- China

- /

- Electrical

- /

- SHSE:688345

Guangdong Greenway Technology Co.,Ltd (SHSE:688345) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Guangdong Greenway Technology Co.,Ltd (SHSE:688345) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the last month did very little to improve the 50% share price decline over the last year.

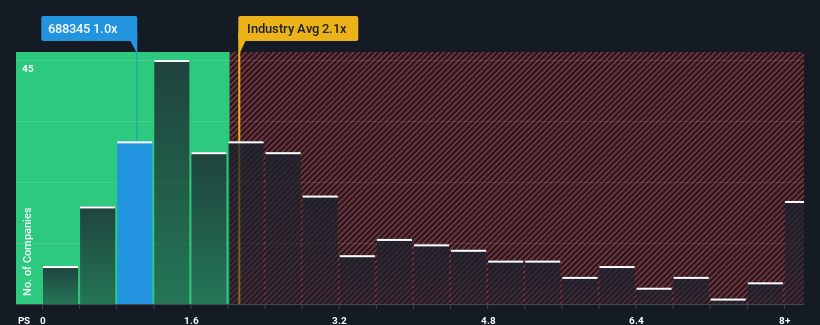

Although its price has surged higher, considering around half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider Guangdong Greenway TechnologyLtd as an solid investment opportunity with its 1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Guangdong Greenway TechnologyLtd

What Does Guangdong Greenway TechnologyLtd's P/S Mean For Shareholders?

Guangdong Greenway TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Guangdong Greenway TechnologyLtd will help you uncover what's on the horizon.How Is Guangdong Greenway TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Guangdong Greenway TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. The last three years don't look nice either as the company has shrunk revenue by 6.7% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 18% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 23% growth forecast for the broader industry.

In light of this, it's understandable that Guangdong Greenway TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Guangdong Greenway TechnologyLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Guangdong Greenway TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Guangdong Greenway TechnologyLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688345

Guangdong Greenway TechnologyLtd

Engages in the research and development, production, sale, and servicing of lithium-ion battery packs and lithium-ion batteries in China, Europe, Asia, North America, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives