- China

- /

- Aerospace & Defense

- /

- SHSE:688297

What You Can Learn From AVIC (Chengdu)UAS Co., Ltd.'s (SHSE:688297) P/S

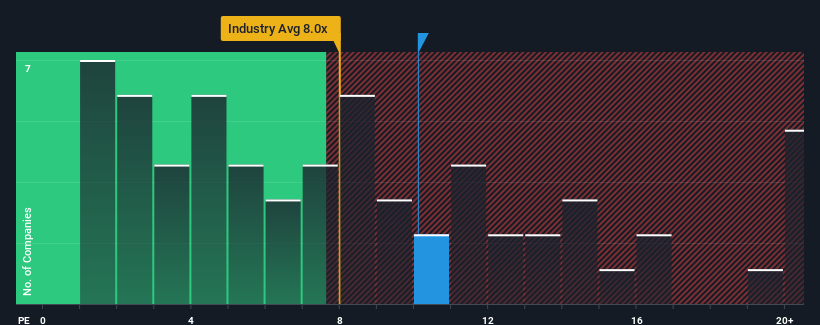

You may think that with a price-to-sales (or "P/S") ratio of 10.1x AVIC (Chengdu)UAS Co., Ltd. (SHSE:688297) is a stock to potentially avoid, seeing as almost half of all the Aerospace & Defense companies in China have P/S ratios under 8x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AVIC (Chengdu)UAS

What Does AVIC (Chengdu)UAS' P/S Mean For Shareholders?

AVIC (Chengdu)UAS could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think AVIC (Chengdu)UAS' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as AVIC (Chengdu)UAS' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.9%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 119% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 33% each year during the coming three years according to the three analysts following the company. With the industry only predicted to deliver 17% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why AVIC (Chengdu)UAS' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From AVIC (Chengdu)UAS' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of AVIC (Chengdu)UAS' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for AVIC (Chengdu)UAS that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688297

AVIC (Chengdu)UAS

Engages in the design, development, manufacturing, sales, and service of unmanned aerial vehicle systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives