- China

- /

- Aerospace & Defense

- /

- SHSE:688631

Nanjing LES Information Technology Co., Ltd.'s (SHSE:688631) 58% Jump Shows Its Popularity With Investors

Nanjing LES Information Technology Co., Ltd. (SHSE:688631) shares have continued their recent momentum with a 58% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

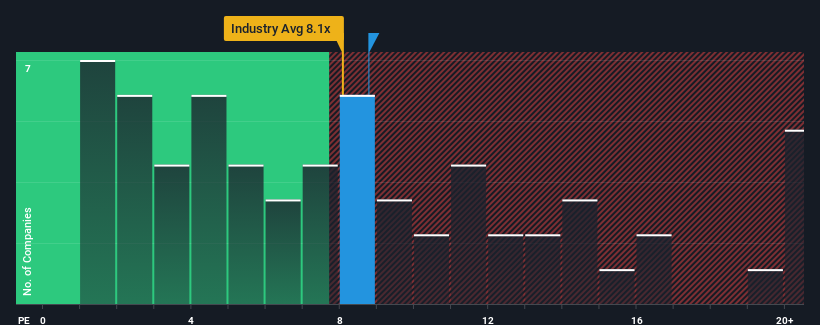

Although its price has surged higher, you could still be forgiven for feeling indifferent about Nanjing LES Information Technology's P/S ratio of 8.8x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in China is also close to 8.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Nanjing LES Information Technology

How Nanjing LES Information Technology Has Been Performing

Recent times haven't been great for Nanjing LES Information Technology as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nanjing LES Information Technology.How Is Nanjing LES Information Technology's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Nanjing LES Information Technology's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.3% last year. The solid recent performance means it was also able to grow revenue by 24% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the one analyst following the company. With the industry predicted to deliver 25% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Nanjing LES Information Technology is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Nanjing LES Information Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Nanjing LES Information Technology's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Nanjing LES Information Technology you should be aware of.

If these risks are making you reconsider your opinion on Nanjing LES Information Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing LES Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688631

Nanjing LES Information Technology

Nanjing LES Information Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives