- China

- /

- Electrical

- /

- SHSE:688668

Market Participants Recognise Dongguan Dingtong Precision Metal Co., Ltd.'s (SHSE:688668) Revenues Pushing Shares 30% Higher

Despite an already strong run, Dongguan Dingtong Precision Metal Co., Ltd. (SHSE:688668) shares have been powering on, with a gain of 30% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 6.6% isn't as attractive.

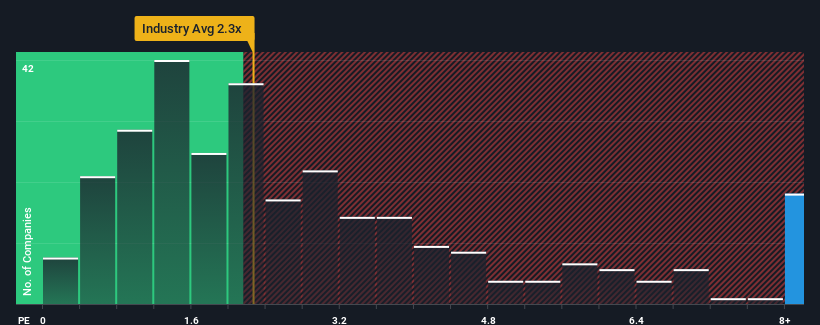

Following the firm bounce in price, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Dongguan Dingtong Precision Metal as a stock not worth researching with its 8.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Dongguan Dingtong Precision Metal

What Does Dongguan Dingtong Precision Metal's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Dongguan Dingtong Precision Metal's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Dongguan Dingtong Precision Metal's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Dongguan Dingtong Precision Metal's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Even so, admirably revenue has lifted 74% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 72% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Dongguan Dingtong Precision Metal's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Dongguan Dingtong Precision Metal have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Dongguan Dingtong Precision Metal maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Dongguan Dingtong Precision Metal you should be aware of, and 2 of them can't be ignored.

If these risks are making you reconsider your opinion on Dongguan Dingtong Precision Metal, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688668

Dongguan Dingtong Precision Metal

Dongguan Dingtong Precision Metal Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives