Revenue Downgrade: Here's What Analysts Forecast For Beijing SinoHytec Co., Ltd. (SHSE:688339)

Today is shaping up negative for Beijing SinoHytec Co., Ltd. (SHSE:688339) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

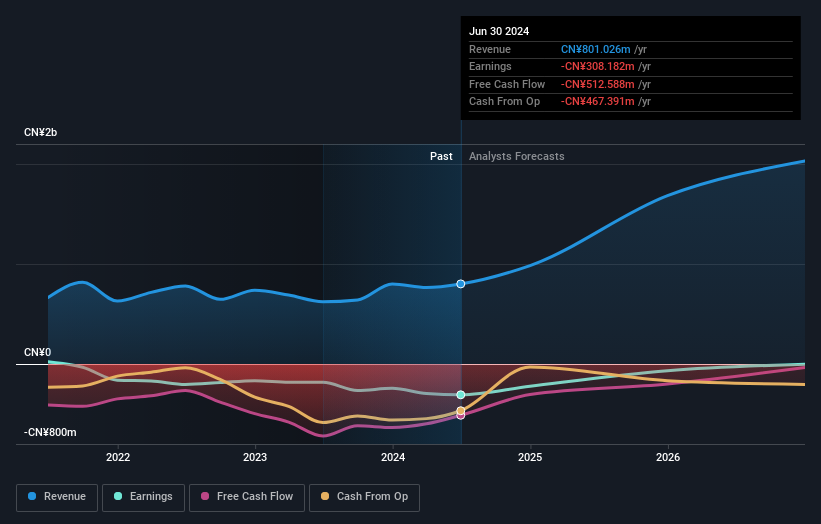

Following the downgrade, the most recent consensus for Beijing SinoHytec from its seven analysts is for revenues of CN¥985m in 2024 which, if met, would be a substantial 23% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CN¥1.2b in 2024. The consensus view seems to have become more pessimistic on Beijing SinoHytec, noting the measurable cut to revenue estimates in this update.

See our latest analysis for Beijing SinoHytec

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Beijing SinoHytec's growth to accelerate, with the forecast 51% annualised growth to the end of 2024 ranking favourably alongside historical growth of 11% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 16% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Beijing SinoHytec to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. The analysts also expect revenues to grow faster than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Beijing SinoHytec going forwards.

Looking for more information? At least one of Beijing SinoHytec's seven analysts has provided estimates out to 2026, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SinoHytec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688339

Beijing SinoHytec

Engages in the research, development, and industrialization of fuel cell engine systems in Mainland China, Canada, and South Korea.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives