- China

- /

- Electronic Equipment and Components

- /

- SHSE:688210

Discovering February 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape marked by escalating inflation and volatile interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. Despite small-cap stocks lagging behind larger indices like the S&P 500, the current economic environment presents unique opportunities for investors to explore lesser-known companies that may offer strong potential for growth. In this context, identifying a good stock often involves looking at companies with solid fundamentals and innovative strategies that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Sun | 32.74% | 8.77% | 65.36% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

JiangSu Changling HydraulicLtd (SHSE:605389)

Simply Wall St Value Rating: ★★★★★★

Overview: JiangSu Changling Hydraulic Co., Ltd specializes in the research, development, production, and sale of hydraulic components both domestically and internationally, with a market cap of CN¥3.97 billion.

Operations: JiangSu Changling Hydraulic Co., Ltd generates revenue primarily from the sale of hydraulic components. The company has a market capitalization of CN¥3.97 billion.

JiangSu Changling Hydraulic Ltd., a smaller player in the machinery sector, is debt-free with no debt compared to five years ago when its debt-to-equity ratio was 1.4%. The company boasts high-quality earnings and has seen a 6.2% growth in earnings over the past year, outpacing the broader machinery industry which saw a -0.06% change. Despite this, its earnings have decreased by 20.7% annually over five years, hinting at potential challenges ahead. With a price-to-earnings ratio of 36.4x slightly below the CN market average of 36.5x, it seems reasonably valued for investors seeking opportunities within this niche market segment.

Shenzhen Pacific Union Precision Manufacturing (SHSE:688210)

