Xi'an Bright Laser TechnologiesLtd (SHSE:688333) stock performs better than its underlying earnings growth over last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Xi'an Bright Laser Technologies Co.,Ltd. (SHSE:688333) which saw its share price drive 194% higher over five years. In more good news, the share price has risen 39% in thirty days.

Since the stock has added CN¥1.6b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Xi'an Bright Laser TechnologiesLtd

While Xi'an Bright Laser TechnologiesLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Xi'an Bright Laser TechnologiesLtd can boast revenue growth at a rate of 33% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 24% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Xi'an Bright Laser TechnologiesLtd worth investigating - it may have its best days ahead.

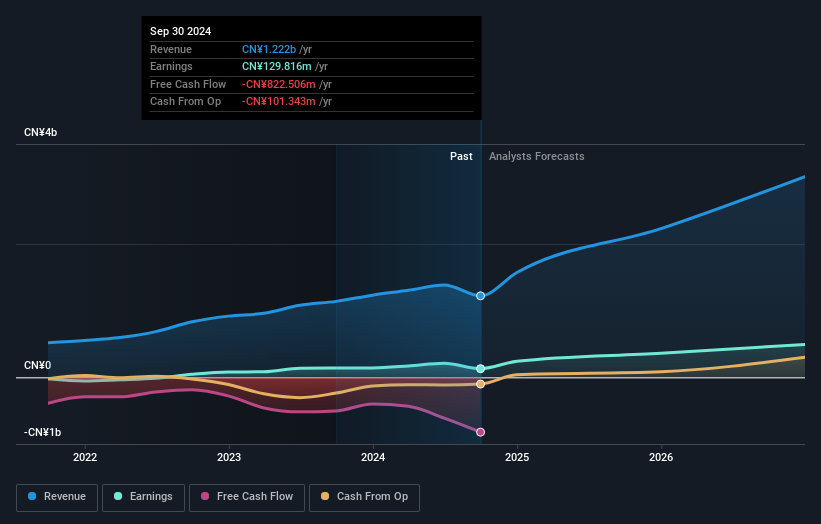

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Xi'an Bright Laser TechnologiesLtd has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Xi'an Bright Laser TechnologiesLtd provided a TSR of 0.9% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 24% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Xi'an Bright Laser TechnologiesLtd , and understanding them should be part of your investment process.

Of course Xi'an Bright Laser TechnologiesLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688333

Xi'an Bright Laser TechnologiesLtd

Offers metal additive manufacturing and repairing solutions in the People's Republic of China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives