Why Investors Shouldn't Be Surprised By North Industries Group Red Arrow Co., Ltd's (SZSE:000519) 33% Share Price Surge

Those holding North Industries Group Red Arrow Co., Ltd (SZSE:000519) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

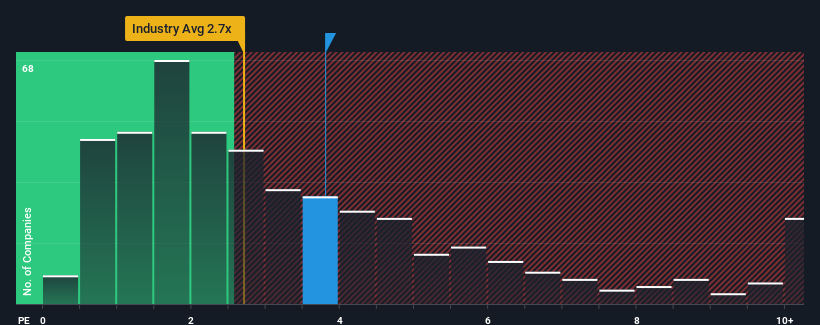

Since its price has surged higher, you could be forgiven for thinking North Industries Group Red Arrow is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for North Industries Group Red Arrow

What Does North Industries Group Red Arrow's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, North Industries Group Red Arrow's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on North Industries Group Red Arrow will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like North Industries Group Red Arrow's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. As a result, revenue from three years ago have also fallen 16% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 41% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in mind, it's not hard to understand why North Industries Group Red Arrow's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in North Industries Group Red Arrow's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into North Industries Group Red Arrow shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with North Industries Group Red Arrow, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if North Industries Group Red Arrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000519

North Industries Group Red Arrow

Manufactures and sells special equipment, superhard materials, and special vehicles and auto parts in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives