Xi'an Bright Laser TechnologiesLtd's (SHSE:688333) earnings growth rate lags the 20% CAGR delivered to shareholders

Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) shareholders might be concerned after seeing the share price drop 18% in the last month. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 143% higher today. We think it's more important to dwell on the long term returns than the short term returns. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 44% decline over the last twelve months.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Xi'an Bright Laser TechnologiesLtd

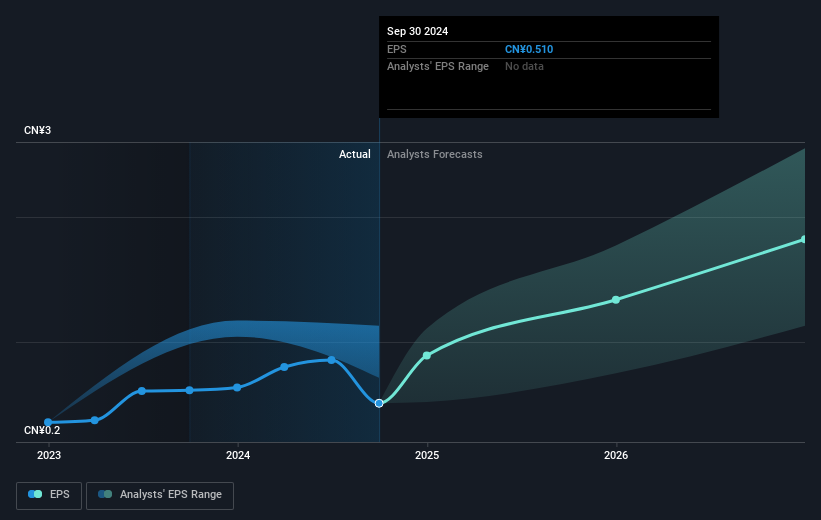

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Xi'an Bright Laser TechnologiesLtd became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Xi'an Bright Laser TechnologiesLtd has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Xi'an Bright Laser TechnologiesLtd's financial health with this free report on its balance sheet.

A Different Perspective

Xi'an Bright Laser TechnologiesLtd shareholders are down 44% for the year (even including dividends), but the market itself is up 4.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 20% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Xi'an Bright Laser TechnologiesLtd better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Xi'an Bright Laser TechnologiesLtd (of which 1 makes us a bit uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

High growth potential with adequate balance sheet.