Simply Wall St Value Rating: ★★★★★☆

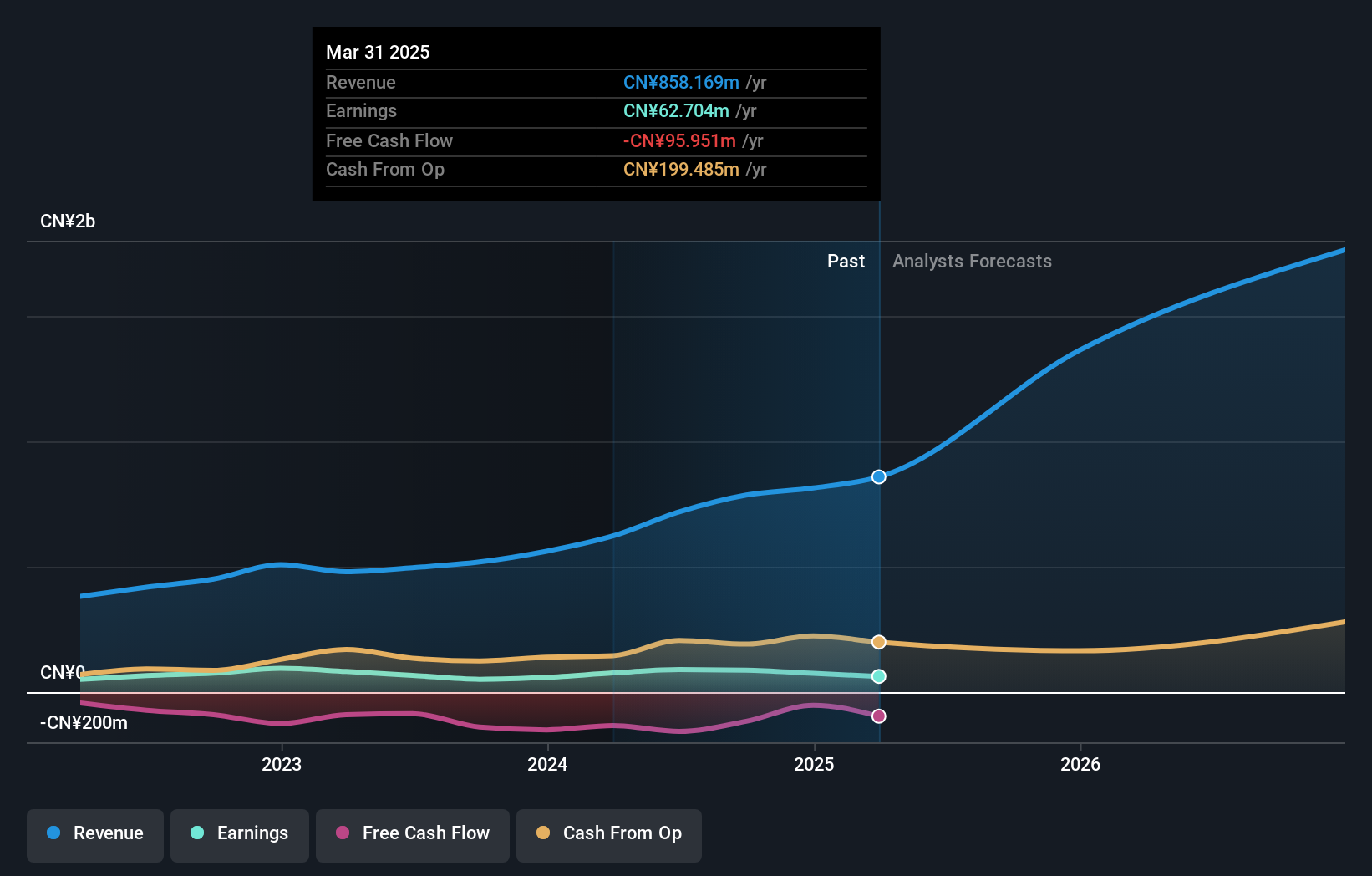

Overview: Shenzhen Pacific Union Precision Manufacturing Co., Ltd. (SHSE:688210) specializes in precision manufacturing and has a market cap of CN¥3.29 billion.

Operations: The company generates revenue primarily through its precision manufacturing operations.

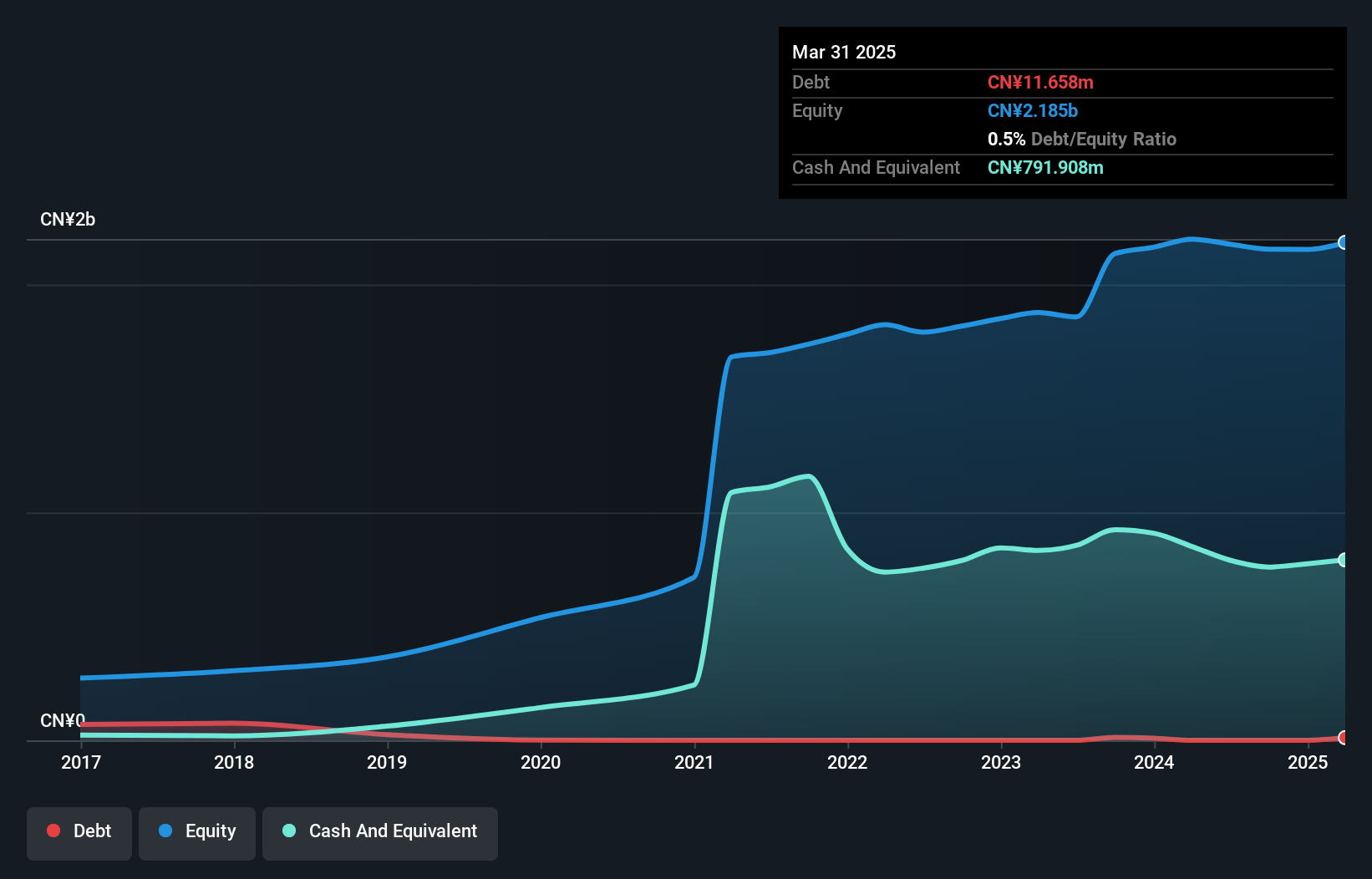

Shenzhen Pacific Union Precision Manufacturing, a nimble player in the electronics sector, showcases notable strengths and areas of caution. Its price-to-earnings ratio at 39.8x is attractively below the industry average of 50.2x, suggesting potential value for investors. The company's earnings surged by 71% last year, outpacing the industry's modest growth of 1.9%, highlighting its robust performance capabilities. However, its debt-to-equity ratio has climbed from 17.9% to 41.2% over five years, indicating increased leverage which could be a concern if not managed well. Despite this, interest payments are comfortably covered by EBIT with a coverage ratio of 103x.

Create Technology & ScienceLtd (SZSE:000551)

Simply Wall St Value Rating: ★★★★★★

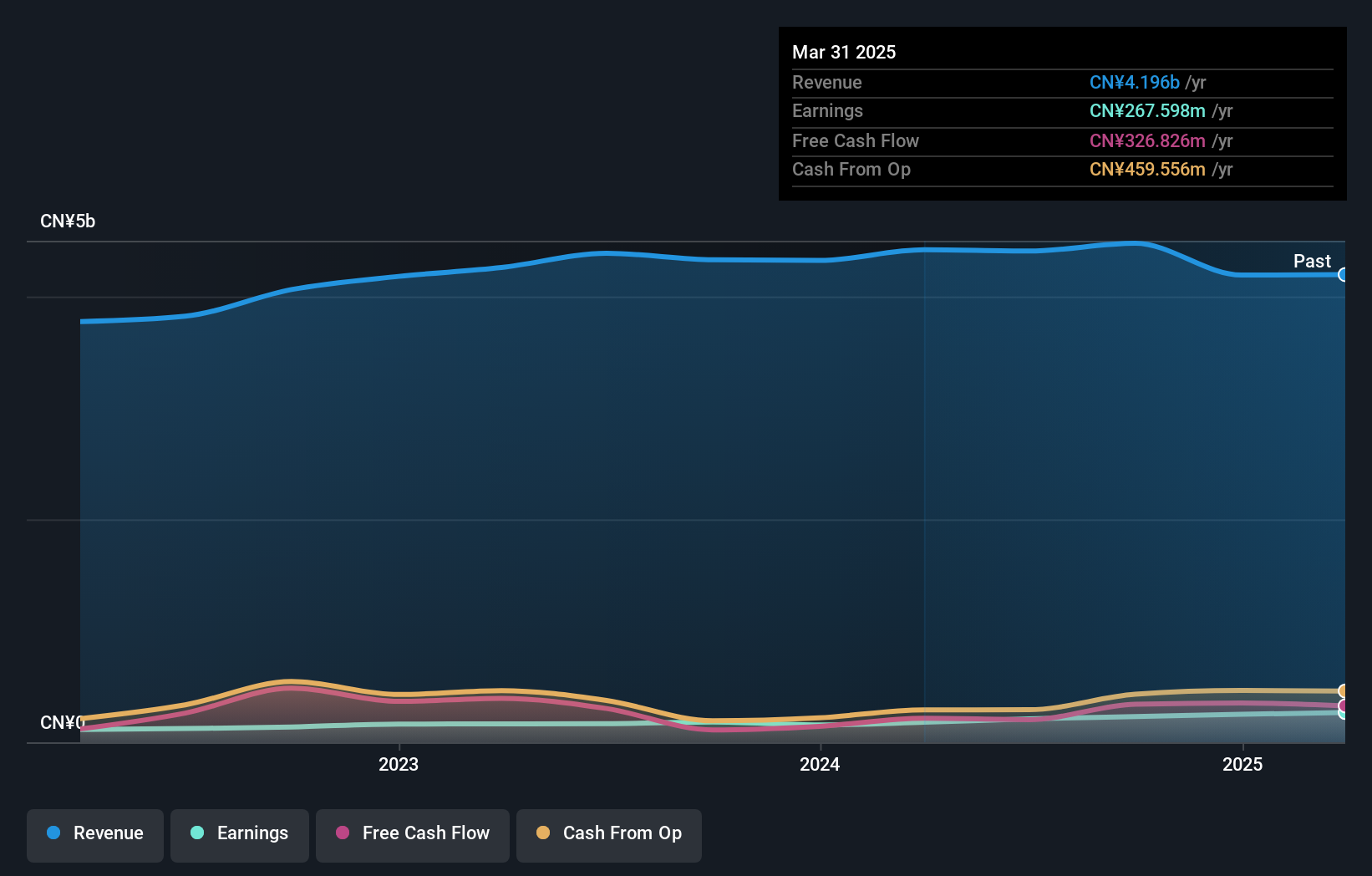

Overview: Create Technology & Science Co., Ltd. focuses on the research, development, production, and sale of high-voltage insulators for power transmission and transformation, as well as clean environmental protection equipment and engineering services in China and internationally, with a market cap of approximately CN¥4.88 billion.

Operations: Create Technology & Science Ltd. generates revenue primarily from the sale of high-voltage insulators and clean environmental protection equipment. The company has a market cap of approximately CN¥4.88 billion, indicating its significant presence in the industry.

Create Technology & Science Ltd, a nimble player in its field, has shown impressive earnings growth of 26.9%, outpacing the broader Machinery industry's -0.06%. Over the past five years, its debt-to-equity ratio improved significantly from 24.1% to 15.5%, indicating prudent financial management. With more cash than total debt and a price-to-earnings ratio of 22.3x, which is favorable compared to the CN market's 36.5x, it seems well-positioned financially. The company is free cash flow positive and boasts high-quality earnings, suggesting robust operational efficiency and potential resilience in future market conditions.

Make It Happen

- Access the full spectrum of 4734 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688210

Shenzhen Pacific Union Precision Manufacturing

Shenzhen Pacific Union Precision Manufacturing Co., Ltd.

Excellent balance sheet with low risk.

Market Insights

Community Narratives