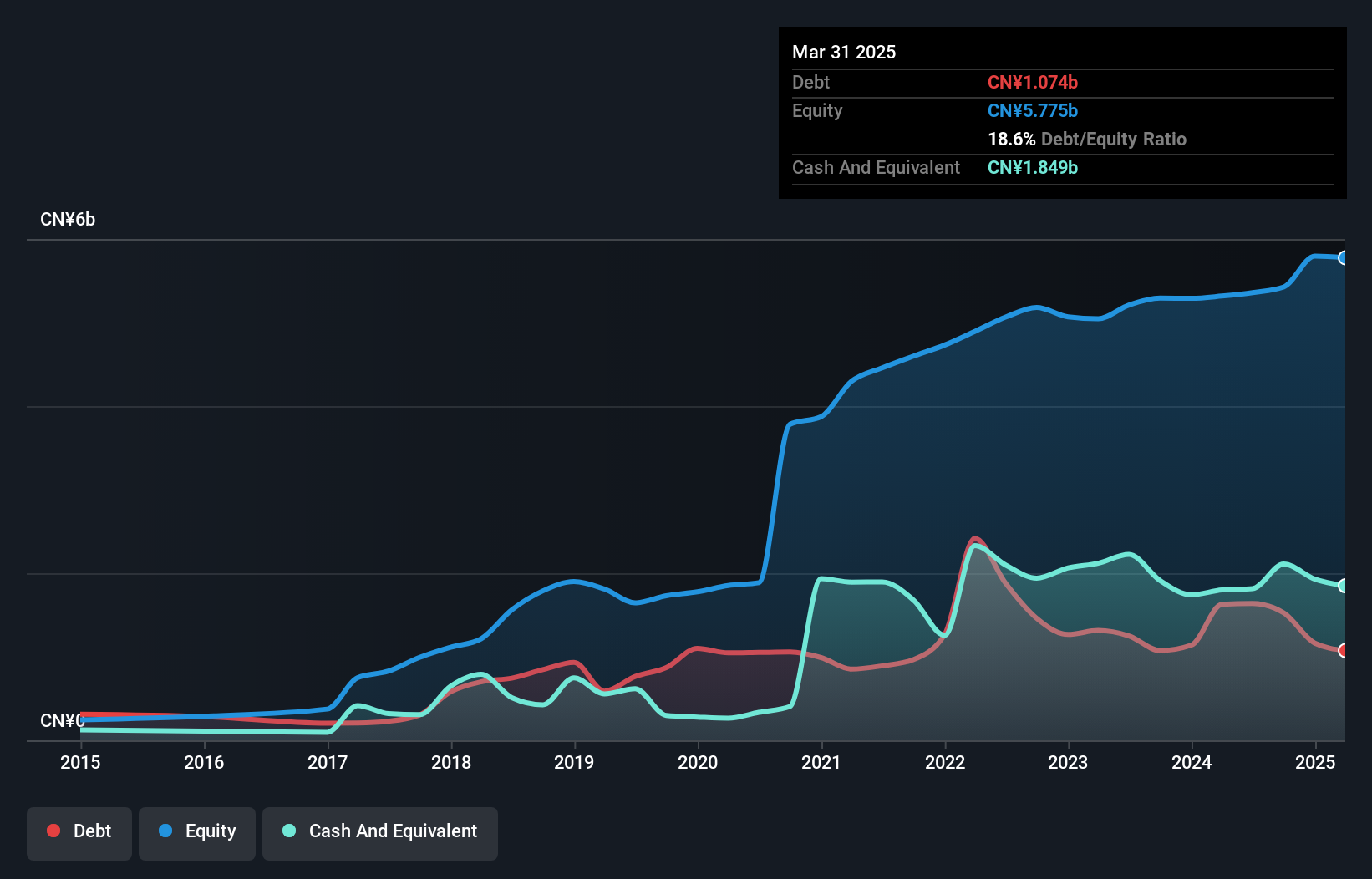

Nanjing Hanrui Cobalt, a nimble player in the metals and mining sector, has been making waves with its impressive financial strides. Over the past year, earnings surged by 41.5%, outpacing industry averages, while net income for Q1 2025 hit CN¥42.86 million compared to CN¥30.66 million from the previous year. The company also boasts a robust debt-to-equity ratio improvement from 56.5% to 18.6% over five years, indicating solid financial health. Despite a one-off gain of CN¥56 million impacting recent results, its interest payments are comfortably covered by EBIT at 32.9 times coverage, showcasing strong operational efficiency and potential for sustained growth amidst market challenges.

- Click here to discover the nuances of Nanjing Hanrui CobaltLtd with our detailed analytical health report.

Learn about Nanjing Hanrui CobaltLtd's historical performance.

Summing It All Up

- Click here to access our complete index of 2601 Asian Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weichai Heavy Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000880

Weichai Heavy Machinery

Develops, manufactures, and sells diesel engines, generating units, and power integration systems for ship power and power generation equipment in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives