- China

- /

- Electronic Equipment and Components

- /

- SZSE:300319

Undiscovered Gems And 2 More Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and interest rate uncertainties, small-cap stocks have shown mixed performance, with the Russell 2000 Index trailing larger indices like the S&P 500. In such an environment, identifying undiscovered gems with strong potential requires a keen eye for companies that demonstrate resilience and growth potential despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★★

Overview: Shareate Tools Ltd. is a Chinese company that manufactures and sells cemented carbide products and drilling tools, with a market cap of CN¥3.40 billion.

Operations: Shareate Tools generates revenue primarily from the sale of cemented carbide products and drilling tools. The company's market capitalization is approximately CN¥3.40 billion, reflecting its scale in the industry.

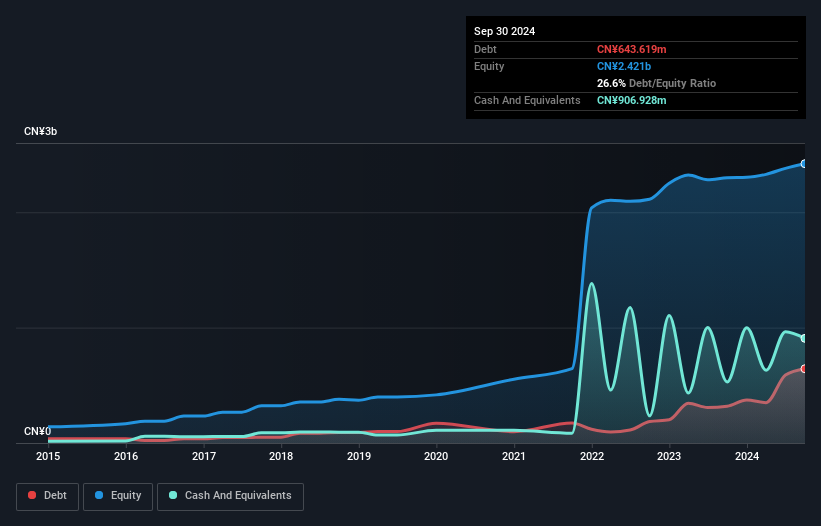

In the bustling machinery sector, Shareate Tools stands out with its earnings growth of 3.8% over the past year, surpassing the industry average of -0.06%. This performance is complemented by a favorable price-to-earnings ratio of 21.4x, which is below the CN market average of 36.5x, suggesting potential undervaluation. The company's debt situation appears manageable as it holds more cash than total debt and has reduced its debt-to-equity ratio from 33.2% to 26.6% over five years, indicating prudent financial management. Looking ahead, an upcoming shareholders meeting on January 13 may provide further insights into strategic directions and growth prospects for this nimble player in Suzhou's industrial landscape.

- Dive into the specifics of Shareate Tools here with our thorough health report.

Evaluate Shareate Tools' historical performance by accessing our past performance report.

Shenzhen Microgate Technology (SZSE:300319)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Microgate Technology Co., Ltd. specializes in the production of passive electronic components and has a market capitalization of approximately CN¥10.70 billion.

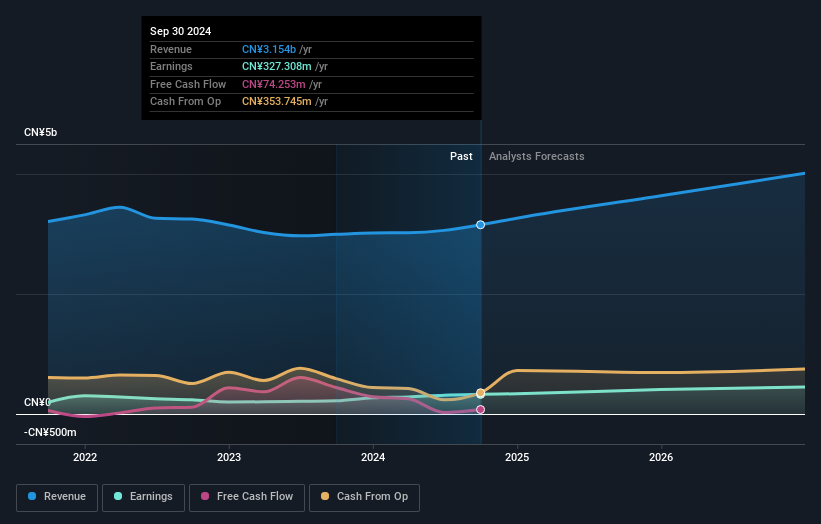

Operations: The company's primary revenue stream is from the electronics manufacturing industry, generating approximately CN¥3.15 billion. Segment adjustments account for a minor portion of the financials at around CN¥7.71 million.

Shenzhen Microgate Technology showcases promising attributes as a smaller player in the electronics sector. Its earnings growth of 49% over the past year outpaced the industry average of 1.9%, highlighting its competitive edge. The company's debt to equity ratio has impressively reduced from 22.5% to 6.5% over five years, indicating strong financial management. With a Price-To-Earnings ratio of 34.6x, it remains attractively valued compared to the broader Chinese market at 36.5x, suggesting potential for value investors seeking under-the-radar opportunities in this space without significant interest payment concerns due to robust earnings coverage.

Jiangyin Haida Rubber And Plastic (SZSE:300320)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangyin Haida Rubber And Plastic Co., Ltd. is a company involved in the production and sale of rubber and plastic products, with a market cap of CN¥5.68 billion.

Operations: Jiangyin Haida generates revenue primarily from its rubber and plastic product sales. The company's financial performance is highlighted by a notable net profit margin trend, which has shown significant variation over recent periods.

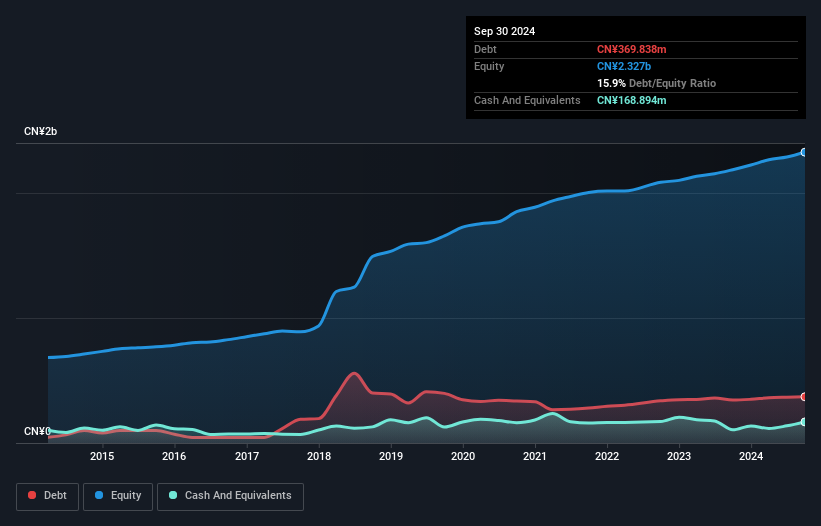

Jiangyin Haida Rubber And Plastic, a nimble player in the chemicals sector, has recently outpaced its industry with an impressive 41.5% earnings growth over the past year. The company's net debt to equity ratio stands at a satisfactory 8.6%, reflecting prudent financial management. Despite a challenging five-year period with earnings dipping by 13.7% annually, it now trades at a compelling 41.2% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Furthermore, its interest payments are well-covered by EBIT at an impressive 18x coverage, enhancing its financial stability and resilience in volatile markets.

Make It Happen

- Reveal the 4734 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300319

Shenzhen Microgate Technology

Engages in the research, development, production, and sale of passive electronic components and modules in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives