- Japan

- /

- Diversified Financial

- /

- TSE:8425

Undiscovered Gems And 2 Other Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's cautious stance on interest rate cuts and political uncertainties, small-cap stocks have experienced heightened volatility, with indexes like the S&P 600 facing notable declines. In such a dynamic environment, identifying promising small-cap companies that exhibit strong fundamentals and growth potential can be crucial for enhancing portfolio resilience.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shipping Corporation of India | 25.17% | 7.01% | 13.70% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| BLS E-Services | NA | 5.87% | 46.48% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| KP Green Engineering | 51.37% | 120.79% | 51.32% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★★

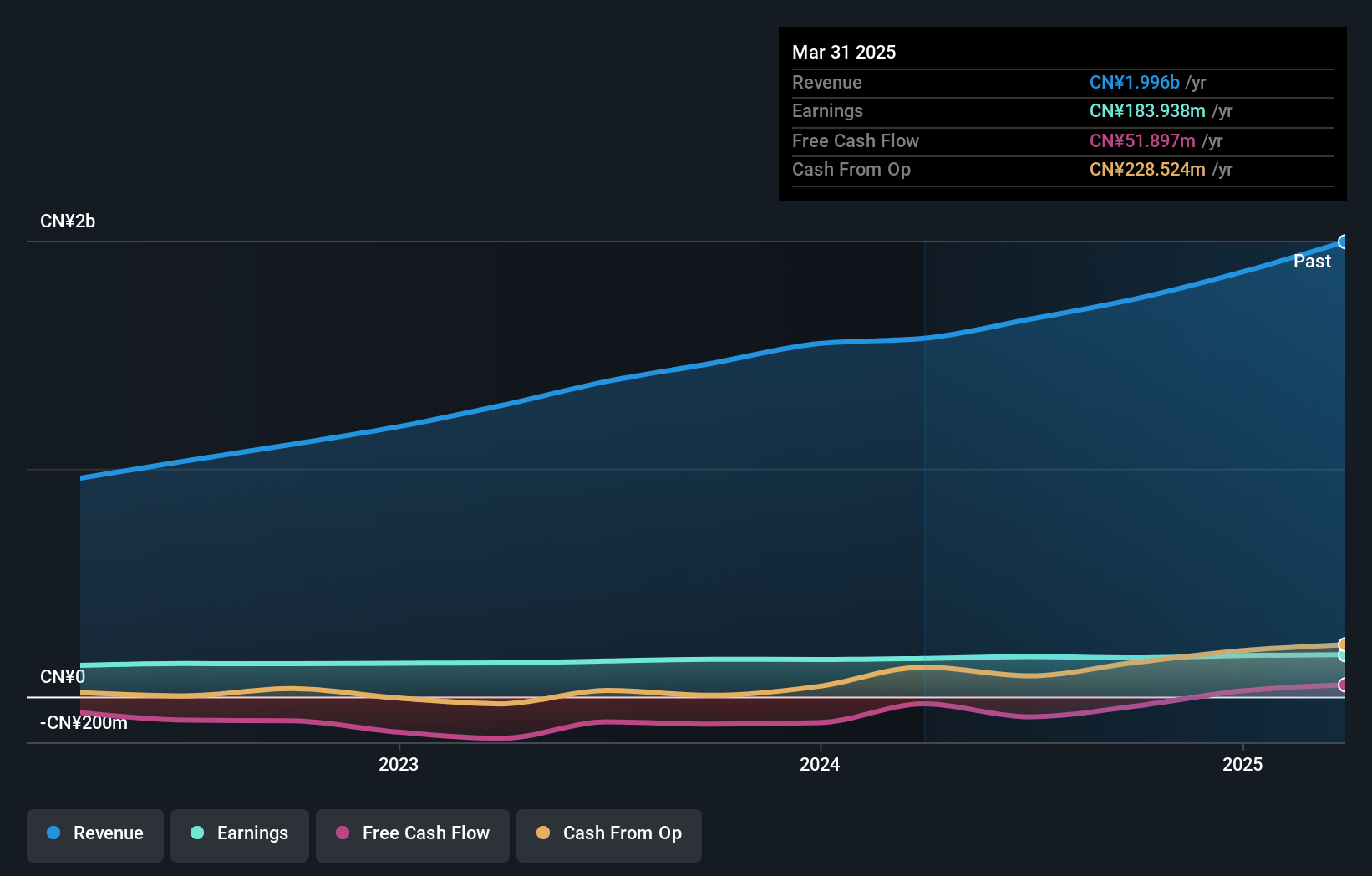

Overview: Shareate Tools Ltd. is a Chinese company that manufactures and sells cemented carbide products and drilling tools, with a market capitalization of CN¥3.27 billion.

Operations: Shareate Tools generates revenue primarily from the sale of cemented carbide products and drilling tools.

Shareate Tools, a promising player in the machinery sector, has shown noteworthy performance with earnings growth of 3.8% over the past year, outpacing the industry average of -0.06%. The company's debt-to-equity ratio improved from 33.2% to 26.6% over five years, indicating prudent financial management. Despite not being free cash flow positive recently, Shareate's net income rose to CNY 134.81 million for nine months ending September 2024 from CNY 127.31 million a year ago, reflecting solid operational efficiency and high-quality earnings that suggest resilience in challenging market conditions.

- Dive into the specifics of Shareate Tools here with our thorough health report.

Explore historical data to track Shareate Tools' performance over time in our Past section.

Kyushu Financial Group (TSE:7180)

Simply Wall St Value Rating: ★★★★★☆

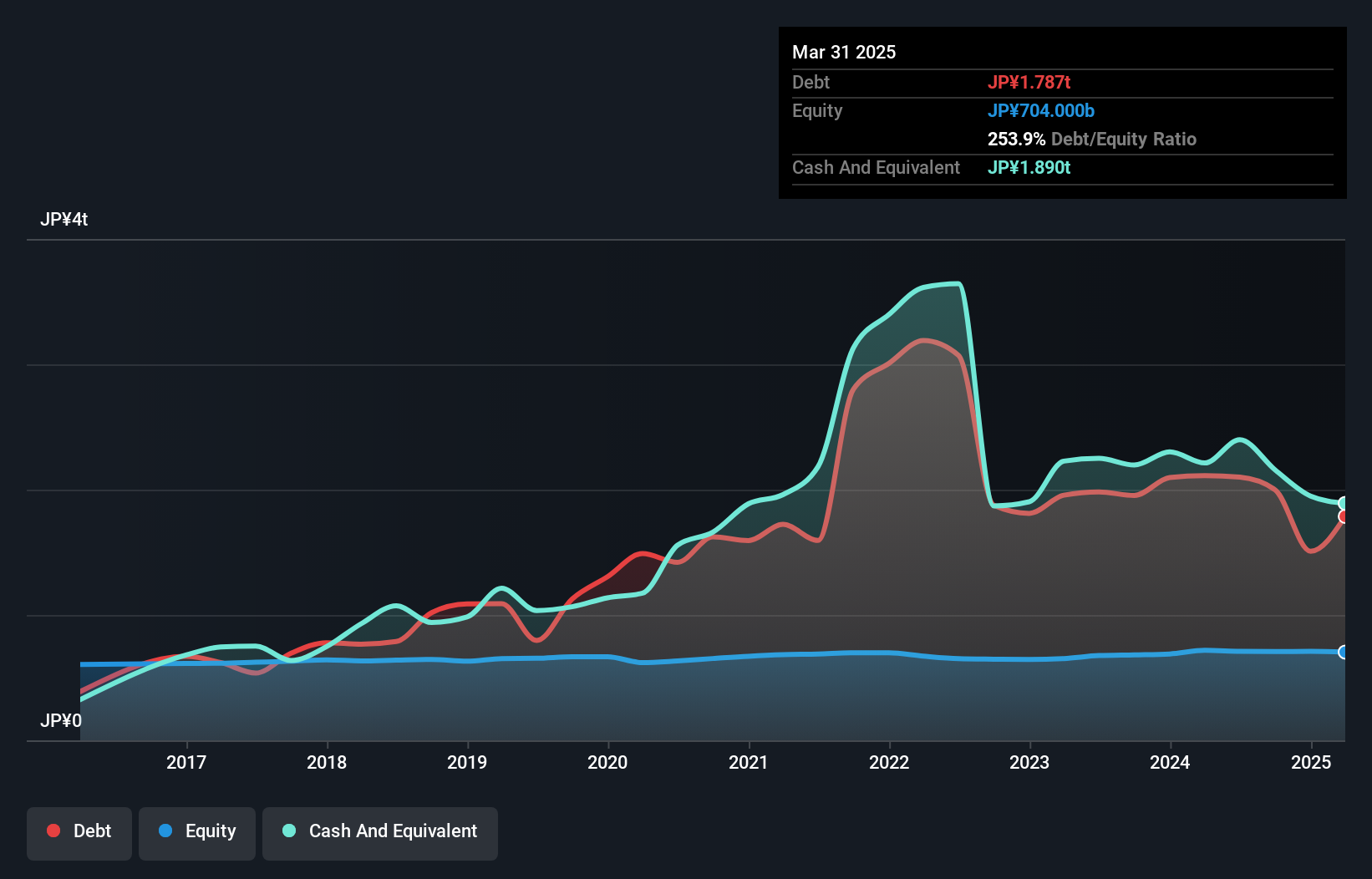

Overview: Kyushu Financial Group, Inc. operates as a financial services provider in Japan through its subsidiaries, offering a range of financial products and services with a market capitalization of ¥301.12 billion.

Operations: The primary revenue streams for Kyushu Financial Group come from its banking operations, with Higo Bank generating ¥85.85 billion and Kagoshima Bank contributing ¥76.85 billion. The leasing business adds another ¥38.83 billion to the total revenue.

Kyushu Financial Group, with assets totaling ¥13,429.1 billion and equity of ¥707.7 billion, offers a compelling profile for those interested in smaller financial institutions. The bank's total deposits stand at ¥10,535.1 billion against loans of ¥8,759.9 billion; however, it has an insufficient allowance for bad loans at 49%, despite non-performing loans being just 1.7%. While earnings have grown by 8.7% annually over the past five years and are projected to increase by 15.81% yearly moving forward, they lag behind the broader industry growth rate of 22.6%. This entity trades at a notable discount to estimated fair value by about one-third and relies on low-risk funding sources for most liabilities (83%).

Mizuho Leasing Company (TSE:8425)

Simply Wall St Value Rating: ★★★★☆☆

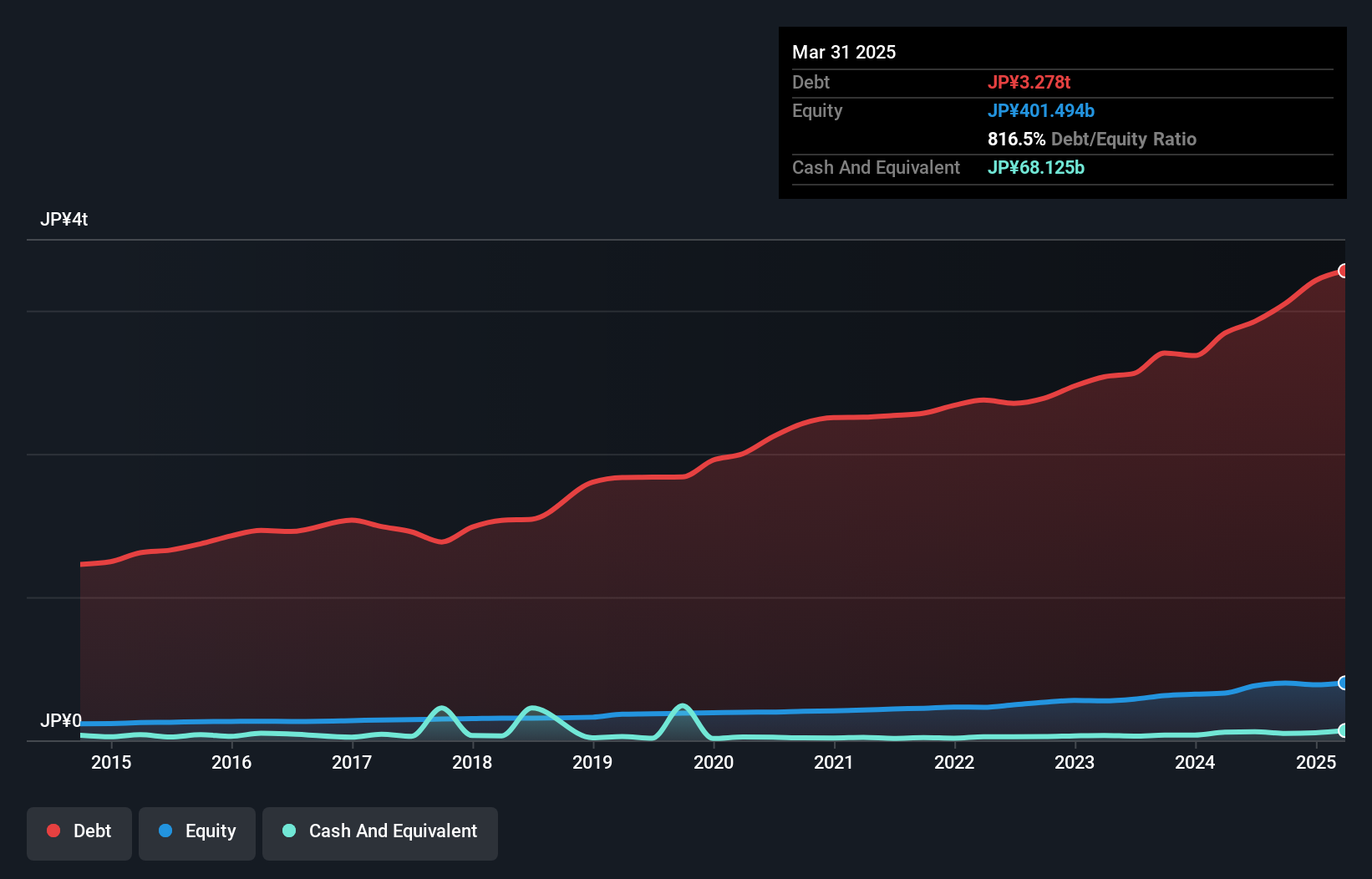

Overview: Mizuho Leasing Company, Limited offers general leasing services both in Japan and internationally, with a market capitalization of ¥282.70 billion.

Operations: Mizuho Leasing generates revenue primarily through its leasing services in Japan and international markets. The company focuses on optimizing its cost structure to improve financial performance, with an emphasis on maintaining a competitive net profit margin.

Mizuho Leasing Company, a relatively small player in the financial sector, has demonstrated robust performance with earnings growth of 39.8% over the past year, outpacing the industry average of 28.6%. Despite a high net debt to equity ratio of 751.3%, its interest payments are comfortably covered by EBIT at 14.5x, indicating strong operational efficiency. The company recently announced fixed-income offerings totaling ¥40 billion (approximately US$273 million), reflecting strategic moves to bolster its financial structure. With net income reaching ¥25,595 million for the half-year ending September 2024 and basic earnings per share at ¥96.89, Mizuho Leasing showcases potential for continued stability and growth within its niche market segment.

- Click here and access our complete health analysis report to understand the dynamics of Mizuho Leasing Company.

Gain insights into Mizuho Leasing Company's past trends and performance with our Past report.

Taking Advantage

- Click through to start exploring the rest of the 4622 Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8425

Mizuho Leasing Company

Provides general leasing services in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives