As global markets navigate a landscape marked by easing trade tensions and stronger-than-expected job growth, small-cap stocks have shown resilience with indices like the S&P 600 advancing for multiple consecutive weeks. Amid this backdrop of cautious optimism, identifying promising investment opportunities requires a focus on companies that demonstrate strong fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Chudenko | NA | 4.67% | 10.65% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

| Kwang Dong Pharmaceutical | 44.94% | 6.47% | 3.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Qinchuan Machine Tool & Tool Group Share (SZSE:000837)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qinchuan Machine Tool & Tool Group Share Co., Ltd. is a company involved in the manufacturing of machine tools and related products, with a market cap of CN¥12.79 billion.

Operations: Qinchuan Machine Tool & Tool Group generates revenue primarily from the manufacturing of machine tools and related products. The company's market cap stands at CN¥12.79 billion, reflecting its position within the industry.

Qinchuan Machine Tool & Tool Group, a smaller player in the machinery industry, has shown impressive earnings growth of 183.7% over the past year, significantly outpacing the industry's 1.7%. The company benefitted from a CN¥143.6 million one-off gain impacting its recent financial results up to March 31, 2025. Over five years, Qinchuan's debt-to-equity ratio improved dramatically from 118.6% to just 15.2%, indicating better financial health and reduced leverage concerns. Despite this progress, free cash flow remains negative as of March 31, suggesting ongoing challenges in generating surplus cash after capital expenditures and working capital changes.

Standard Foods (TWSE:1227)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Foods Corporation, with a market cap of NT$31.79 billion, manufactures and sells nutritious foods, edible oil, dairy products, and beverages in Taiwan and internationally.

Operations: The company generates revenue primarily from its China Standard and Standard Foods segments, contributing NT$13.54 billion and NT$12.38 billion, respectively. The Standard Dairy Products segment adds NT$3.77 billion to the revenue stream.

Standard Foods has been making waves with its impressive earnings growth of 41.5% over the past year, outpacing the food industry average of 10%. Despite a challenging five-year period where earnings fell by 23.8% annually, recent performance shows promise. The company reported TWD 28.97 billion in sales for 2024, up from TWD 27.80 billion the previous year, while net income rose to TWD 1.73 billion from TWD 1.22 billion a year ago. Its debt-to-equity ratio has improved significantly from 8.8 to just over three in five years, suggesting better financial health and strategic management moving forward.

- Click to explore a detailed breakdown of our findings in Standard Foods' health report.

Examine Standard Foods' past performance report to understand how it has performed in the past.

Tigerair Taiwan (TWSE:6757)

Simply Wall St Value Rating: ★★★★★★

Overview: Tigerair Taiwan Co., Ltd. offers airline services in Taiwan with a market capitalization of NT$39.47 billion.

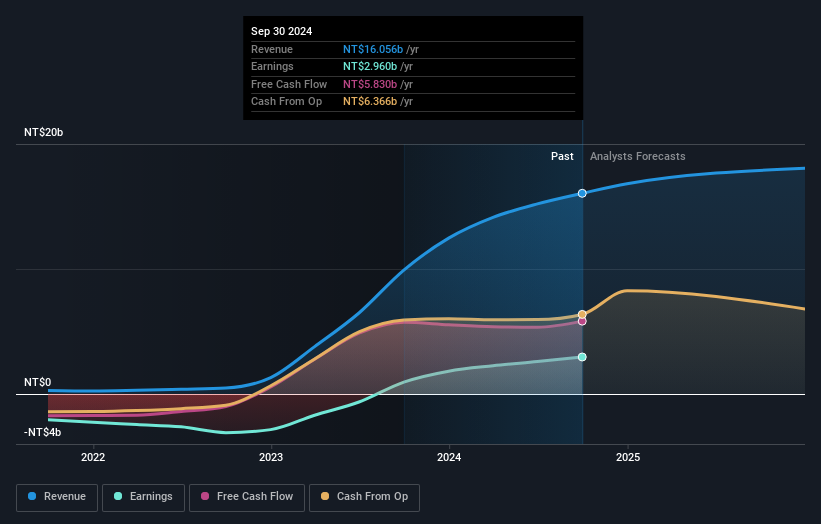

Operations: Tigerair Taiwan generates revenue primarily from passenger and cargo air transportation services, totaling NT$16.42 billion.

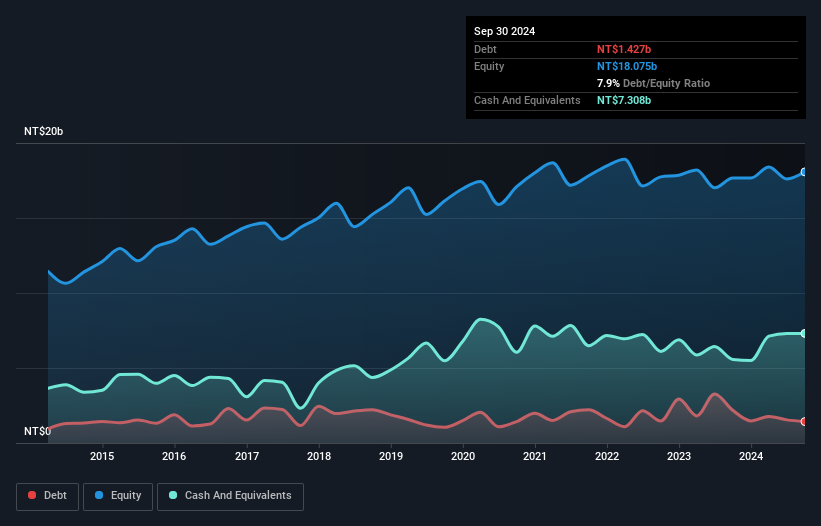

Tigerair Taiwan has been making waves with its impressive financial performance. Over the past year, earnings surged by 51.7%, outpacing the broader airline industry growth of 9%. The company is trading at a substantial 52.1% discount to its estimated fair value, suggesting potential upside for investors. Tigerair's debt situation has improved significantly, with a debt-to-equity ratio dropping from 24.5% to just 2.8% over five years, while maintaining more cash than total debt enhances financial stability further. Recent executive changes include a new CFO and interim president, indicating strategic shifts in leadership as they gear up for future growth opportunities.

Next Steps

- Discover the full array of 3311 Global Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tigerair Taiwan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6757

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives