Shareate Tools' (SHSE:688257) Solid Earnings May Rest On Weak Foundations

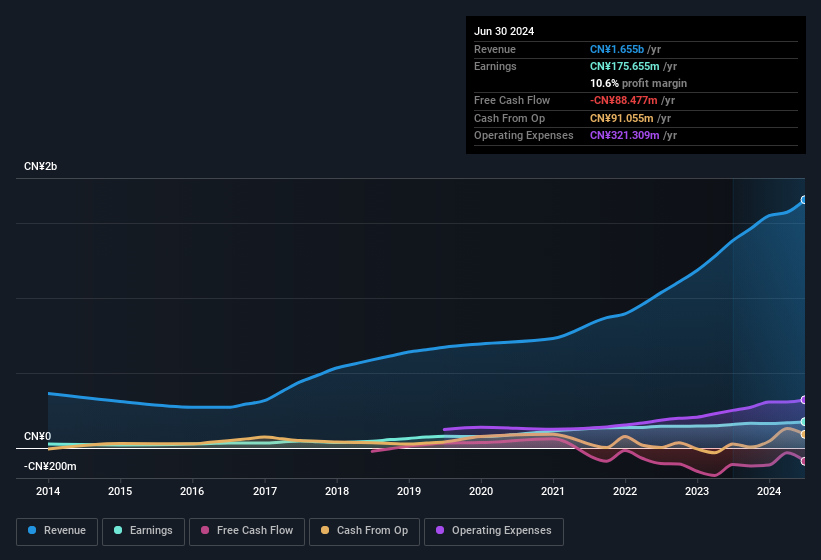

Shareate Tools Ltd.'s (SHSE:688257) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

Check out our latest analysis for Shareate Tools

The Impact Of Unusual Items On Profit

To properly understand Shareate Tools' profit results, we need to consider the CN¥18m gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. If Shareate Tools doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shareate Tools.

Our Take On Shareate Tools' Profit Performance

We'd posit that Shareate Tools' statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Shareate Tools' true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 13% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Shareate Tools as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Shareate Tools you should know about.

This note has only looked at a single factor that sheds light on the nature of Shareate Tools' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688257

Shareate Tools

Manufactures and sells cemented carbide products and drilling tools in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives