As global markets continue to navigate a complex landscape, Asia stands out with its dynamic economic developments and emerging opportunities. Amidst this backdrop, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on the region's evolving market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 72.03% | 6.01% | 64.19% | ★★★★★★ |

| Anapass | 9.82% | 14.16% | 55.21% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 8.74% | 3.20% | -7.84% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 2.97% | 4.24% | ★★★★★★ |

| Tibet Development | 48.40% | 0.42% | 52.26% | ★★★★★★ |

| Suzhou Longjie Special Fiber | 1.49% | 12.26% | -16.14% | ★★★★★☆ |

| Well Lead Medical | 25.36% | 7.92% | 12.58% | ★★★★★☆ |

| Guangdong Goworld | 27.20% | 1.38% | -9.57% | ★★★★★☆ |

| Suzhou Chunqiu Electronic Technology | 46.46% | 3.33% | -19.72% | ★★★★★☆ |

| Guangdong Sanhe Pile | 76.56% | -2.58% | -32.76% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Vivant (PSE:VVT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vivant Corporation, with a market cap of ₱25.59 billion, operates in the Philippines through its subsidiaries by generating, distributing, and retailing electric power.

Operations: Vivant's primary revenue streams are derived from its electric power generation, distribution, and retail operations in the Philippines. The company's financial performance is influenced by these segments' contributions to overall revenue.

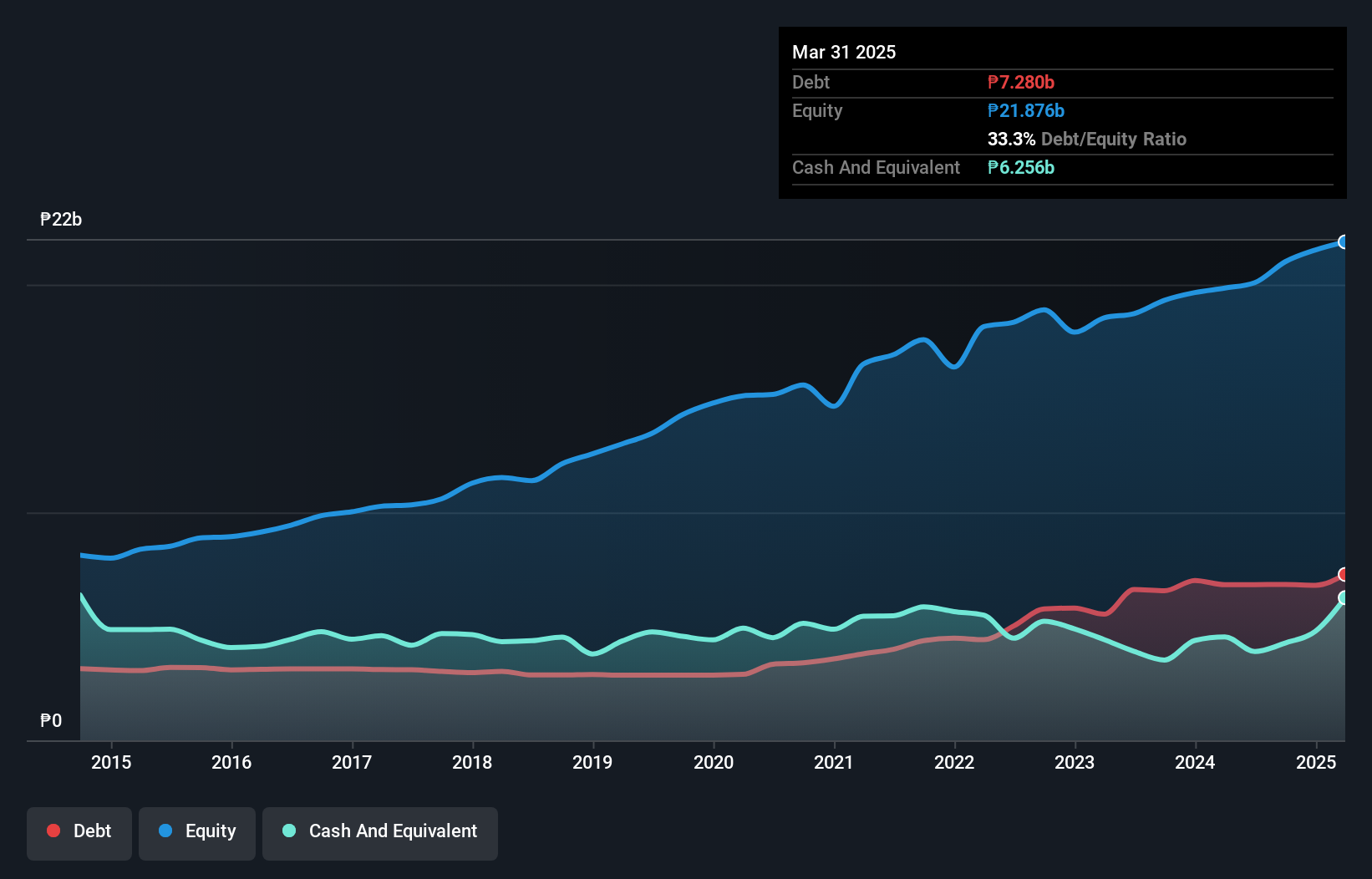

Vivant, a notable player in the renewable energy sector, has shown impressive earnings growth of 24.3% over the past year, outpacing the industry's -4.4%. Despite a volatile share price recently, its debt is well managed with an EBIT coverage of 8.1x and a net debt to equity ratio at 4.7%, which is satisfactory. Recent leadership changes include appointing Alfredo S. Panlilio as an Independent Director and Erickson B. Omamalin as VP - Head of Off-Grid Solutions, reflecting strategic shifts to bolster governance and operations in off-grid solutions. The company also declared an annual dividend of PHP 0.5753 per share for shareholders.

- Click here and access our complete health analysis report to understand the dynamics of Vivant.

Gain insights into Vivant's historical performance by reviewing our past performance report.

Bingshan Refrigeration & Heat Transfer Technologies (SZSE:000530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bingshan Refrigeration & Heat Transfer Technologies Co., Ltd. specializes in the production of refrigeration and air-conditioning equipment, with a market cap of CN¥4.59 billion.

Operations: The primary revenue stream for Bingshan Refrigeration & Heat Transfer Technologies comes from its refrigeration and air-conditioning equipment segment, which generated CN¥4.44 billion. The company's market cap stands at CN¥4.59 billion.

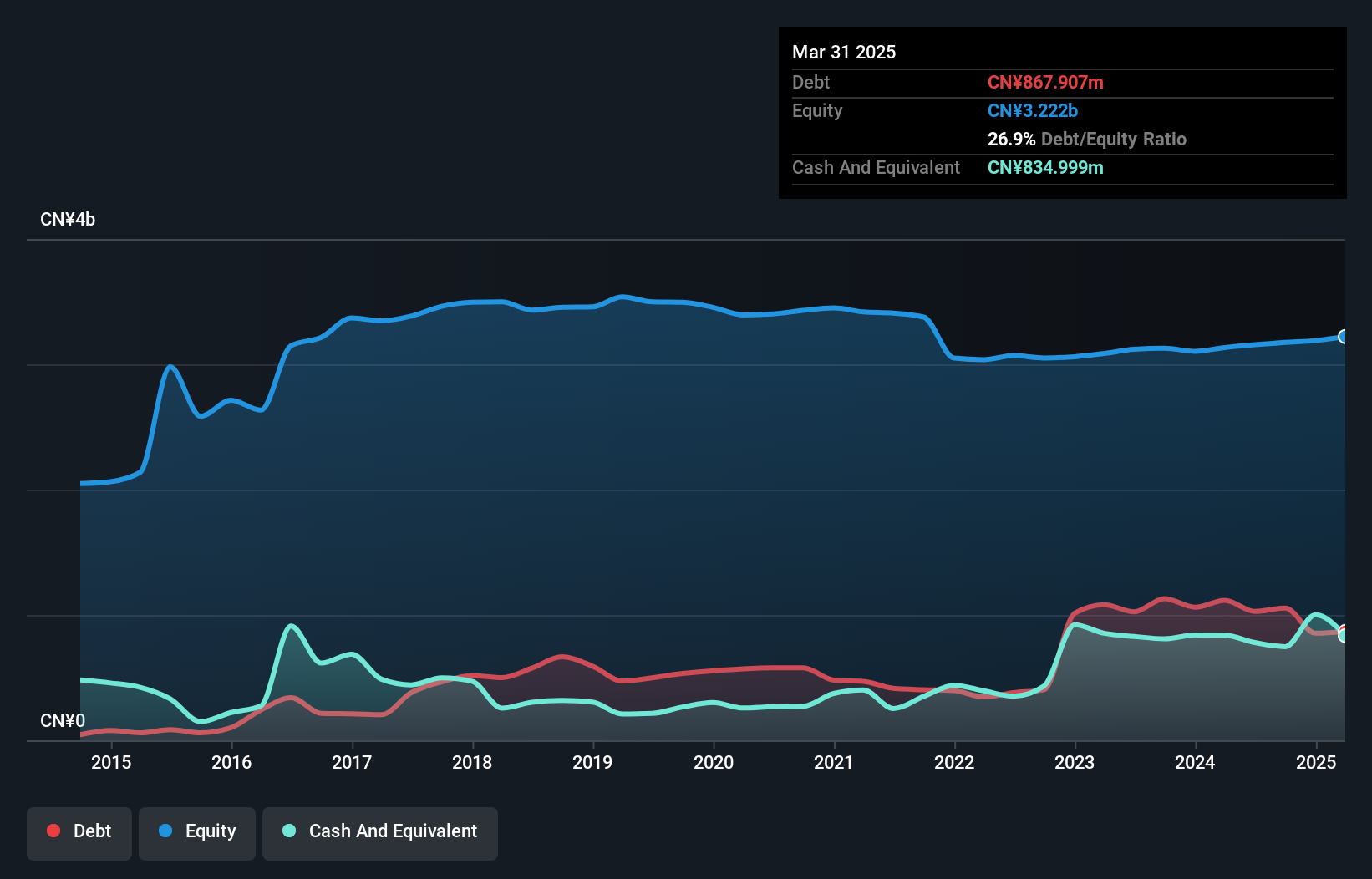

Bingshan Refrigeration & Heat Transfer Technologies, a smaller player in the Asian market, shows promise with its recent earnings growth of 108.8%, outpacing the machinery industry average. The company trades at 53.9% below estimated fair value, suggesting potential undervaluation. Despite a rise in the debt-to-equity ratio from 16.8% to 26.9% over five years, its net debt to equity remains a satisfactory 1%. A notable one-off gain of CN¥38.5 million impacts recent results, but robust earnings and interest coverage indicate financial health is not an immediate concern for this firm poised for future growth.

Beijing Scitop Bio-tech (SZSE:300858)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Scitop Bio-tech Co., Ltd. focuses on the research, development, manufacturing, and sale of probiotic lactic acid bacteria and related products in China, with a market cap of CN¥4.94 billion.

Operations: Beijing Scitop Bio-tech generates revenue primarily from the sale of probiotic lactic acid bacteria and related products. The company's net profit margin shows a notable trend, reflecting its efficiency in converting revenue into profit.

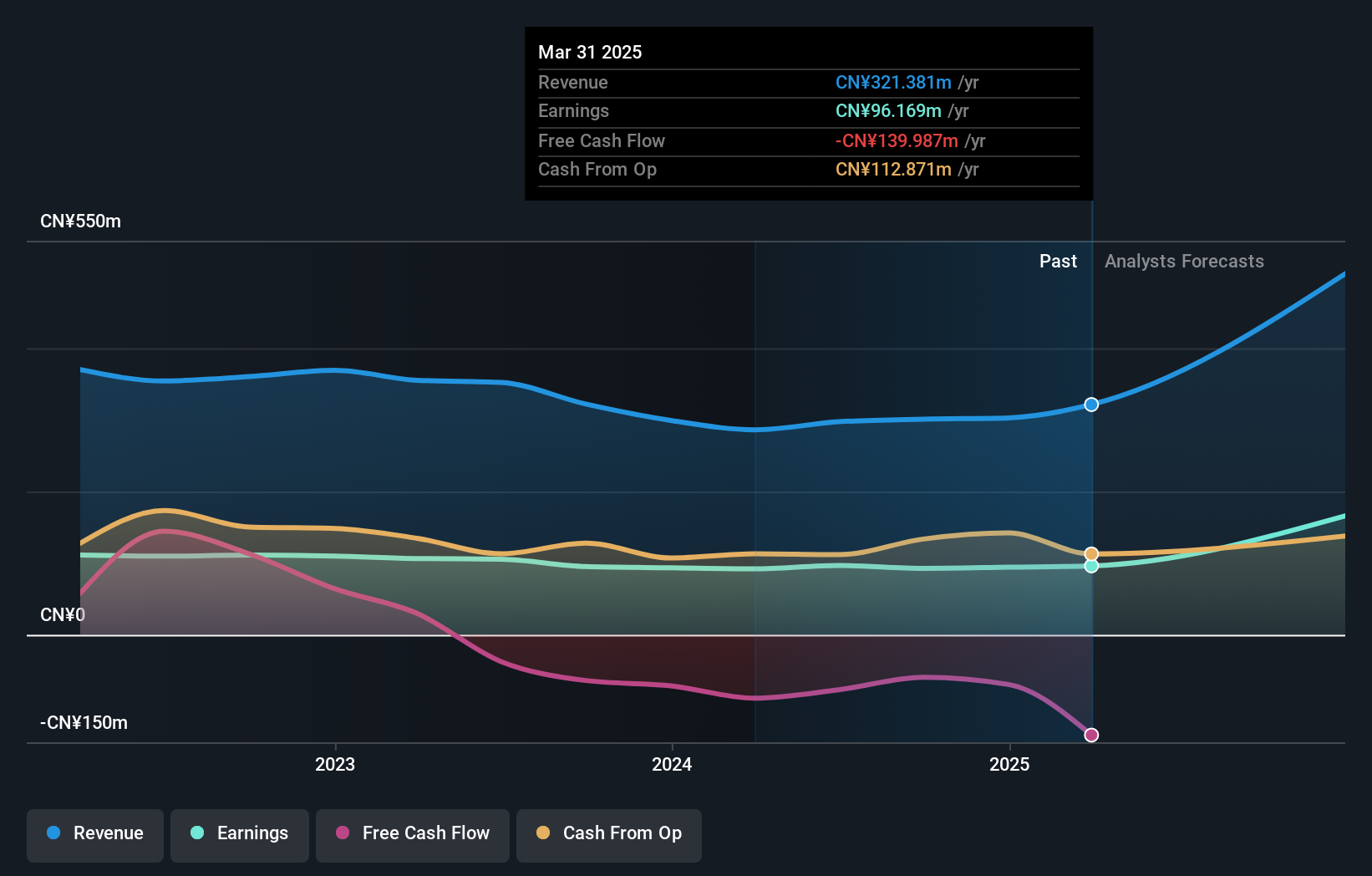

Scitop Bio-tech, a nimble player in its field, showcases high-quality earnings and remains debt-free. Over the past year, earnings grew by 4.6%, outpacing the food industry's -4.7% performance. However, it's important to note that over five years, earnings have seen a 1% annual decline. The company recently reported first-quarter sales of CNY 77.61 million (up from CNY 59.03 million) and net income of CNY 20.33 million compared to CNY 18.52 million last year, highlighting its potential despite share price volatility in recent months and lack of free cash flow positivity.

Where To Now?

- Dive into all 2612 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Scitop Bio-tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300858

Beijing Scitop Bio-tech

Researches, develops, manufactures, and sells probiotic lactic acid bacteria and related products in China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives