Optimistic Investors Push Jiangsu Nonghua Intelligent Agriculture Technology Co.ltd (SZSE:000816) Shares Up 27% But Growth Is Lacking

Jiangsu Nonghua Intelligent Agriculture Technology Co.ltd (SZSE:000816) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

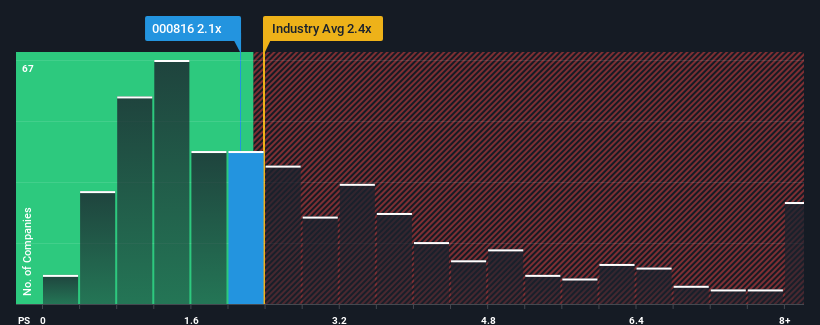

In spite of the firm bounce in price, it's still not a stretch to say that Jiangsu Nonghua Intelligent Agriculture Technologyltd's price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Jiangsu Nonghua Intelligent Agriculture Technologyltd

What Does Jiangsu Nonghua Intelligent Agriculture Technologyltd's P/S Mean For Shareholders?

Revenue has risen firmly for Jiangsu Nonghua Intelligent Agriculture Technologyltd recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Nonghua Intelligent Agriculture Technologyltd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Jiangsu Nonghua Intelligent Agriculture Technologyltd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Still, lamentably revenue has fallen 39% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Jiangsu Nonghua Intelligent Agriculture Technologyltd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Its shares have lifted substantially and now Jiangsu Nonghua Intelligent Agriculture Technologyltd's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Jiangsu Nonghua Intelligent Agriculture Technologyltd trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jiangsu Nonghua Intelligent Agriculture Technologyltd you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000816

Jiangsu Nonghua Intelligent Agriculture Technologyltd

Develops and sells power equipment in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives