- China

- /

- Construction

- /

- SZSE:000032

Shenzhen SED Industry Co., Ltd.'s (SZSE:000032) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

The Shenzhen SED Industry Co., Ltd. (SZSE:000032) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 29%, which is great even in a bull market.

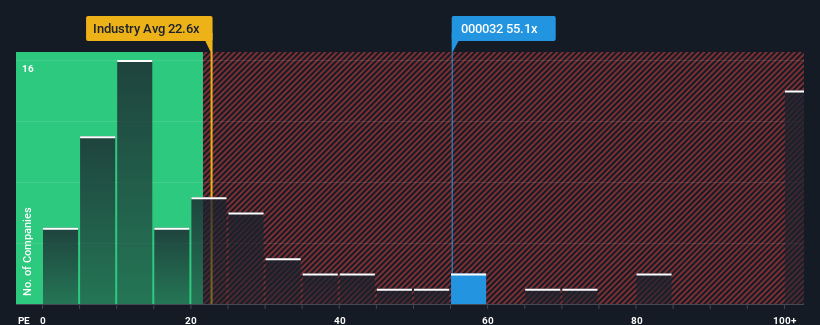

In spite of the heavy fall in price, Shenzhen SED Industry's price-to-earnings (or "P/E") ratio of 55.1x might still make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 37x and even P/E's below 21x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Shenzhen SED Industry certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Shenzhen SED Industry

Does Growth Match The High P/E?

Shenzhen SED Industry's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 408%. The strong recent performance means it was also able to grow EPS by 200% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 3.1% over the next year. With the market predicted to deliver 36% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Shenzhen SED Industry is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Shenzhen SED Industry's P/E

Shenzhen SED Industry's P/E hasn't come down all the way after its stock plunged. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shenzhen SED Industry's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shenzhen SED Industry (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Shenzhen SED Industry, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Shenzhen SED Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000032

Shenzhen SED Industry

Provides digital and information, and industrial services in China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives